Zendesk Support is a complete customer service helpdesk system. It brings together customer interactions from many channels into one platform. This cloud-based solution helps businesses track, prioritize, and resolve support issues efficiently. Zendesk acts as a shared inbox for your support team, collecting requests from email, chat, social media, and phone. It also offers tools to nurture customer relationships with more personalized interactions.

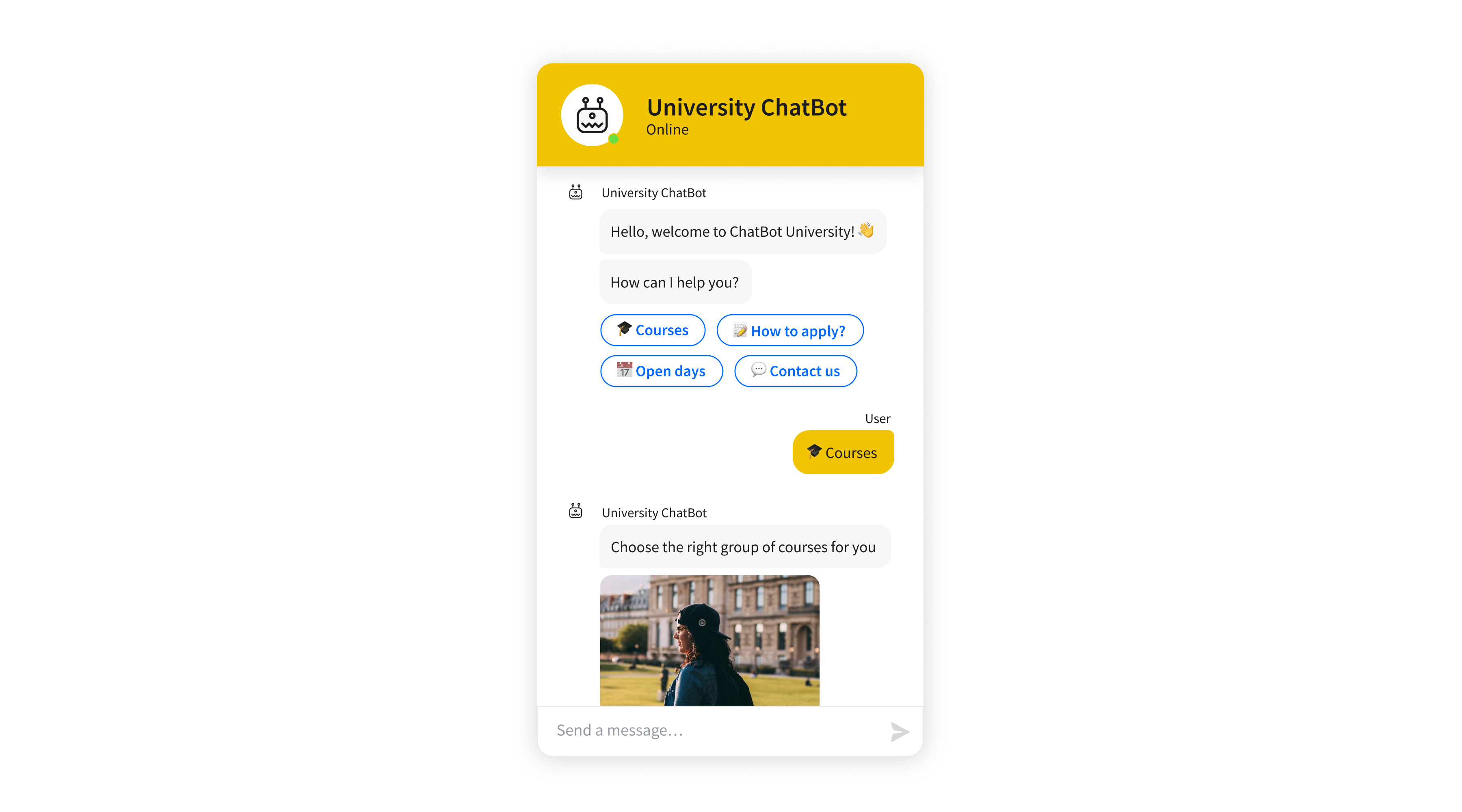

Zendesk Support offers many powerful features. These include multi-channel support, ticketing management, automation, and self-service options. The ticketing system gathers customer requests from various sources and manages them all in one place. Support agents can handle multiple tickets at once, improving efficiency. Automation takes care of repetitive tasks like ticket routing and follow-ups. This gives agents more time to tackle complex customer issues. Moreover, Zendesk's knowledge base and self-service tools help customers find answers independently through FAQs and AI-powered bots.

Zendesk's impact is no joke. A Forrester Consulting study found that a single organization received an ROI of $31.2 million over three years against a total cost of $8.1 million after implementing Zendesk Support. Companies like Spartan Race have also recorded a 27% sales increase after integrating Zendesk with their Shopify store. Many others reported different benefits, such as better response times and customer satisfaction.

Zendesk Support serves organizations of all sizes, from startups to large firms. Major companies like Uber, Shopify, Airbnb, Slack, and Netflix use Zendesk to handle millions of customer queries daily. The platform is often used by companies with 50-200 employees and $10-50 million in revenue. A flexible pricing structure makes it accessible to businesses at various growth stages, from small teams needing basic email support to large organizations needing full omnichannel capabilities.

Zendesk Support: Plans and pricing

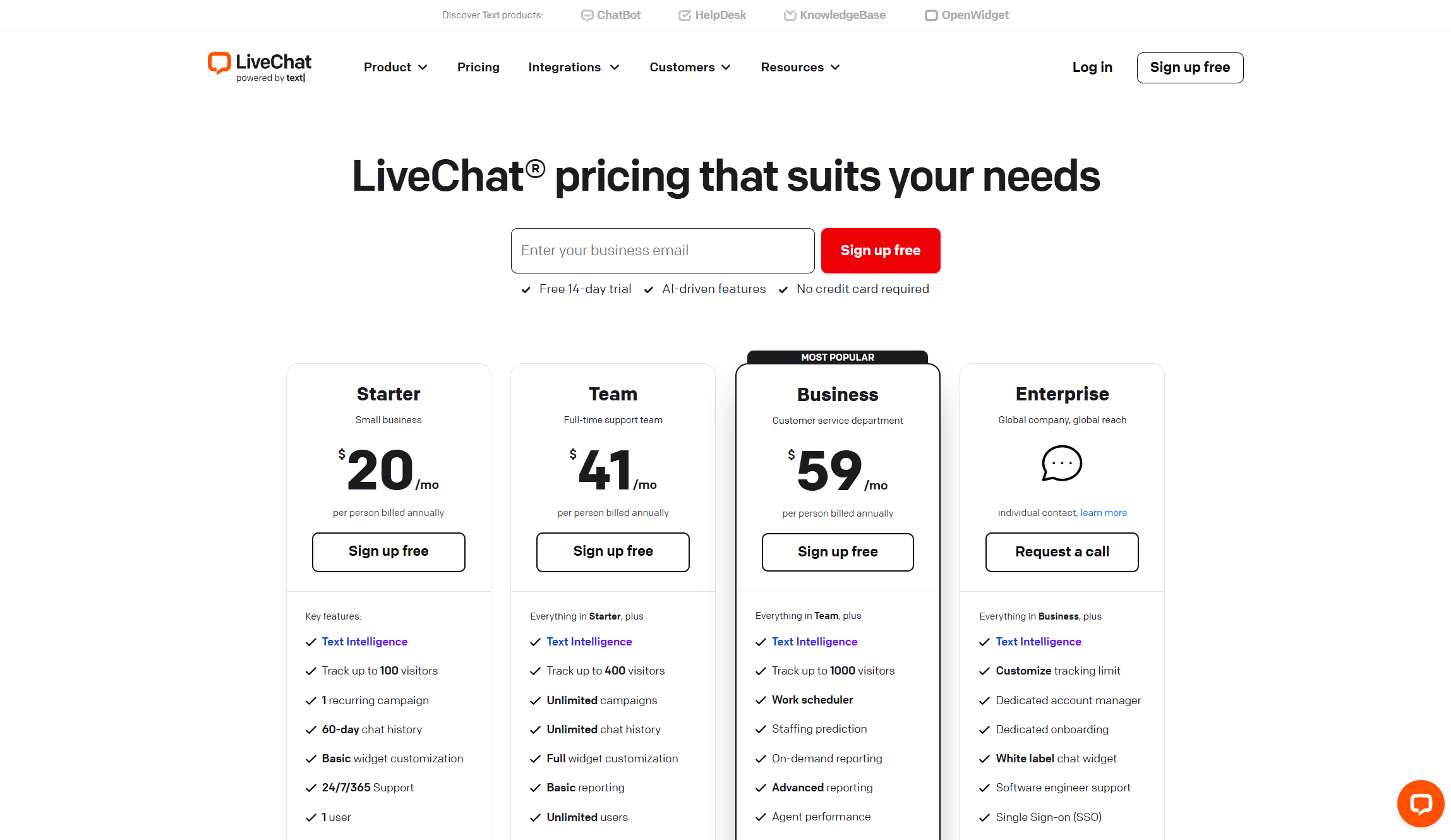

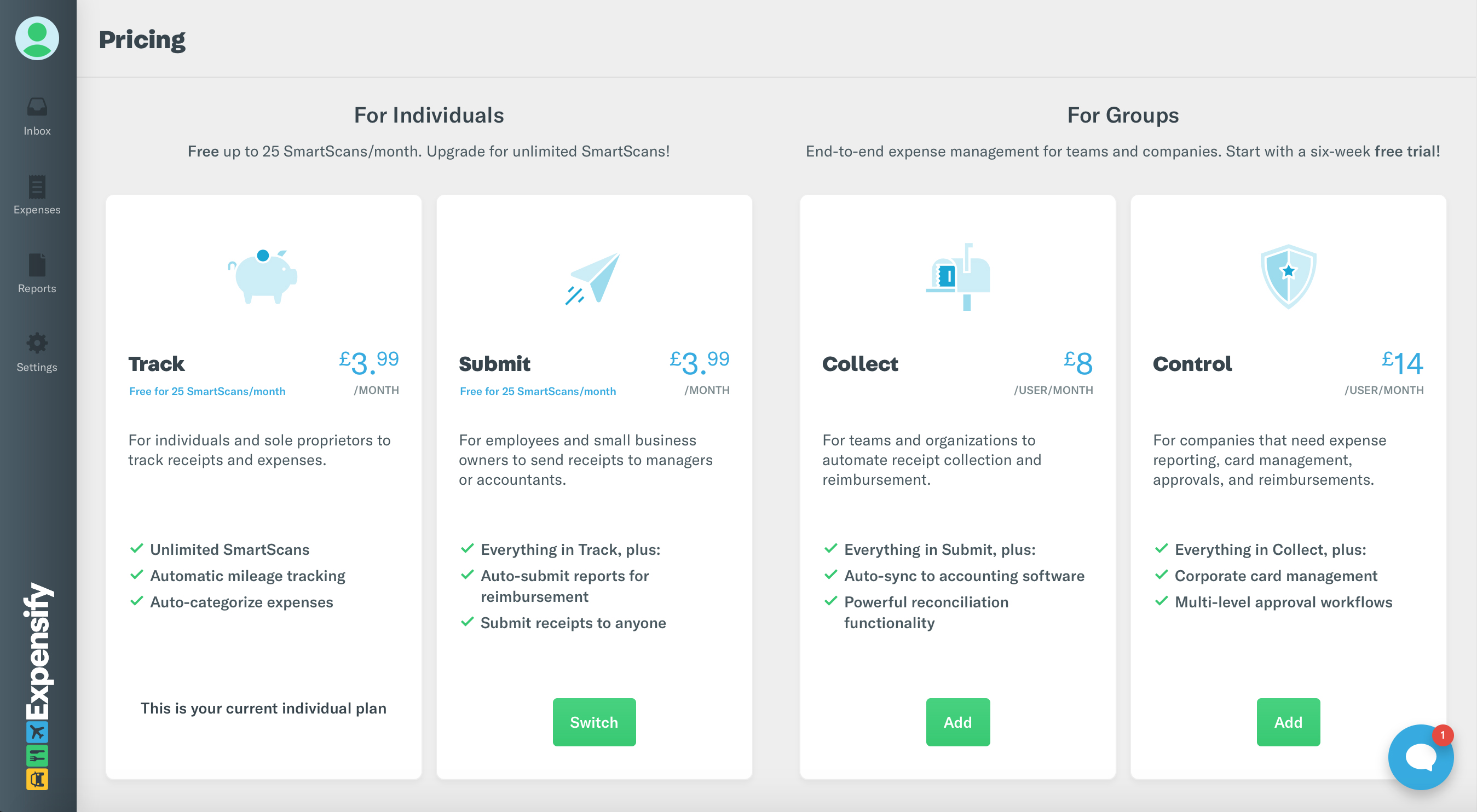

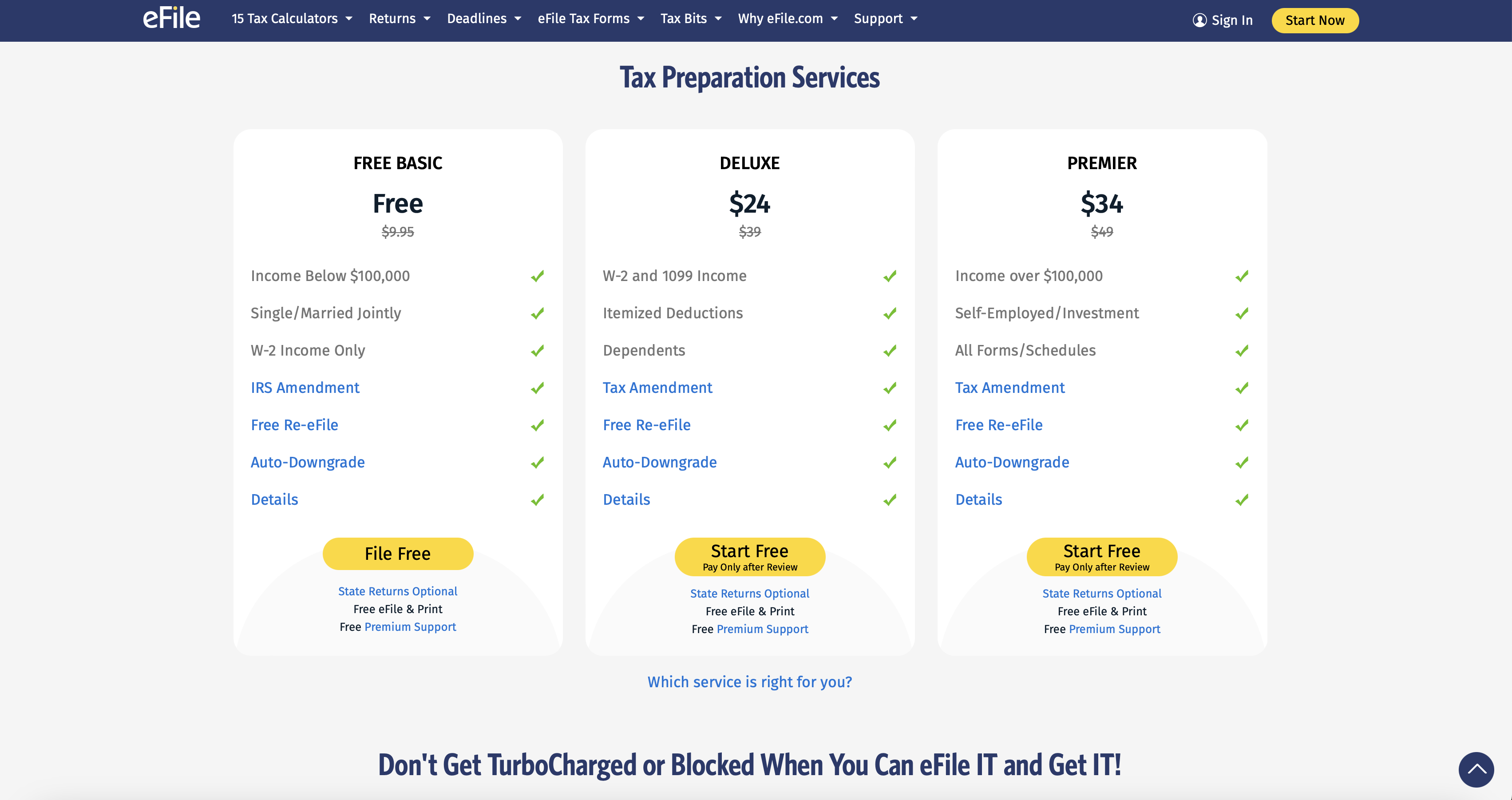

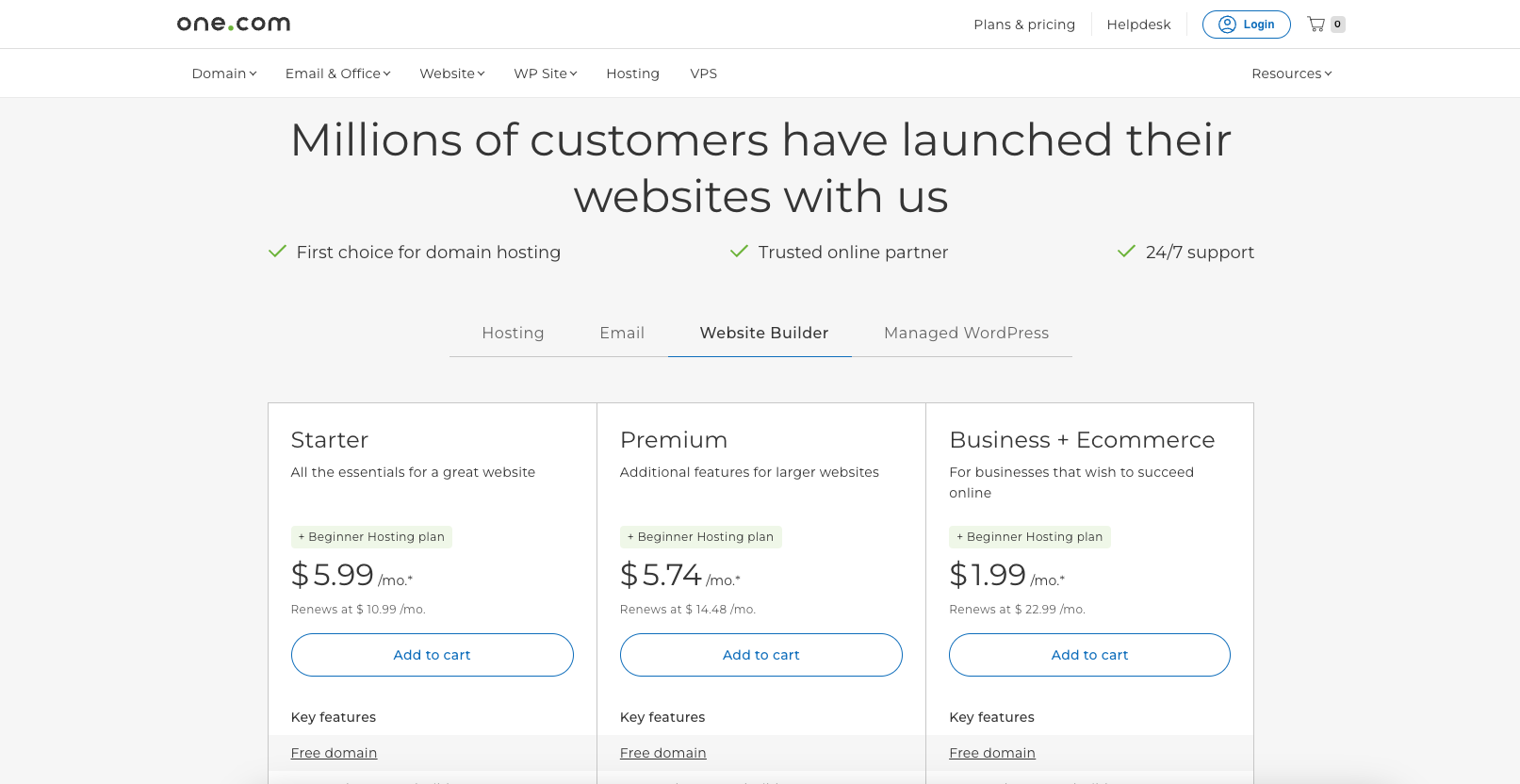

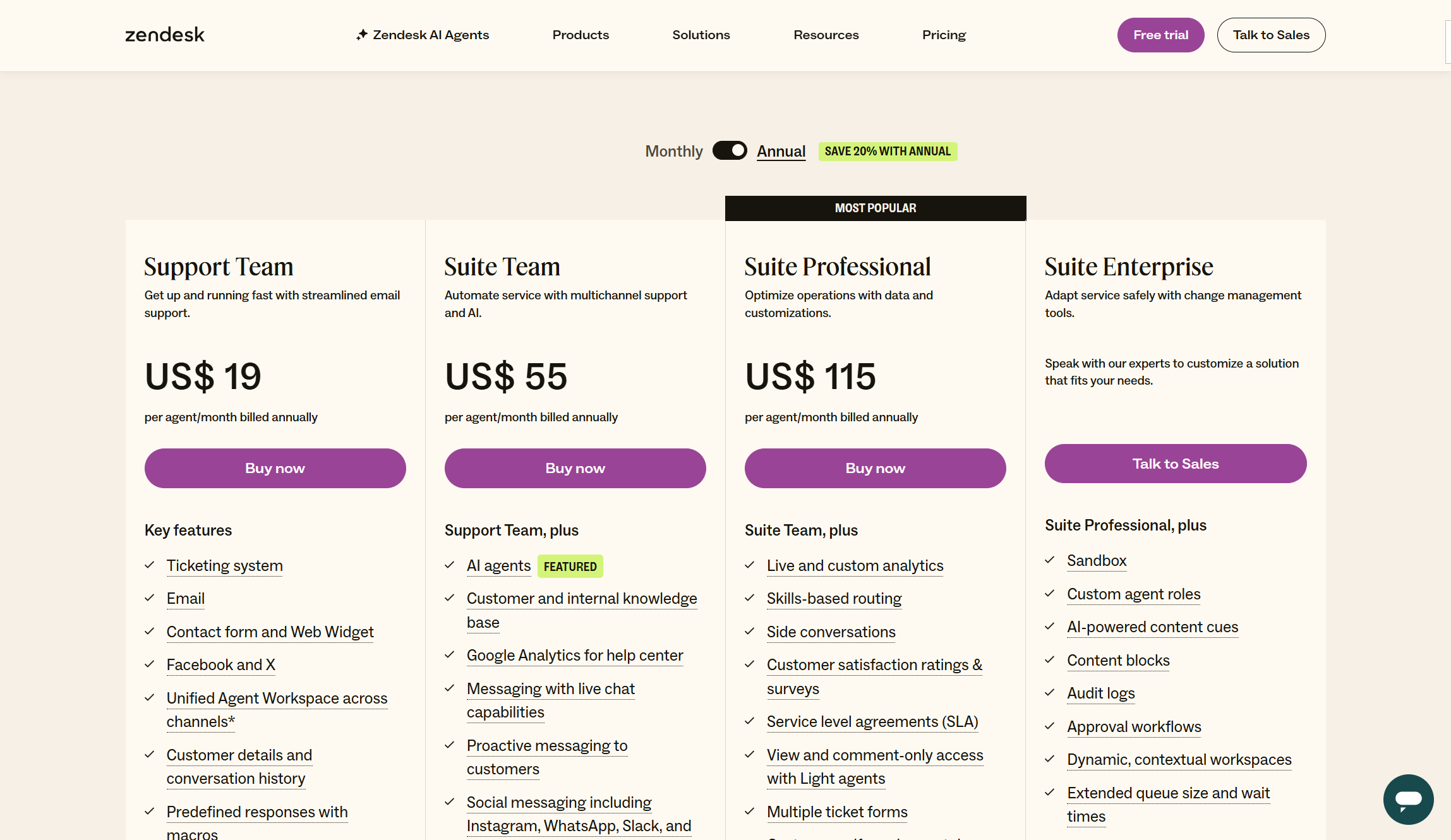

Zendesk has a tiered pricing structure for businesses of all sizes, from small startups to large enterprises. As of 2025, there are three main plans for Zendesk Support:

Support Team: $19 per agent per month

Support Professional: $55 per agent per month

Support Enterprise: $115 per agent per month (billed annually)

The entry-level Support Team plan includes essential features. It offers a ticketing system, support via email, Twitter, and Facebook, workflow automation, and basic reporting dashboards.

For businesses needing more comprehensive solutions, Zendesk has Suite plans that bundle multiple products. The Suite Team plan starts at $55 per agent per month. It includes the ticketing system and omnichannel support through email, chat, voice, social media, and knowledge bases. It also has 24/7 standard chatbots.

The Suite Growth plan is $89 per agent per month, adding private internal collaboration, SLAs, multi-language support, and multiple ticket forms. The Suite Professional plan at $115 per agent per month enhances capabilities with customizable reporting, automatic ticket routing based on skills, and HIPAA compliance.

Enterprise-level businesses can choose the Suite Enterprise plan, which has custom pricing and advanced features. These include enhanced data protection, a sandbox environment for testing workflows, and sophisticated access controls for agents. All plans provide annual billing discounts compared to monthly payments, making them more cost-effective for long-term commitments.

Zendesk also offers add-ons, which can be purchased separately:

Advanced AI: $50/agent/month

Workforce Management: $25/agent/month

Quality Assurance: $35/agent/month

Advanced Data Privacy and Protection: $50/agent/month

Zendesk Support: Features

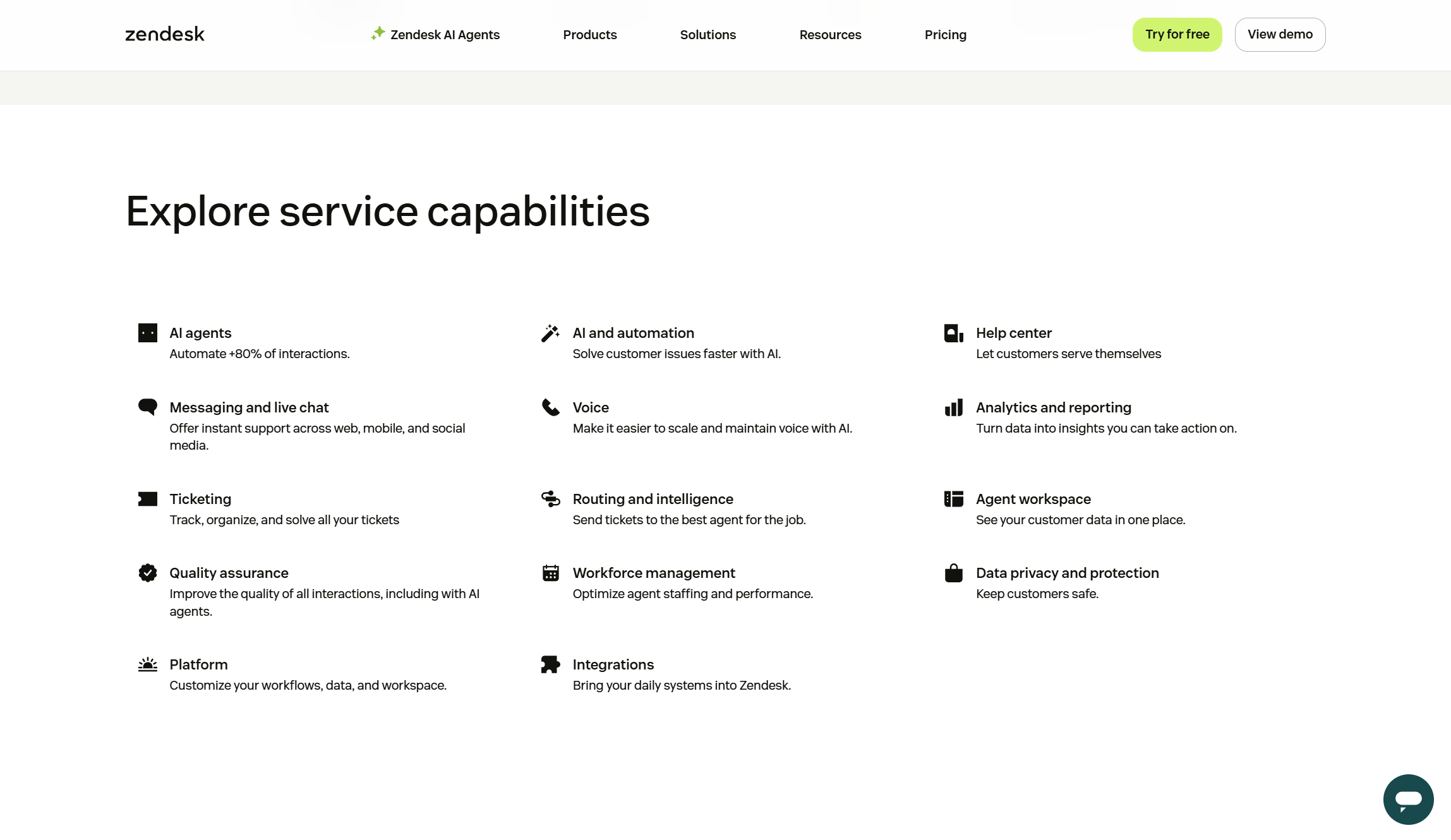

Zendesk Support provides a wide range of features to improve customer service across channels. At its core, Zendesk is a ticketing system. It brings together customer interactions from email, chat, social media, phone, and messaging apps. Its omnichannel approach offers a consistent experience for agents and customers. It also gives agents full visibility of customer interaction history.

In 2025, Zendesk updated its helpdesk platform with AI automation, customization tools, and advanced analytics. Zendesk supports businesses of all sizes, from early-stage startups to Uber, Shopify, and Netflix. It offers a lot of customization freedom, while still keeping the interface simple for non-technical users.

Omnichannel support

Zendesk's omnichannel support feature helps businesses deliver more well-informed customer service. It lets support teams handle all interactions from one interface. Your team can manage emails, live chats, social media, phone calls, and messaging apps without switching between tools. Zendesk's dashboard keeps track of past conversations, so agents always know exactly where they are jumping in.

As a result, customers too can move between channels without repeating themselves. Zendesk saves the context of their previous chats. And with smart routing, complex questions go straight to the right agents. AI chatbots also help, by answering common questions quickly. This leads to happier customers, better efficiency, and consistent service at every touchpoint.

Ticketing system

The ticketing system is the backbone of Zendesk Support. It turns customer requests from different sources into trackable tickets. Agents can manage multiple tickets at once without missing a beat. It boosts efficiency and ensures no customer inquiry is missed. Zendesk's workflow helps teams assign and track ticket status — like assigned, routed, or escalated — so all interactions stay on track.

With features like conditional and custom ticket fields, agents can collect specific details about support issues. This gives them the context needed for personalized support. The system also has agent collision detection, which alerts staff when multiple agents view or work on the same ticket. It prevents duplicate work and supports real-time collaboration. By centralizing customer support requests, the ticketing system speeds up resolution times, boosts agent productivity, and improves customer satisfaction.

AI automation

Zendesk's automation features are among its most valuable. They help deal with repetitive tasks that take up agents' time. The platform uses AI-powered tools to automate ticket routing, follow-up emails, and escalation processes. This lets agents focus on more complex issues.

Automation also helps with workflow management. You can set up triggers that start actions based on ticket changes or customer interactions. Custom macros let agents create standard replies for common inquiries. These can be shared across teams as templates. Overall, these features lead to better business results.

Self-service options

Zendesk helps customers find answers on their own with strong self-service tools. Businesses can build knowledge bases, community forums, and FAQs that tackle common questions without needing an agent. The basic plan allows companies to create and share help center articles in one language. Higher tiers support over 40 languages with more advanced self-service features.

Zendesk lets you publish support articles that can be added as widgets on a company's website. This makes information easy for customers to access. For those on Professional and Enterprise plans, Zendesk Gather lets businesses create online communities. Customers can connect with each other and the brand, giving feedback and boosting loyalty. These options lower ticket volume, cut support costs, and enhance customer satisfaction.

SLA management

Zendesk's Service Level Agreement (SLA) management helps businesses set response and resolution times based on ticket priority. Support teams can mark issues as urgent, high, or low priority. This ensures urgent customer problems get quick attention, while less urgent inquiries are still managed properly. SLA views let teams track status by the minute and avoid breaching their service commitments.

Real-time tracking and alerts notify agents when tickets near their SLA deadlines. This helps teams stay focused on high-priority issues. It also ensures accountability within support teams and provides clear work prioritization guidelines. However, businesses must set realistic SLAs to match team capacity and ticket volumes to avoid agent burnout.

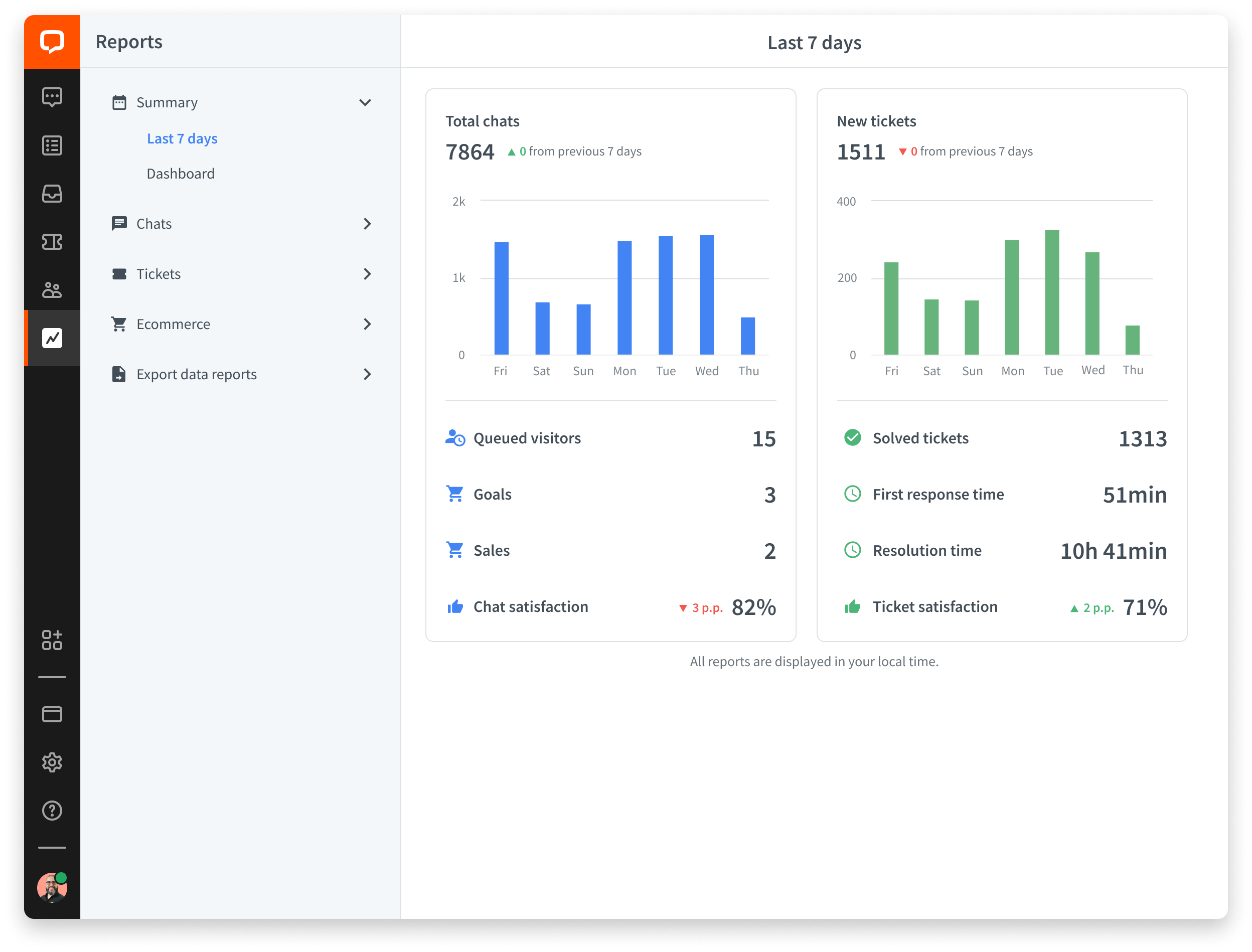

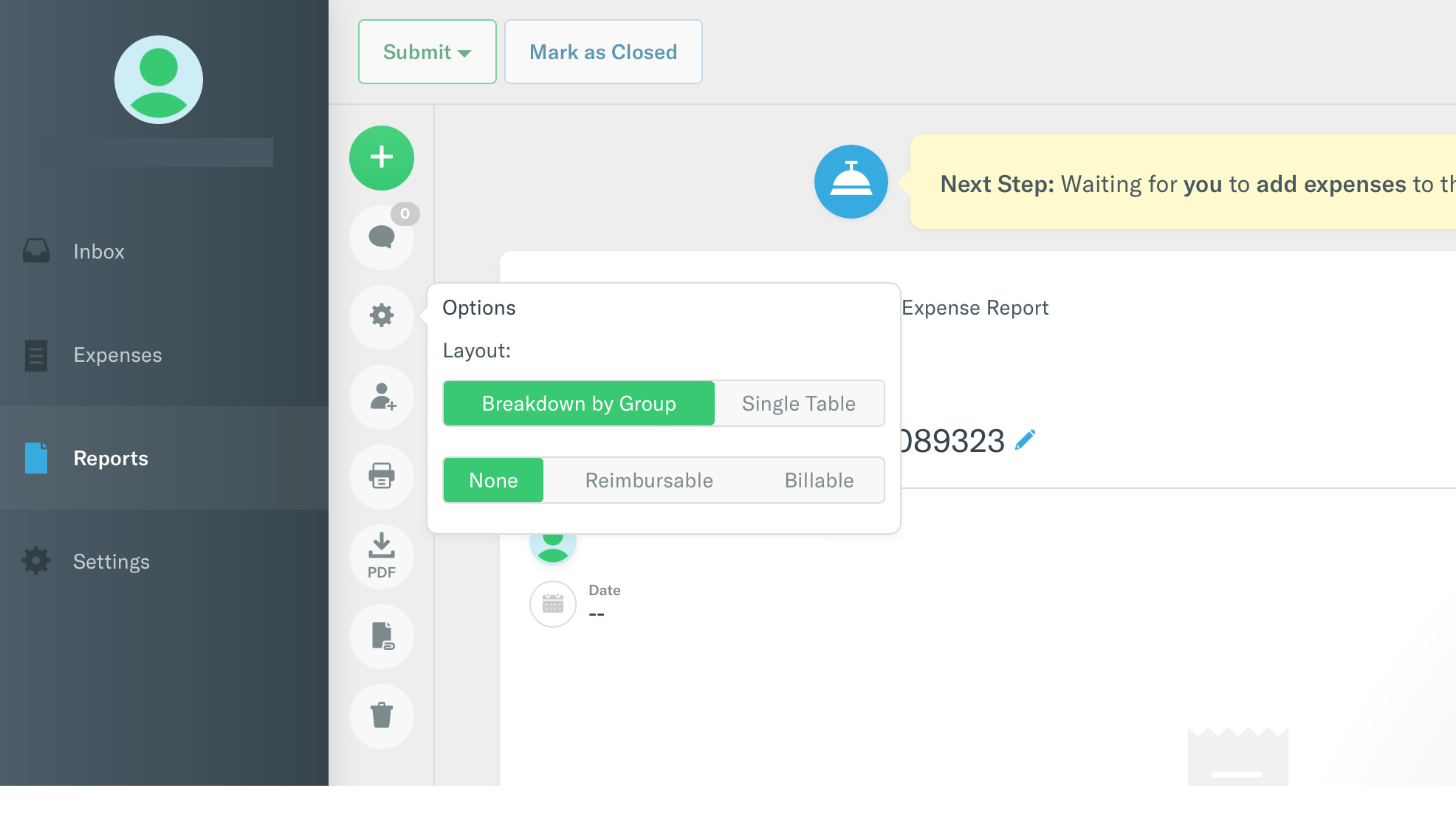

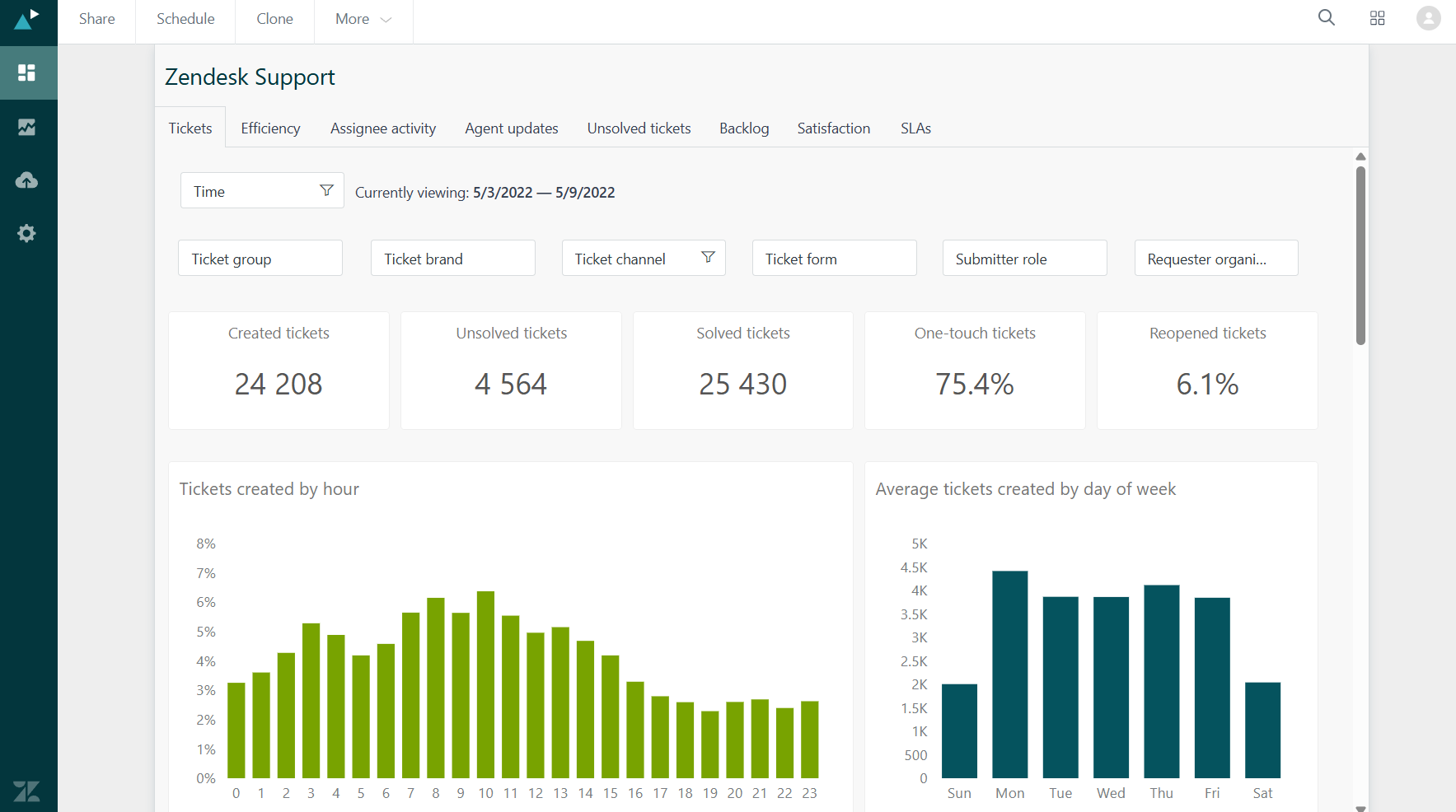

Zendesk Support: Analytics

Zendesk offers several analytics and reporting tools for customer service. With customizable dashboards and detailed metrics tracking, businesses can gain valuable insights. The key feature, Zendesk Explore, helps managers monitor crucial performance indicators. These include ticket response times, resolution rates, customer satisfaction scores, and agent productivity in real time.

Zendesk's analytics dashboards are fully customizable. Managers can focus on data points that matter most to their goals. For example, if improving response times is important, teams can create dashboards showcasing real-time response data. If customer satisfaction is the main goal, they can highlight satisfaction scores and feedback trends.

The reporting tools in Zendesk gather data from various channels into one dashboard. Its omnichannel approach gives managers a complete view of customer interactions. They can track performance consistently everywhere, whether customers reach out via email, chat, phone, or social media. The platform also provides pre-built dashboards for quick insights and lets users create custom reports for specific analysis. Teams can even share reports with colleagues, promoting collaborative analysis and keeping everyone updated on past data and current trends.

Zendesk's analytics tools are strong, but they have some limitations. Custom report creation can be tough for those unfamiliar with data tools, plus there’s a learning curve for setting up dashboards properly. Some users find it hard to generate reports and question the accuracy of the data. For those needing more advanced analytics or integration with data from other sources, third-party tools like Power BI or SquaredUp can enhance Zendesk Explore.

Zendesk Support: Ease of use

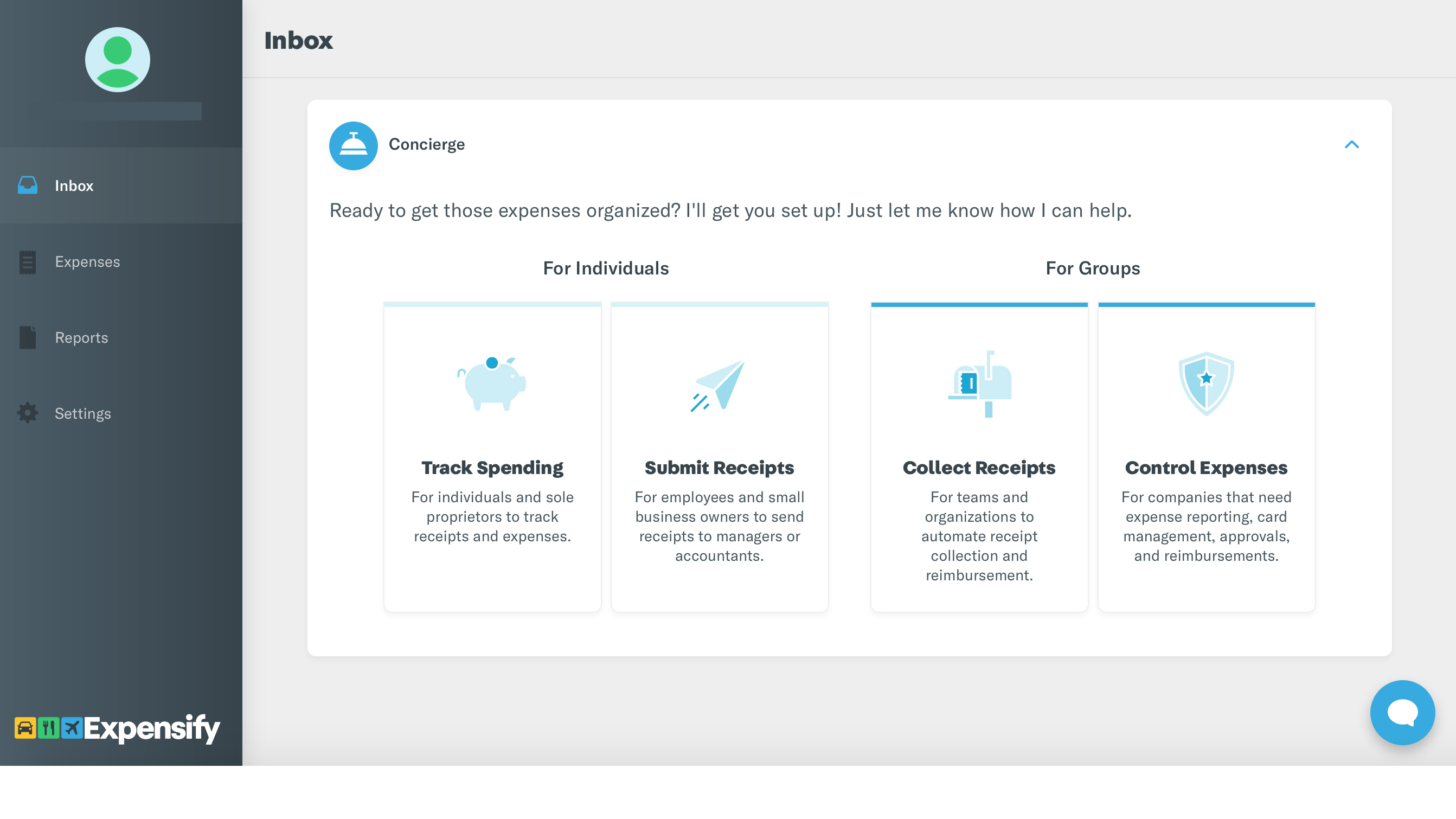

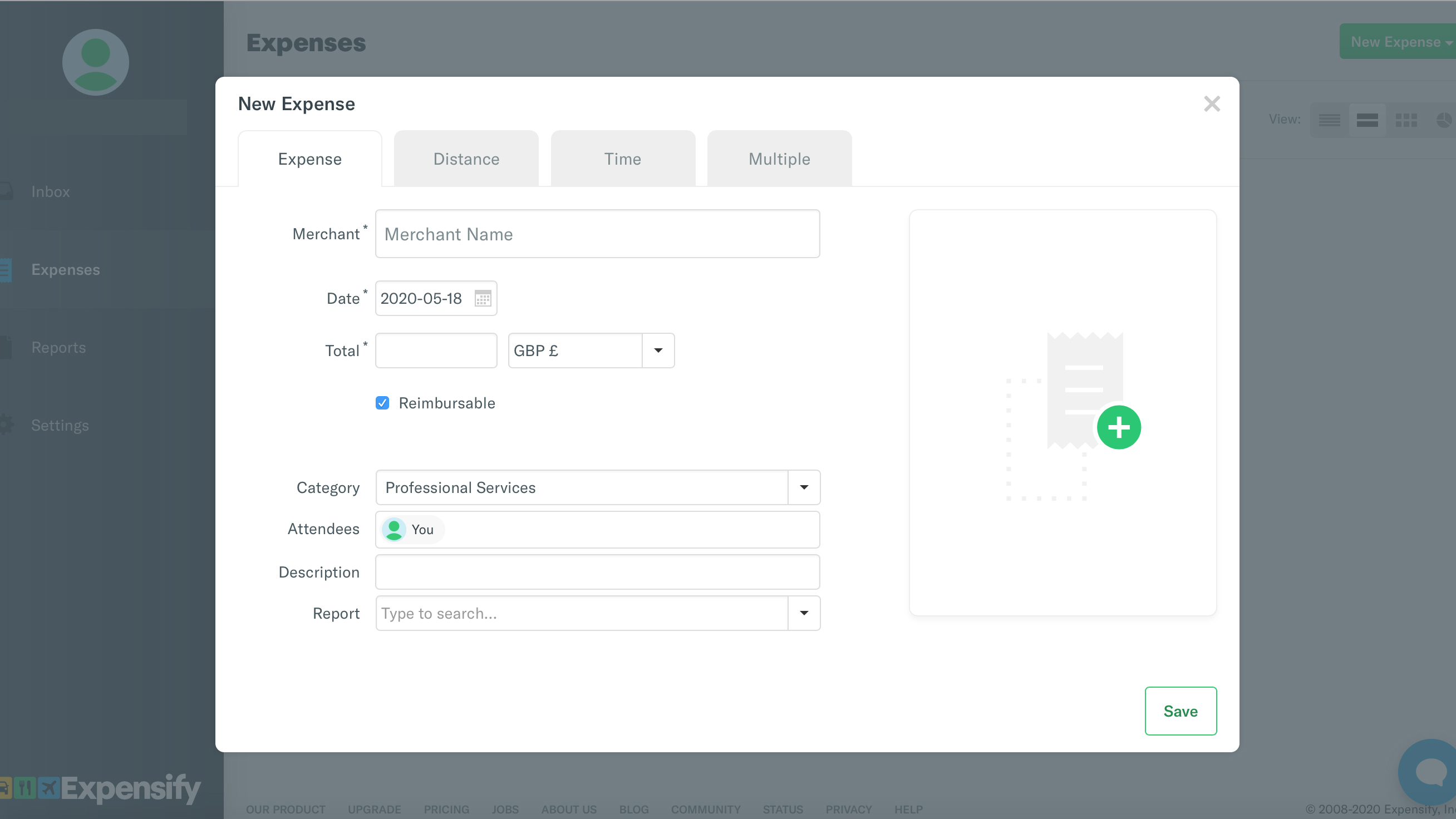

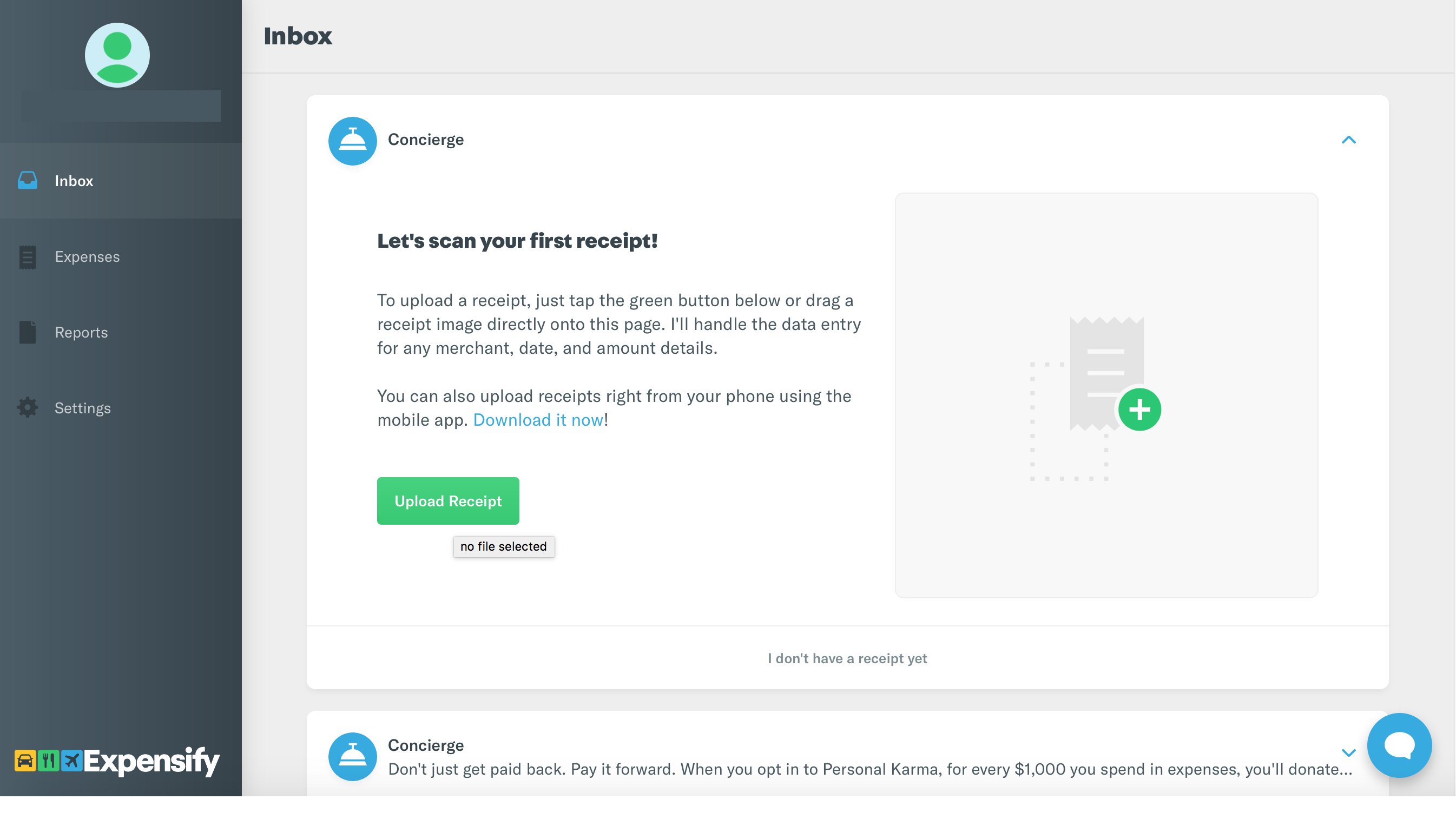

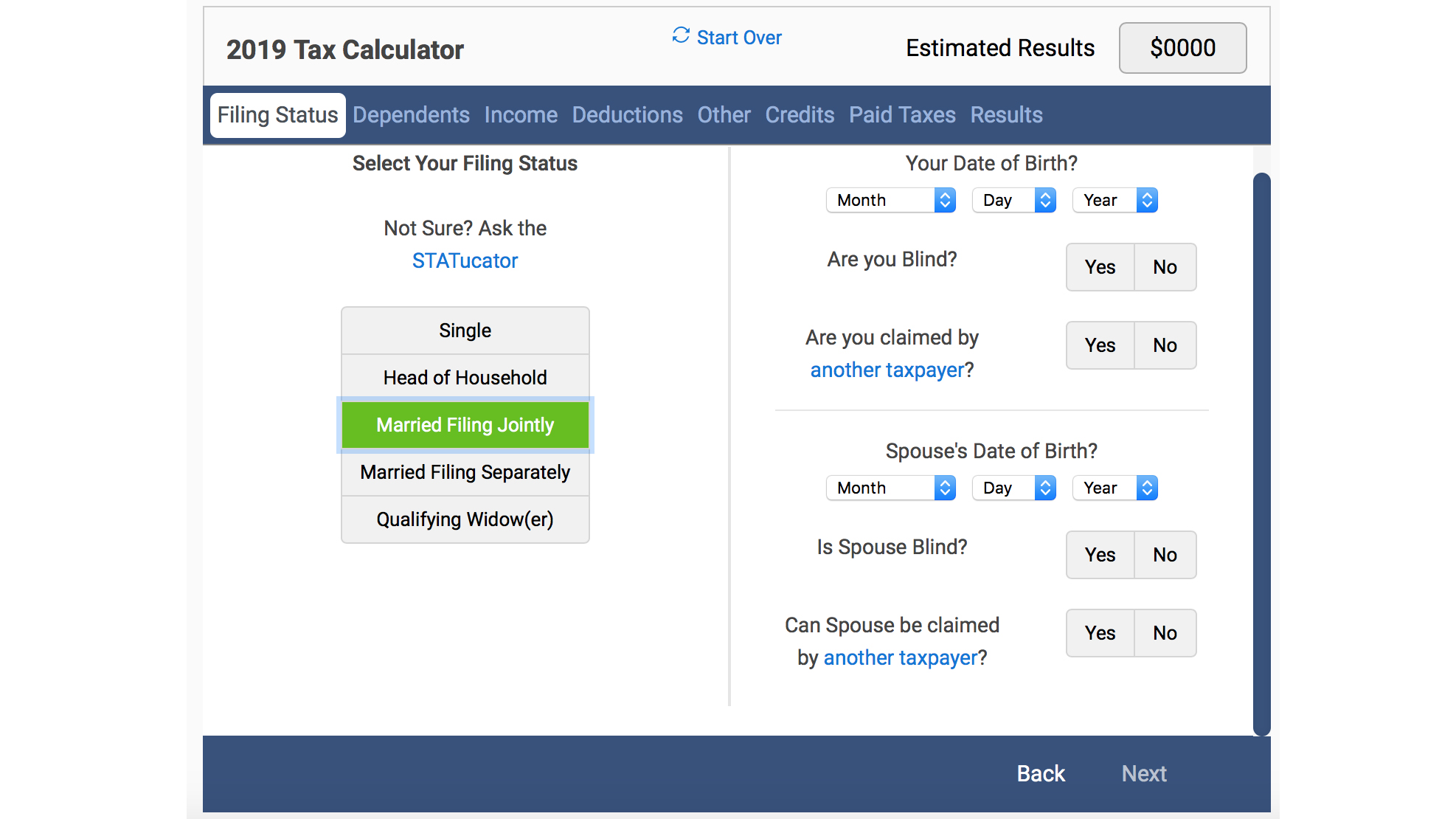

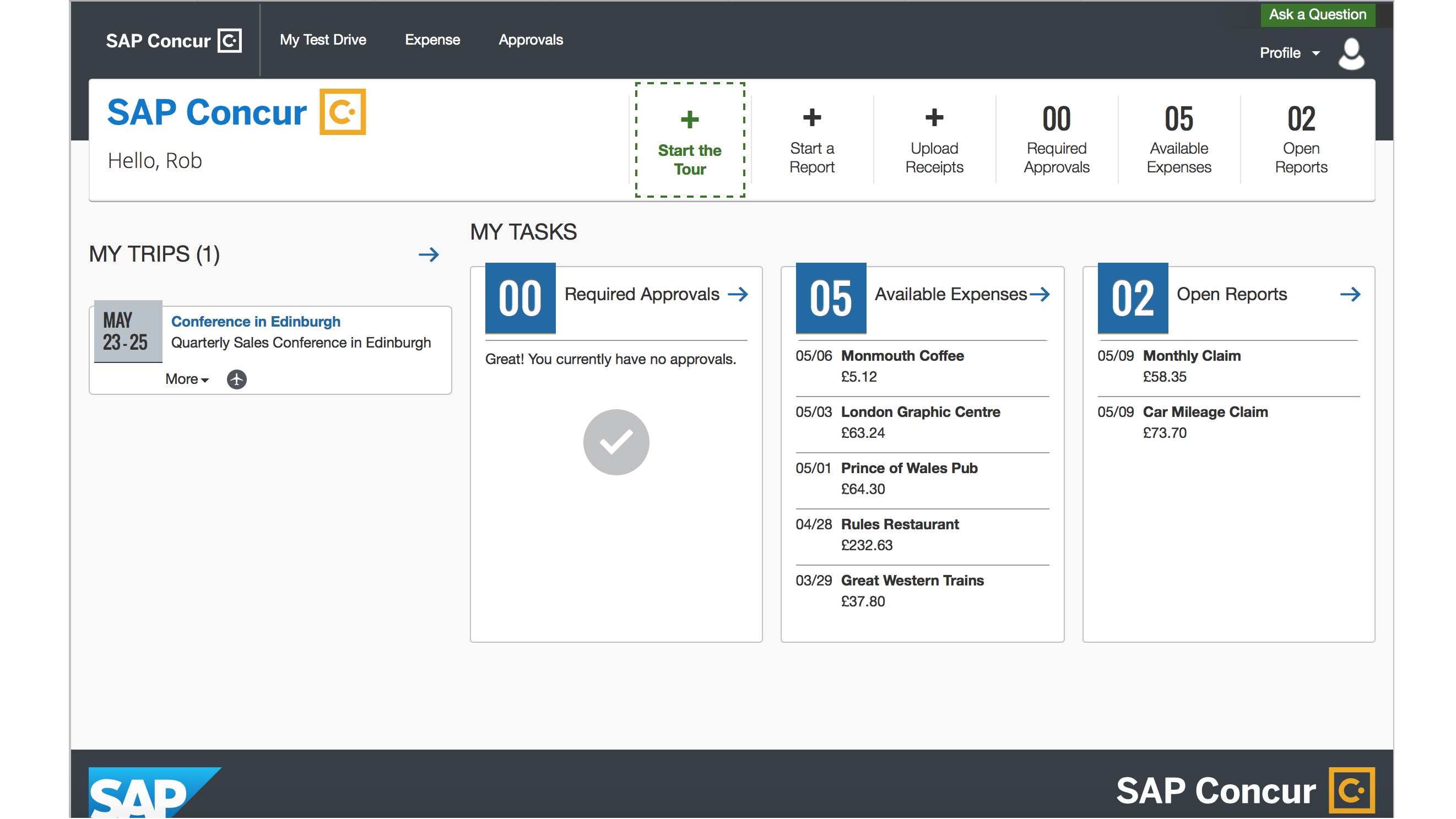

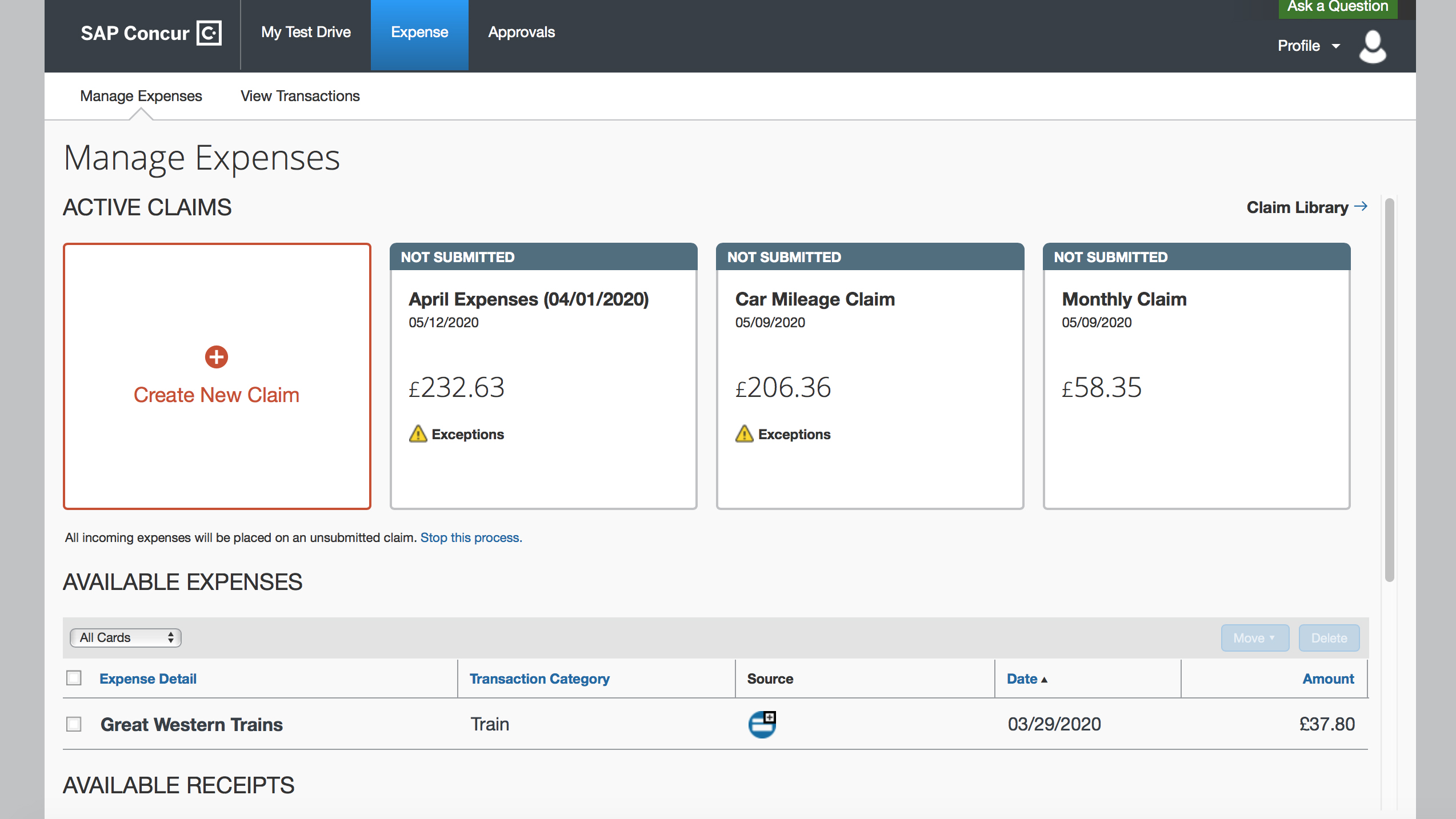

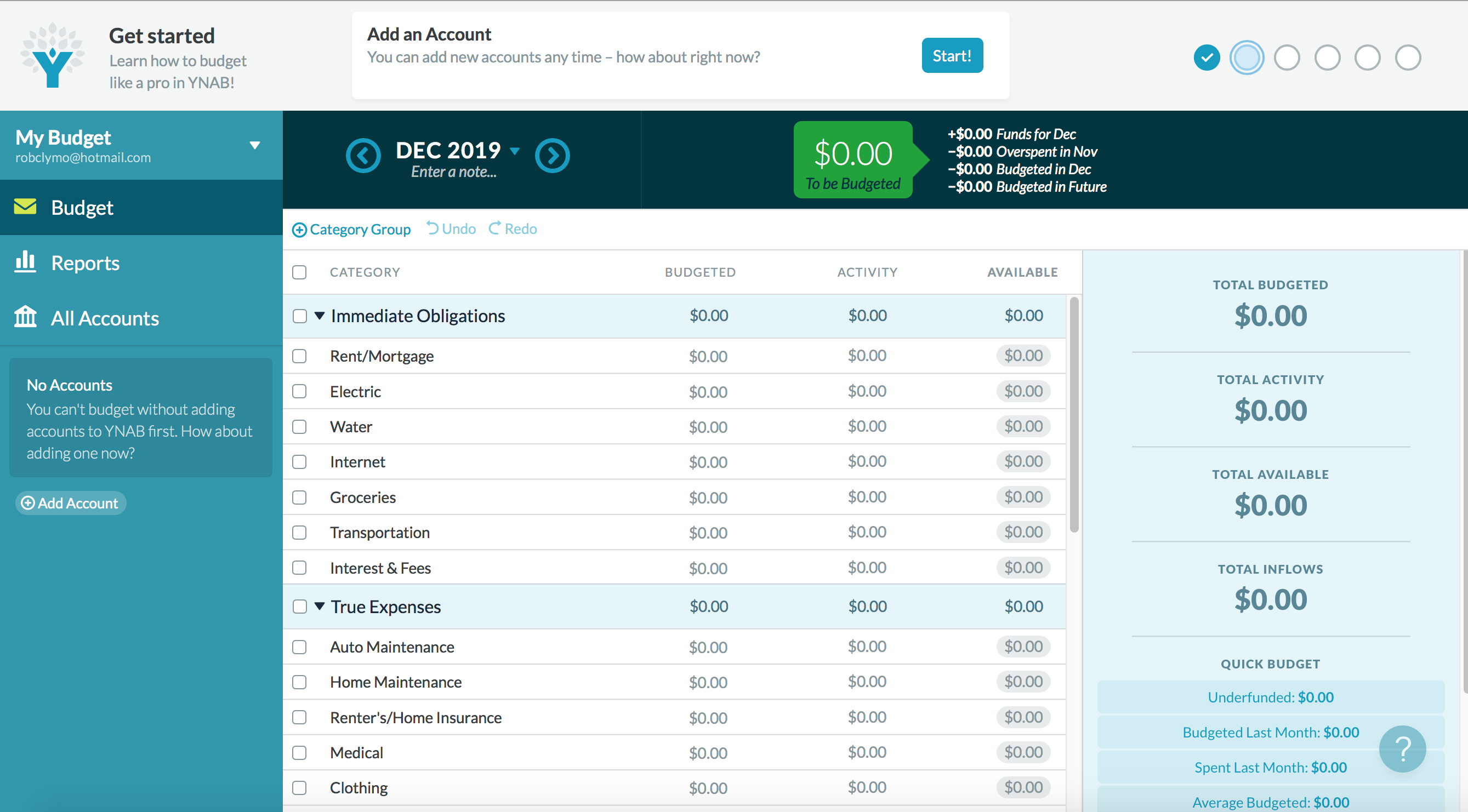

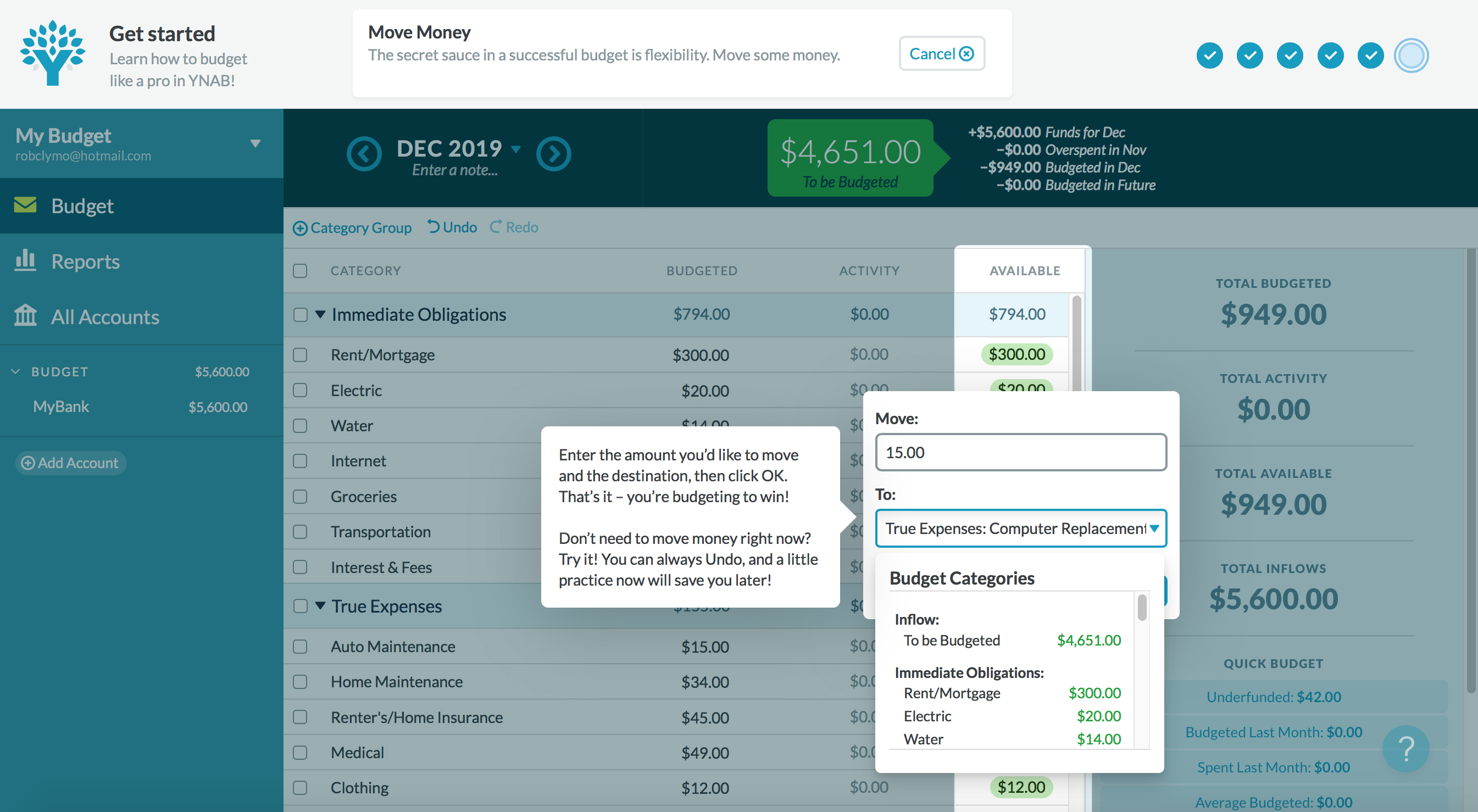

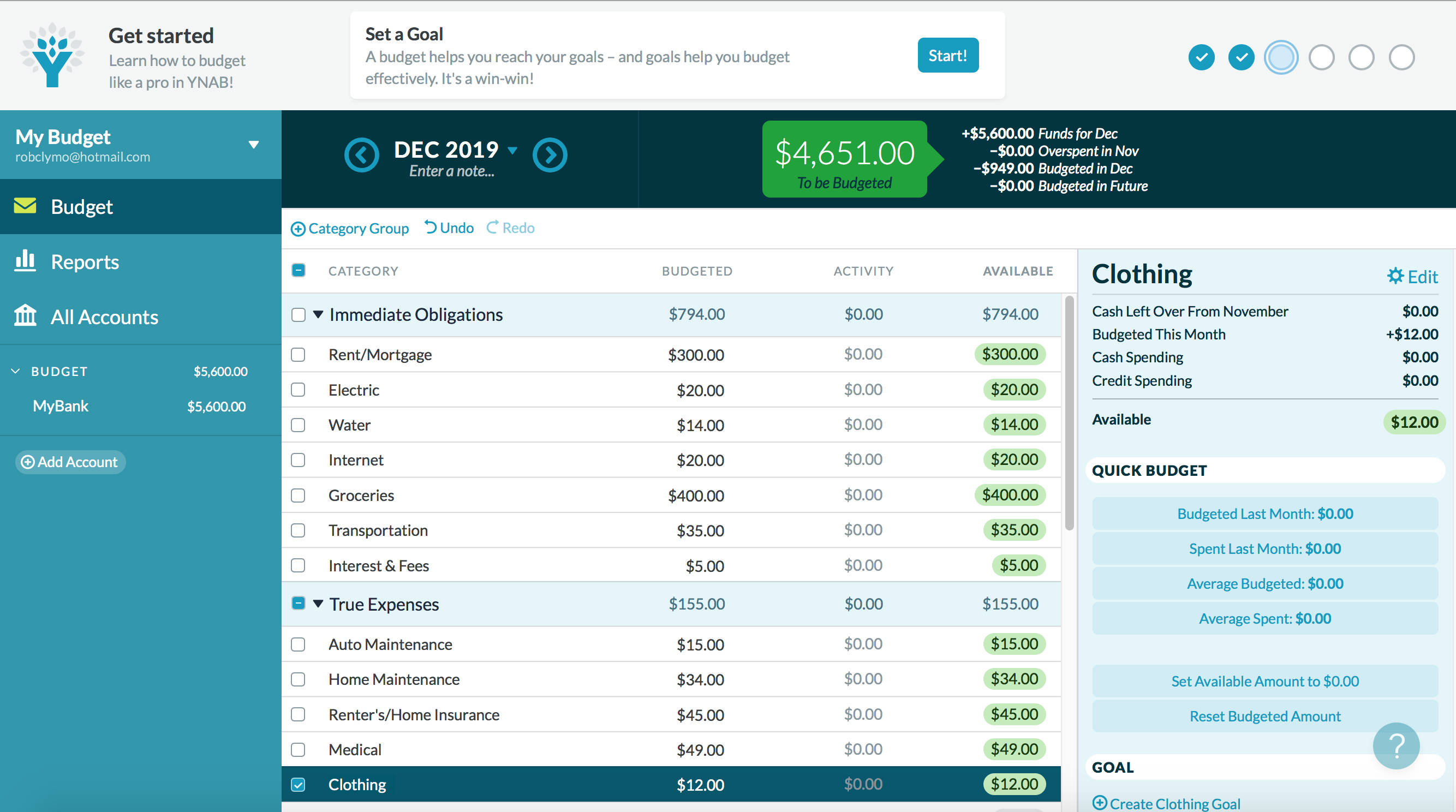

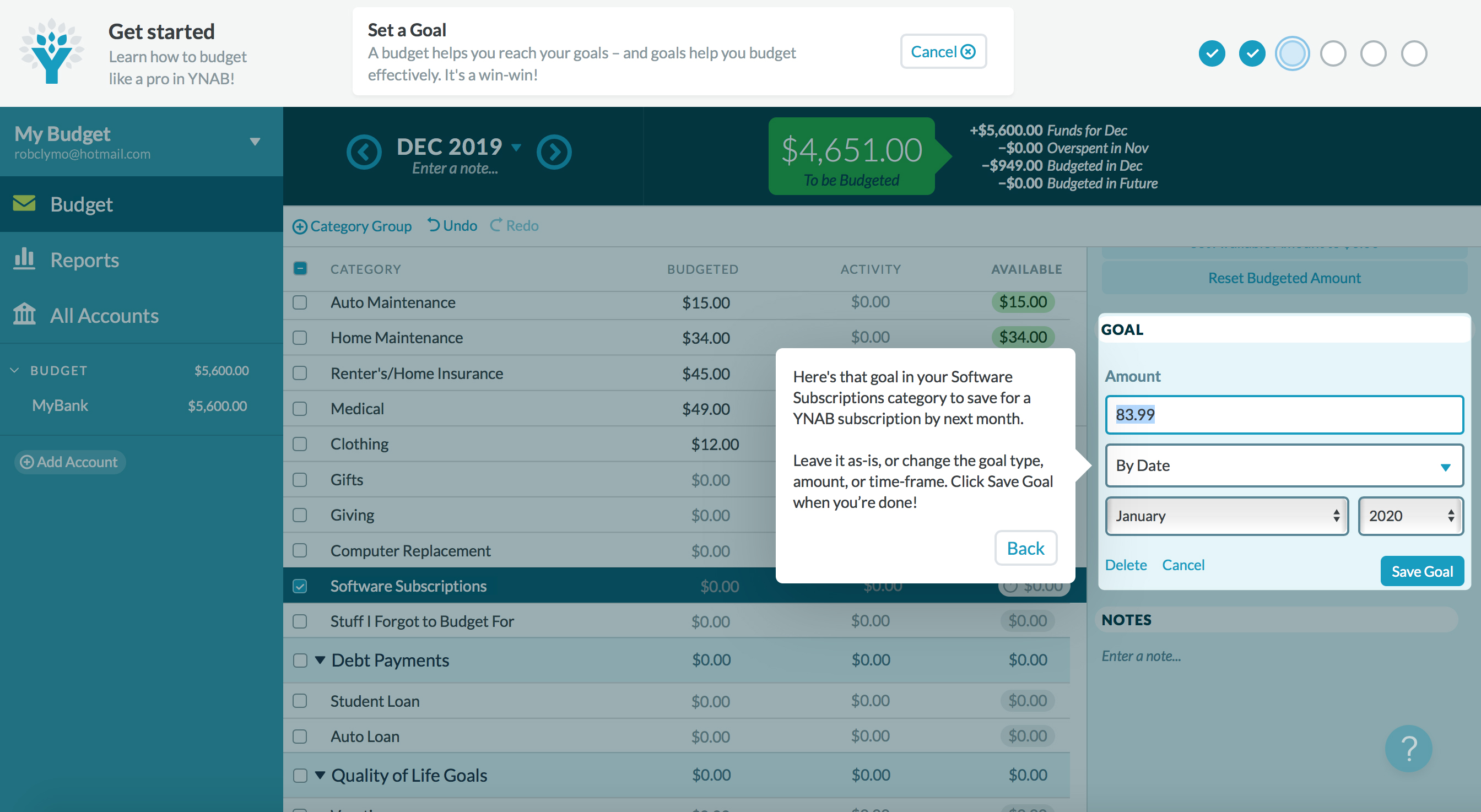

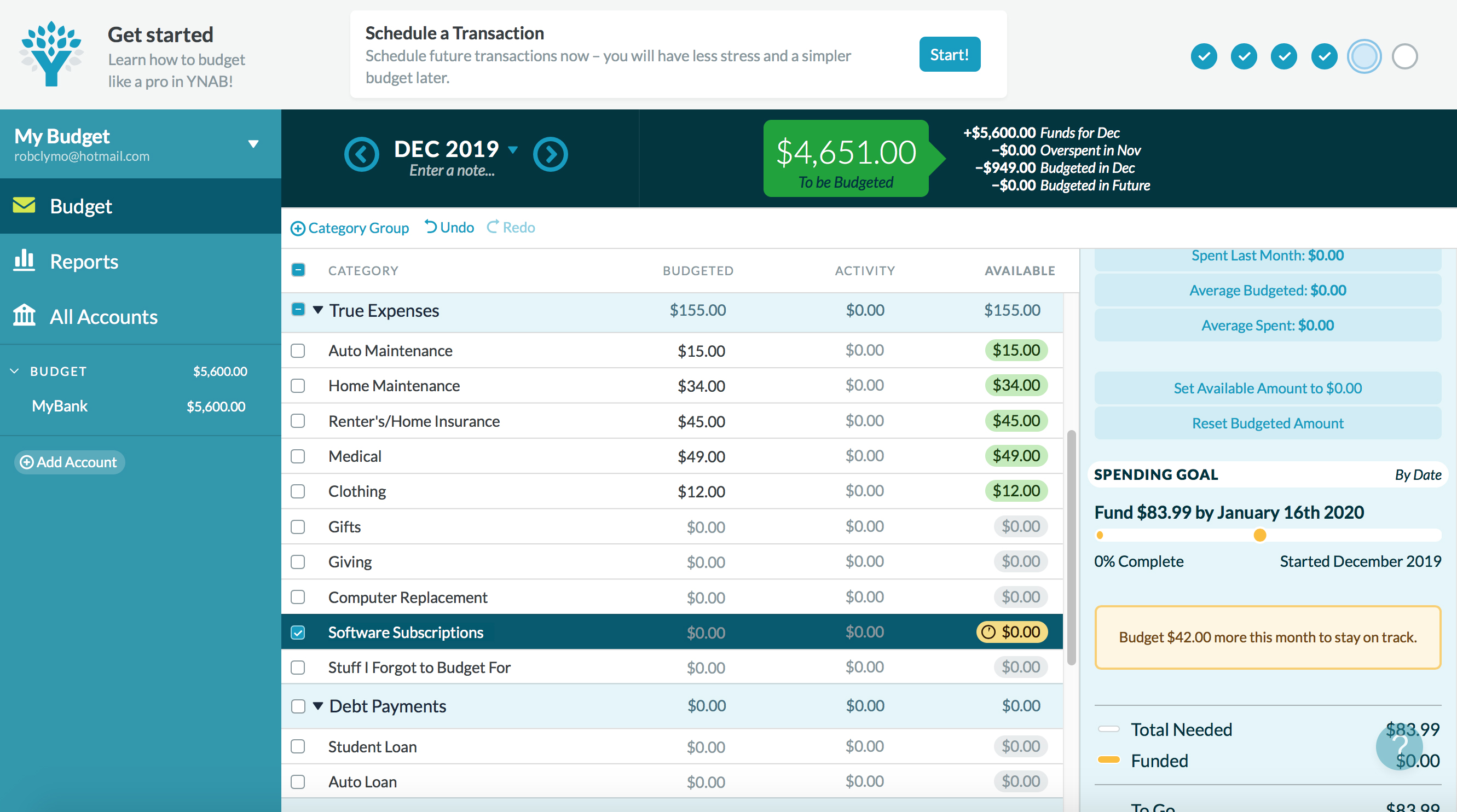

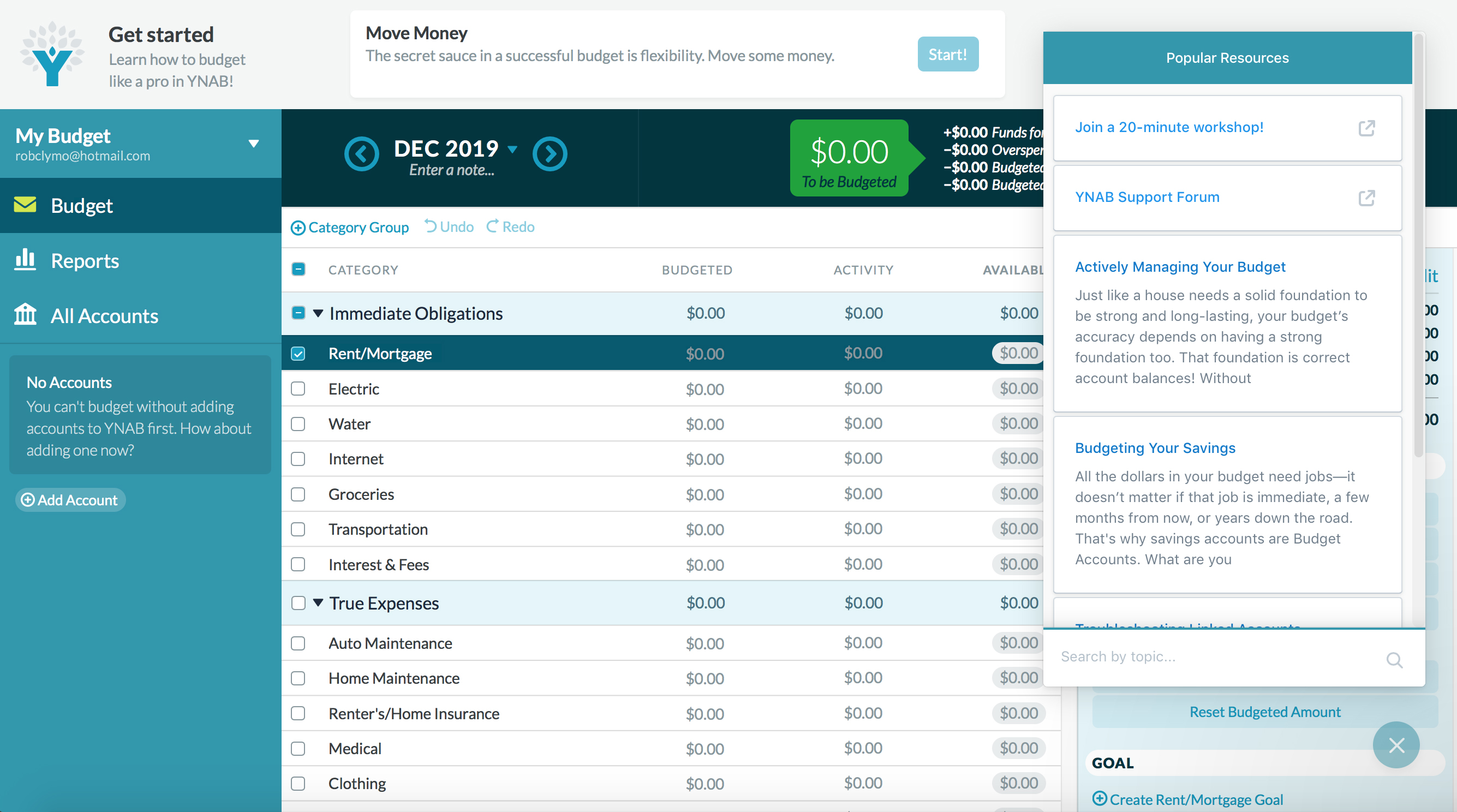

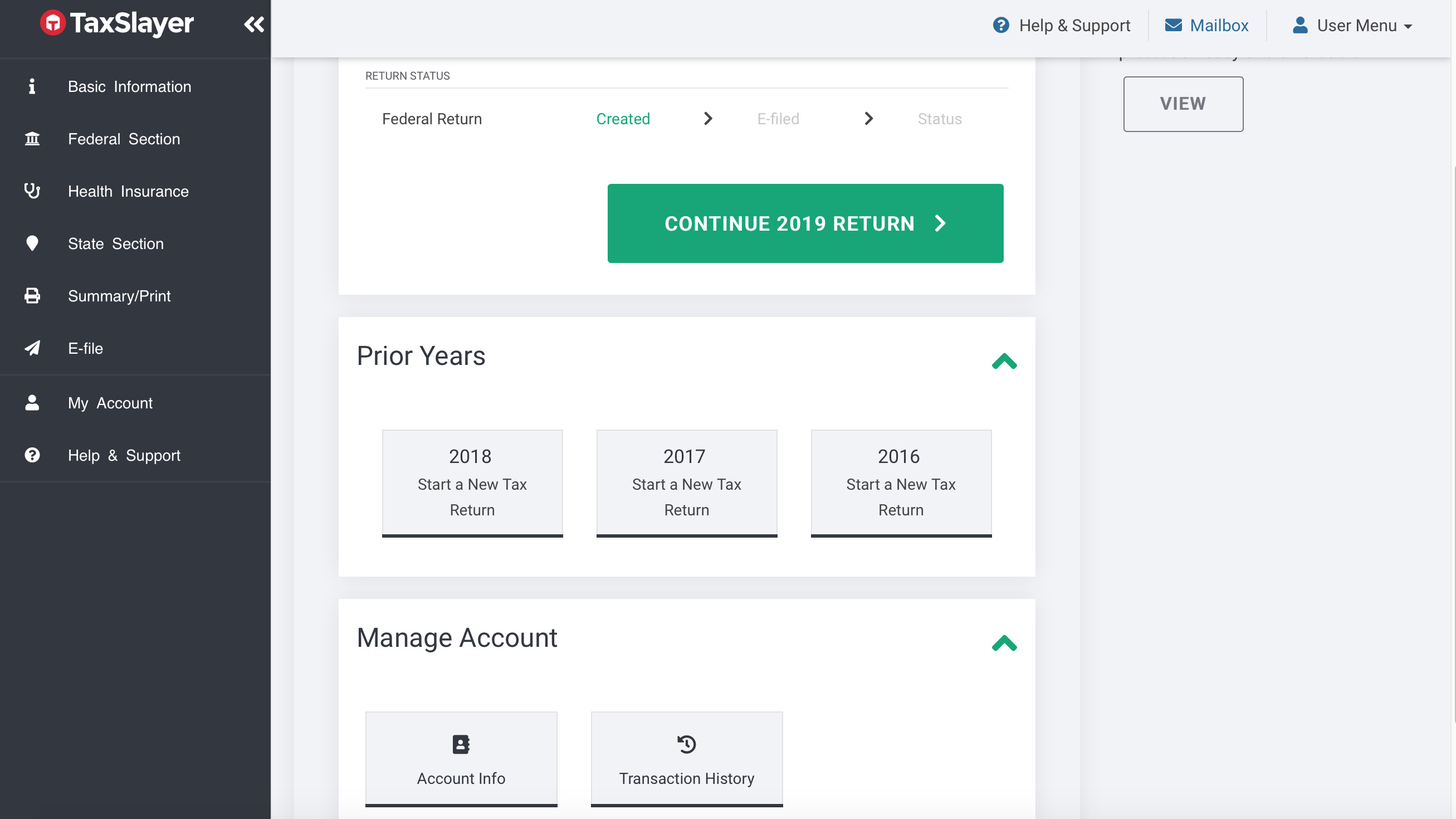

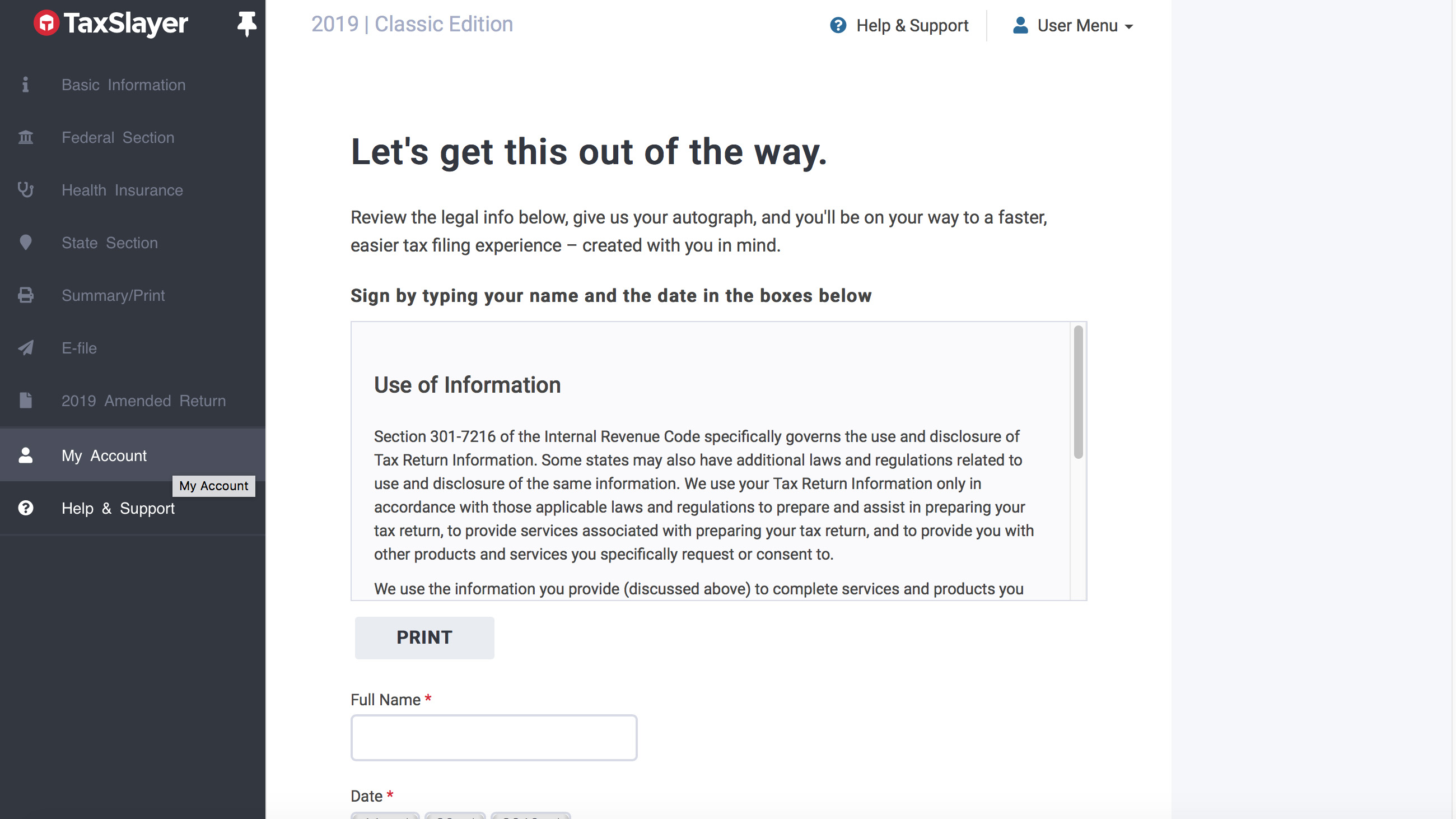

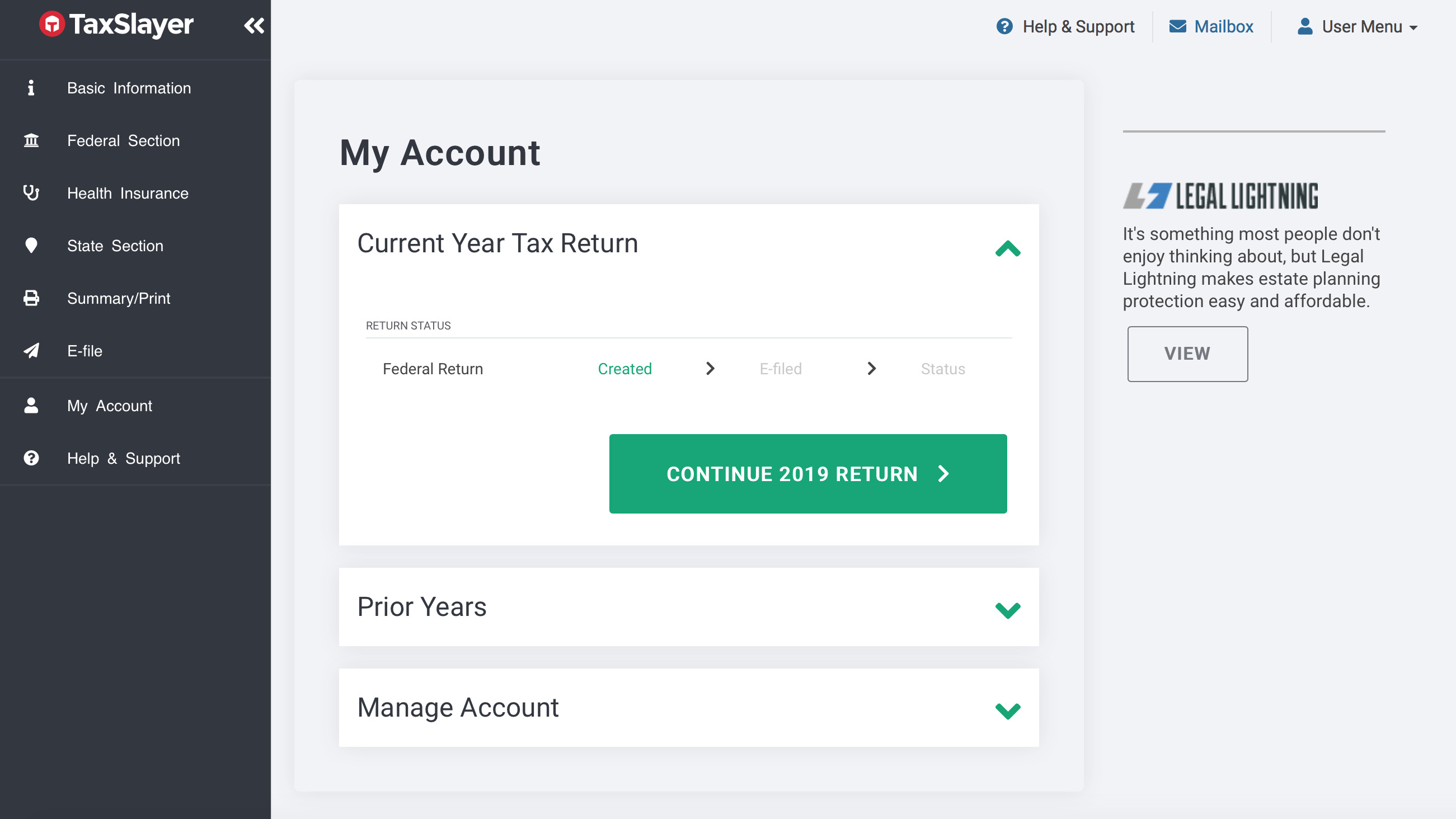

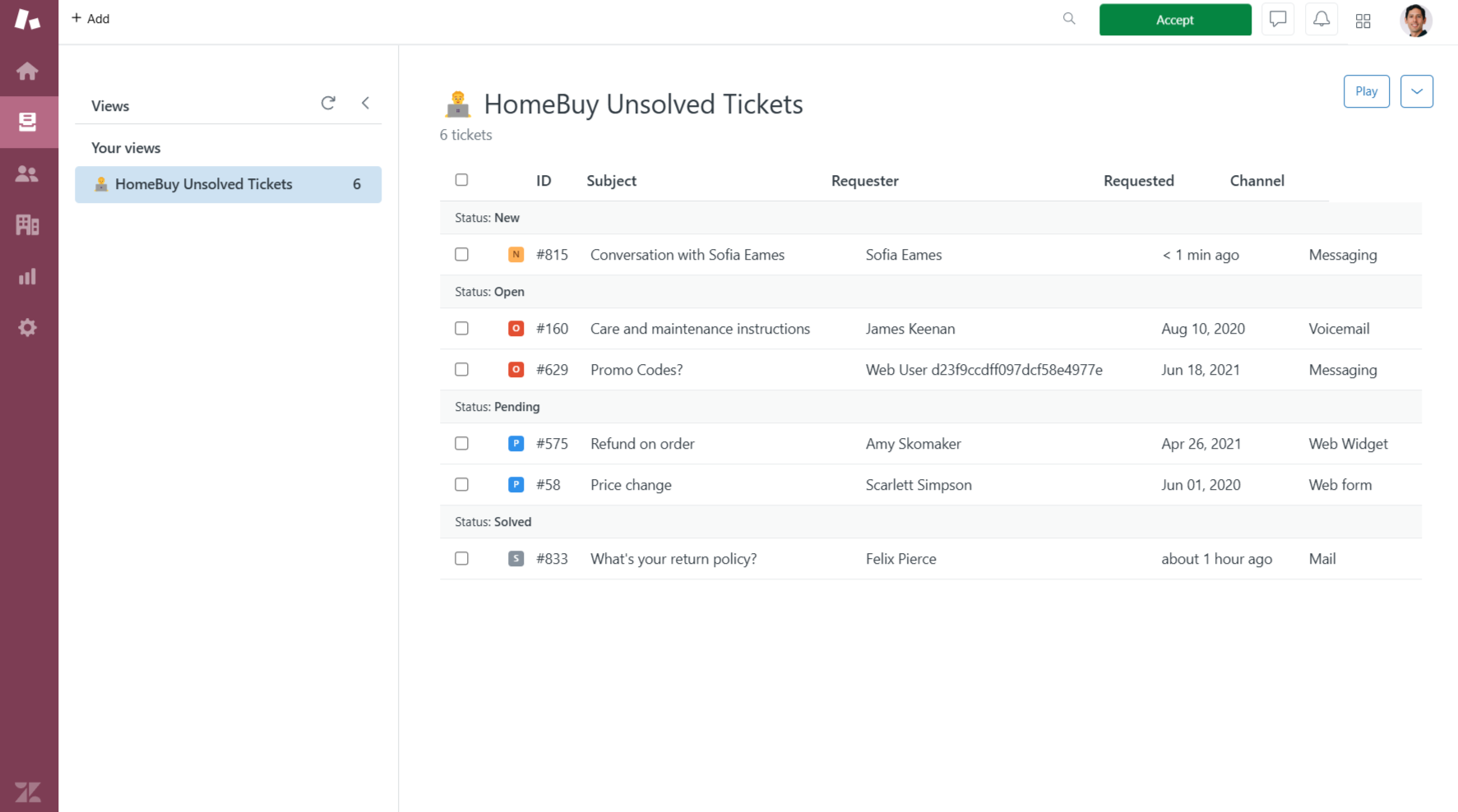

After you’ve created an account and logged in for the first time, you’re presented with a getting started wizard to guide you through the first-time setup. With that done, you can move on to the dashboard, where you get an overview of all your tickets.

Hovering over a ticket will give you a popup with a quick view of the latest replies. Clicking on a ticket adds a tab for it to the top of the window for quick access later, (until you manually remove the tab). Each ticket has a lot of fine-grained controls, like setting the ticket type, its priority, tags, who it’s assigned to, and others who should be following it.

In general, Zendesk is intuitive and easy to use, but there were a couple of aspects we found could be improved. One is that a lot of functionality — like the ability to relate tickets, display the five most recent ones, and link tickets to others — has to be installed as separate apps. Installing these only takes a few seconds for each one, but a lot of this functionality seems like it could be included by default.

Another thing was that reporting is part of a separate app called Zendesk Explore. It’s still included with Zendesk's support solution, but you have to launch the platform in a separate tab or window. It has its own navigation, so it doesn’t feel as tightly integrated with the helpdesk as some of the reporting tools from other helpdesk solutions.

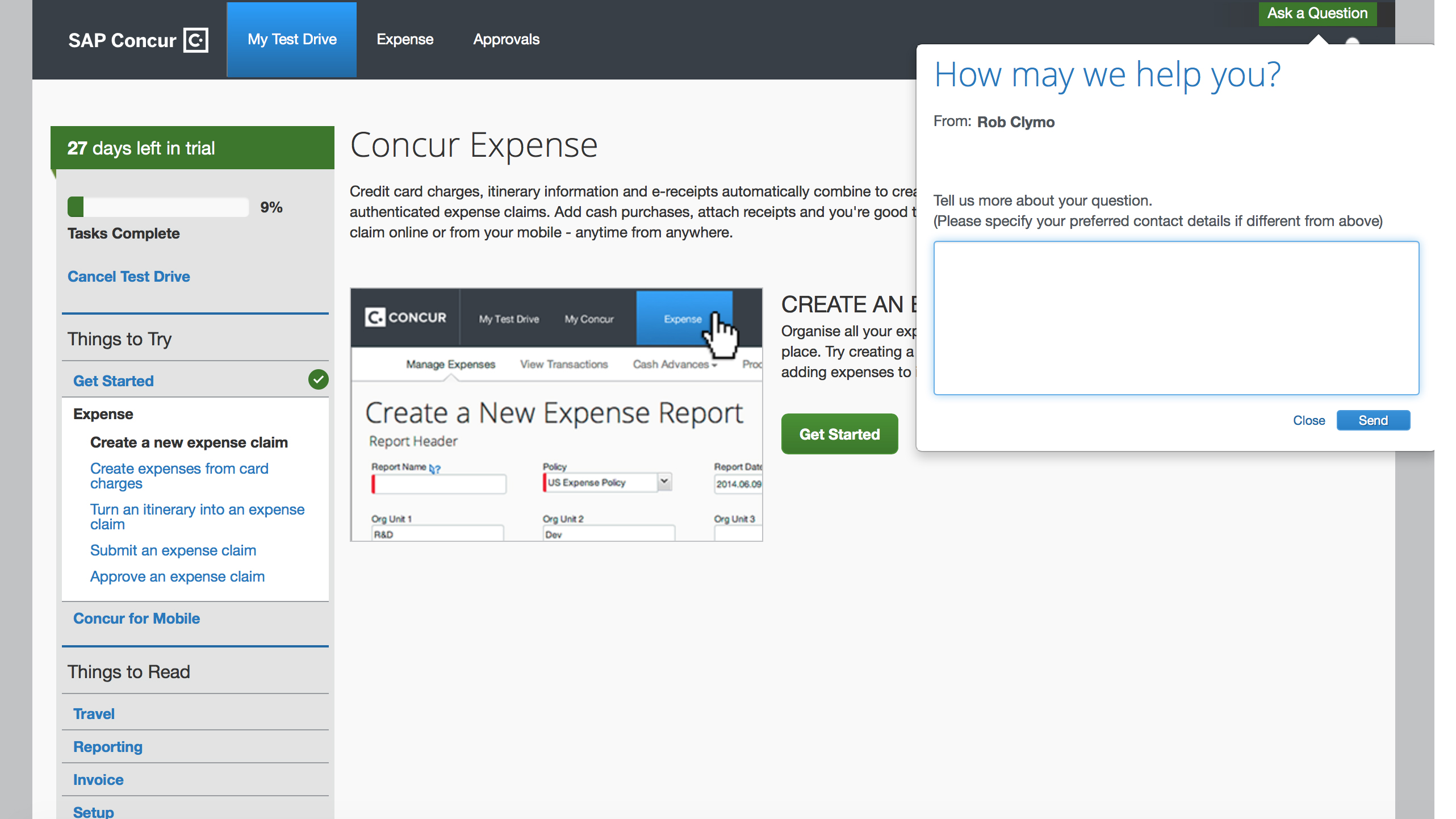

Zendesk Support: Support

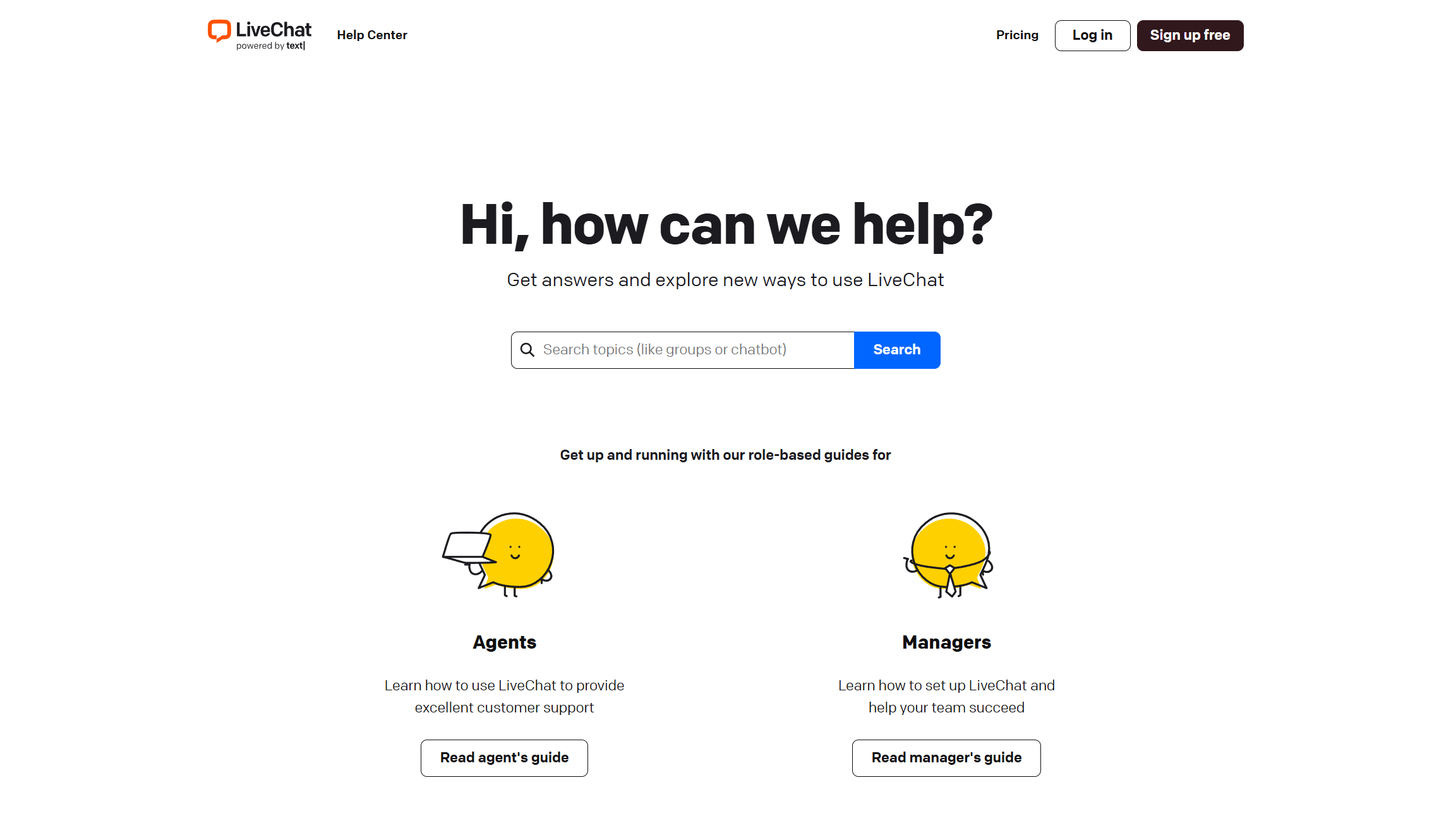

As a system designed to provide support to others, Zendesk itself features many of the support methods built into its own products, including a knowledge base, community forums, help widgets, and live chat (which is only available when you’re logged into your account).

Zendesk advertises three main support channels: a self-service help center, a community forum, and contacting their support team from within your product. There's also a Zendesk Community 101 video and you can comment on specific articles for further information.

Also, regardless of which payment plan you are signed up to, Zendesk Support users can purchase several add-ons for the support they receive. They can pay a little extra for 24/7 proactive support and engagement, professional services, and hands-on help with Zendesk Assist. So there's lots of support options to choose from.

Zendesk has 23 offices in various locations around the world, with many of them having phone numbers or email addresses listed, but office hours aren’t mentioned.

Zendesk Support: Security

Help desk solutions make use of large amounts of customer data - some of which is bound to be of a sensitive nature. A single breach here could prove hugely damaging. Luckily, Zendesk is fully compliant with security and privacy frameworks like HIPAA and PCI DSS.

Zendesk Support has a globally distributed security team and uses AWS data centers, which have a number of on-site security measures in place like security guards and intrusion detection technology.

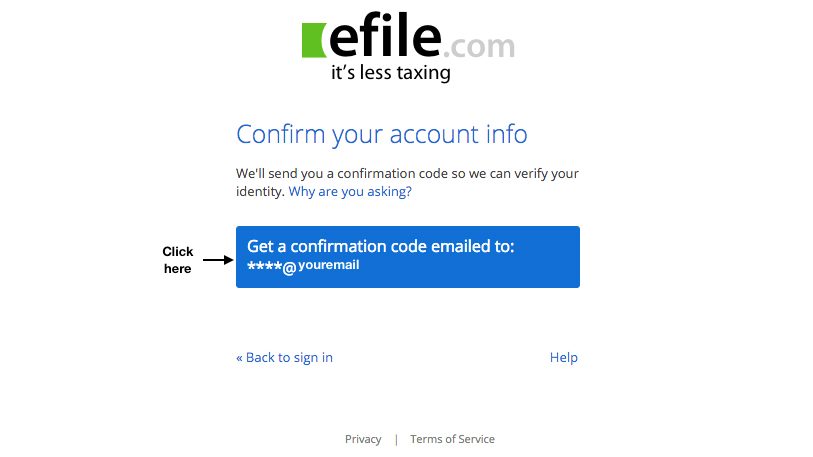

All communications with Zendesk and its APIs use encryption as standard, and customers can enable multi-factor authentication (MFA) or single sign-on (SSO) for end-user protection.

Collectively, this adds up to some pretty decent security. Plus, the company offers frequent guidance on security best practices for users. This is important because no technological safeguard can completely protect against human failings. So, it's essential that agents and other members of staff understand how best to keep customer information protected.

Zendesk Support: The Competition

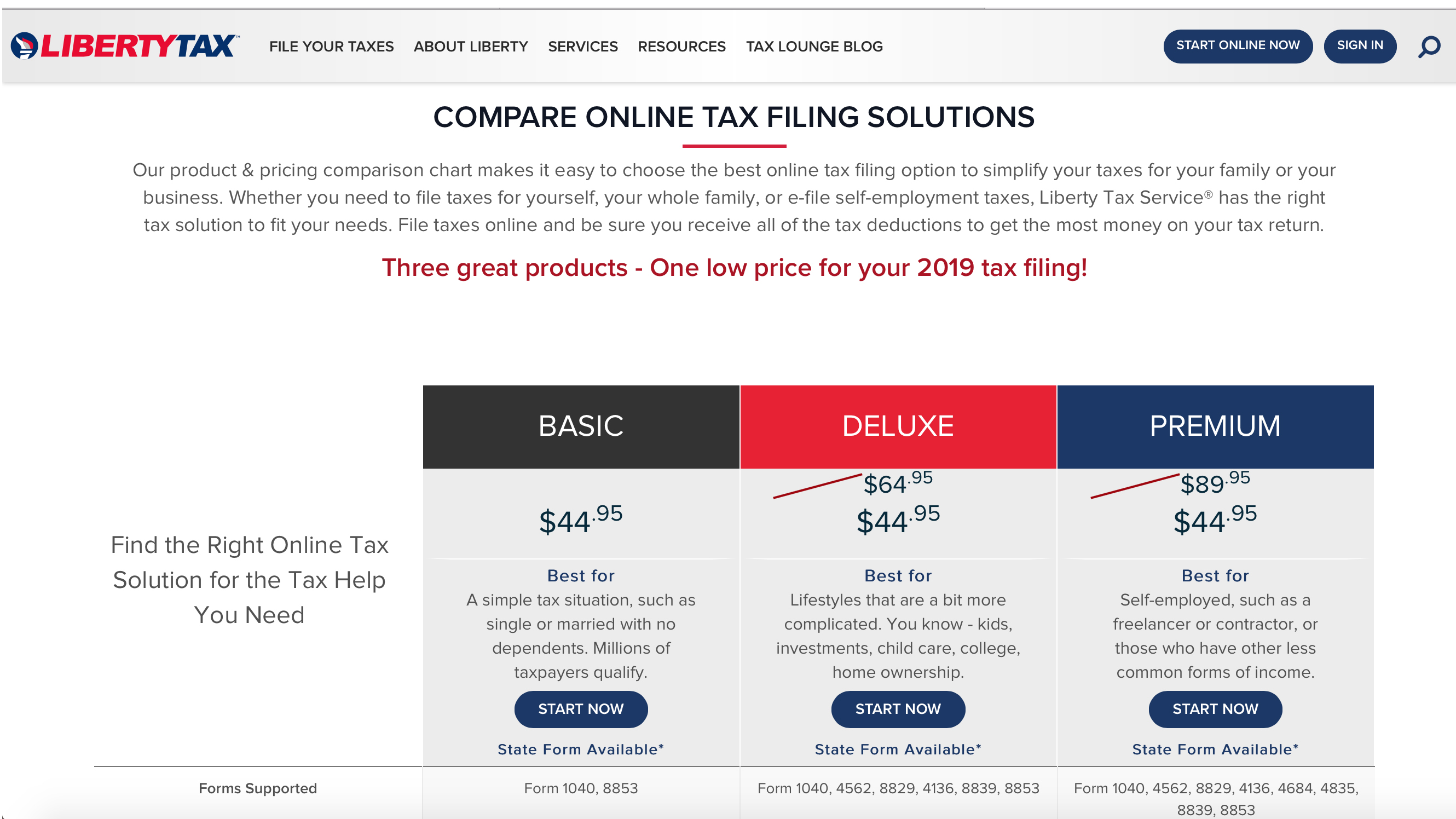

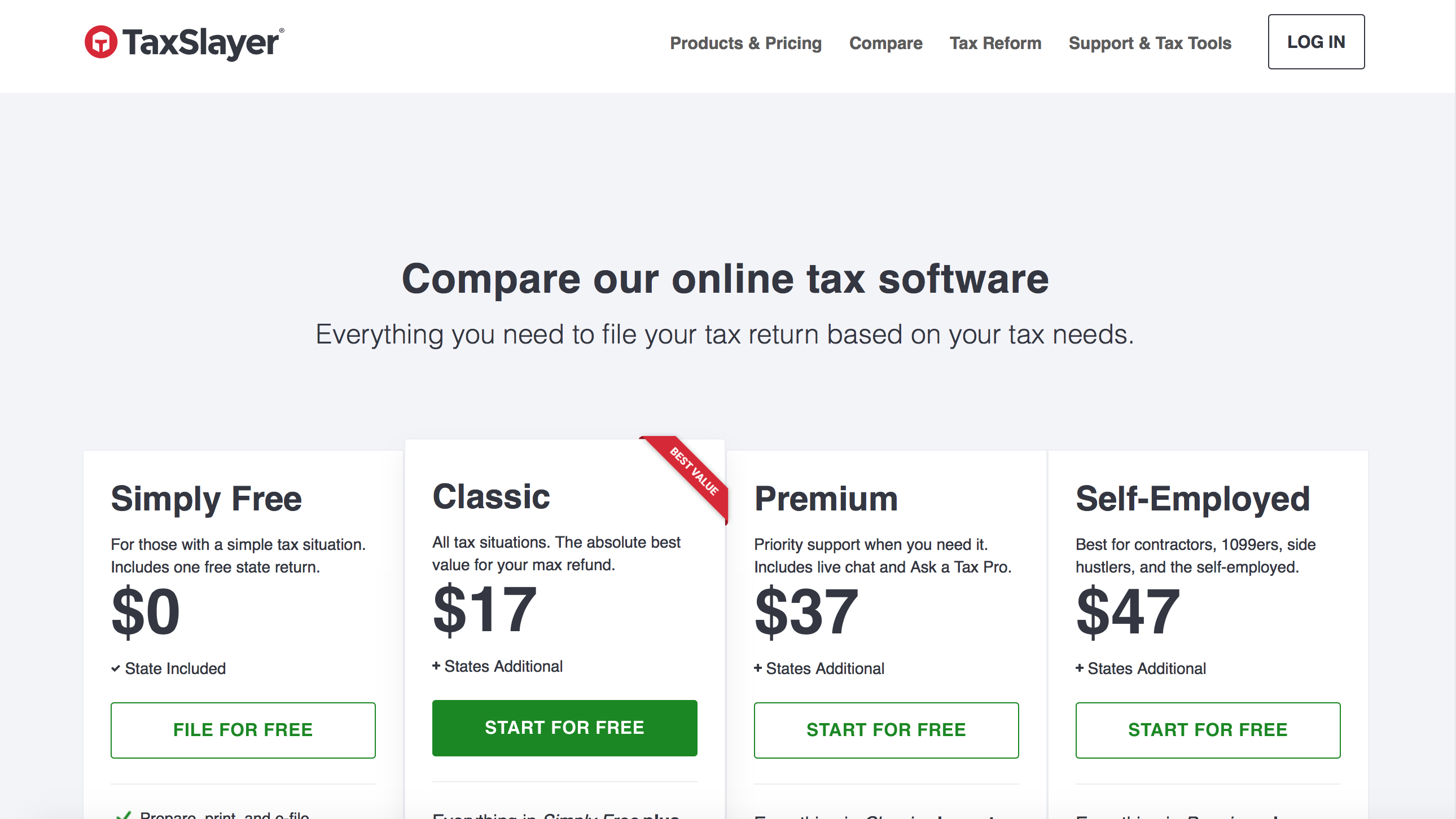

Zendesk has a lot of competition in the online helpdesk space. Among the alternatives to consider are Zoho Desk and Freshdesk, which both offer free plans.

Freshdesk also offers five plans, with its free plan available for unlimited agents but with a limited feature set. The paid plans go from $15/agent/month up to $99/agent/month, and all plans come with a 21-day free trial.

Zoho Desk also has a comprehensive feature set, with four plans available, starting with the free plan for three agents and going up to $35/agent/month for unlimited agents. All paid plans come with a 15-day free trial.

There are also other help desk programs that work especially well with specific third-party solutions. For instance, Social Intents is an obvious alternative if you use Slack or Microsoft Teams a lot internally.

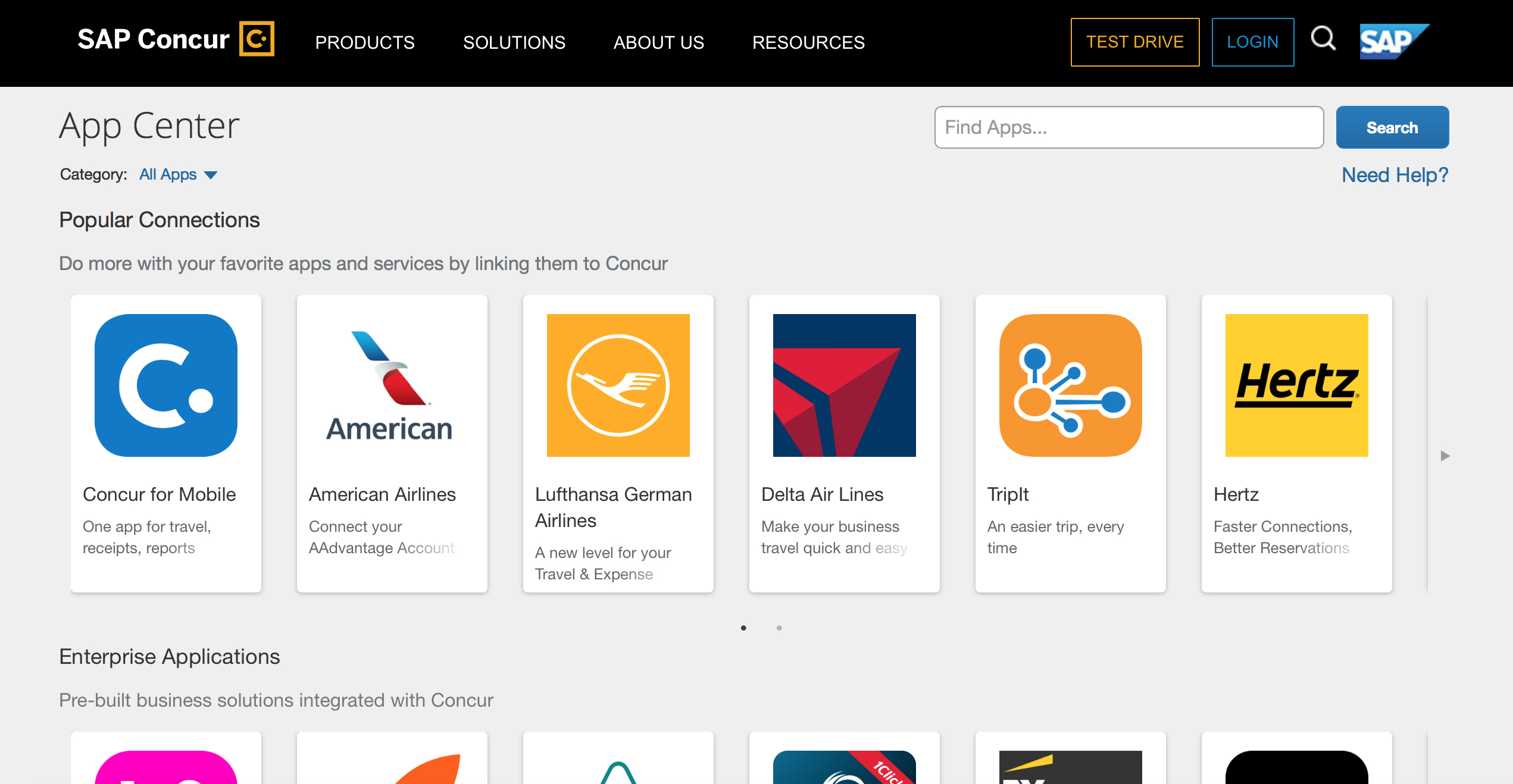

But there are sadly very few help desk tools that can compete with Zendesk Support on the integration front. And if you already use any of Zendesk's other platforms, it's a no-brainer to also employ Zendesk Support.

Zendesk Support: Final Verdict

Zendesk is competitively priced, but it doesn’t have a free option like some competitors. But it does have a large feature set and an impressive approach to customer security. And if Zendesk Support isn't enough for your team, you can always give the full suite a look, which is more of a complete solution with better pricing.

Zendesk Support's ticketing management system provides a lot of fine-grained control over tickets, but we found the separation of reporting into a separate app, and the fact that some functionality has to be installed rather than being included by default, slightly detracting from the user experience.