PayAnywhere is an American company that has been in existence for around a decade or so now, although it's only in the last couple of years that it has been improved enough to be called a serious player in the card processing stakes.

There’s no doubt that on face value if you take a tour of the PayAnywhere website that this could be an interesting and useful prospect, especially during the coronavirus crisis. So does PayAnywhere have what it takes to become an option if your business needs to process payments, or is it best avoided?

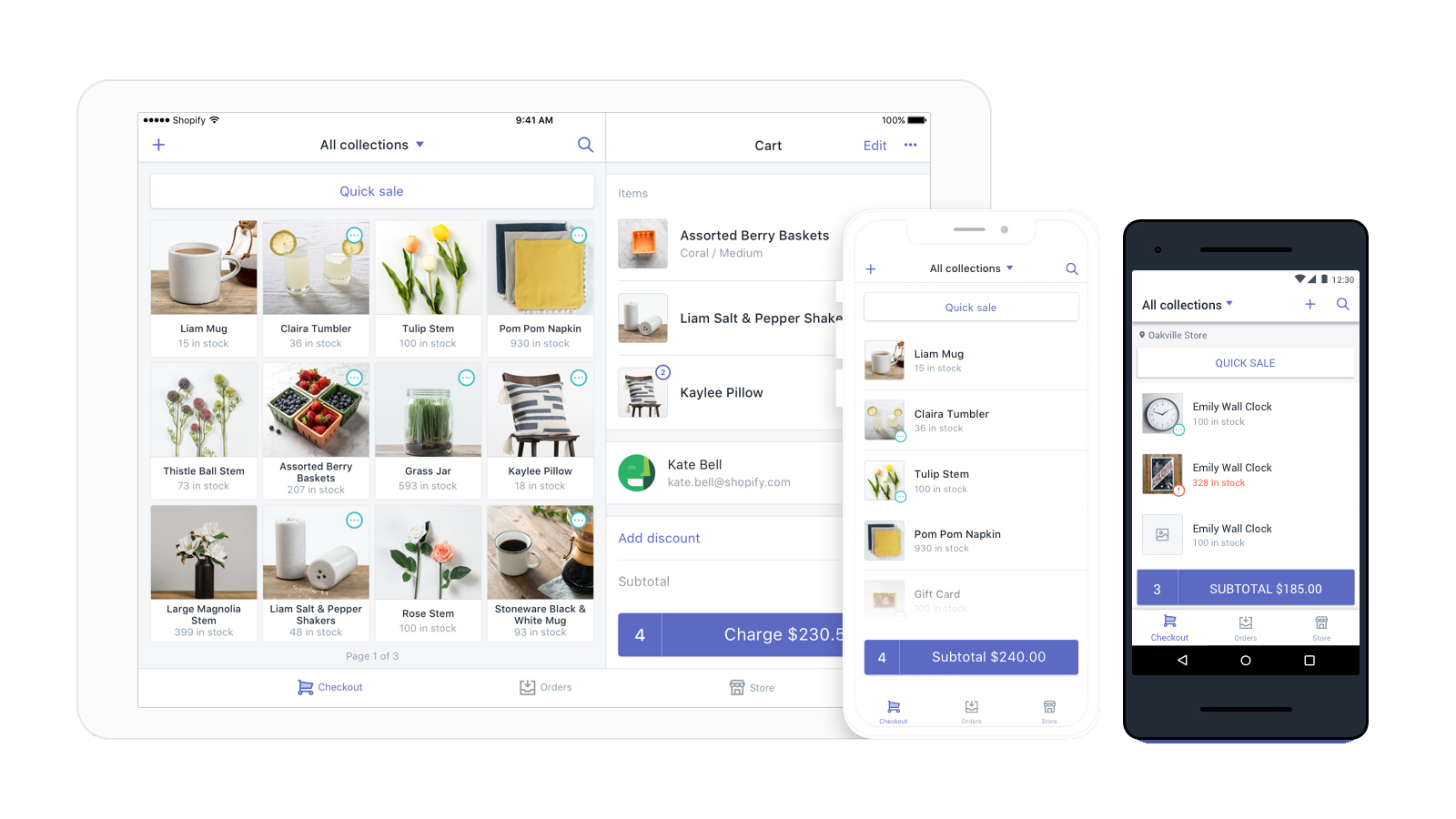

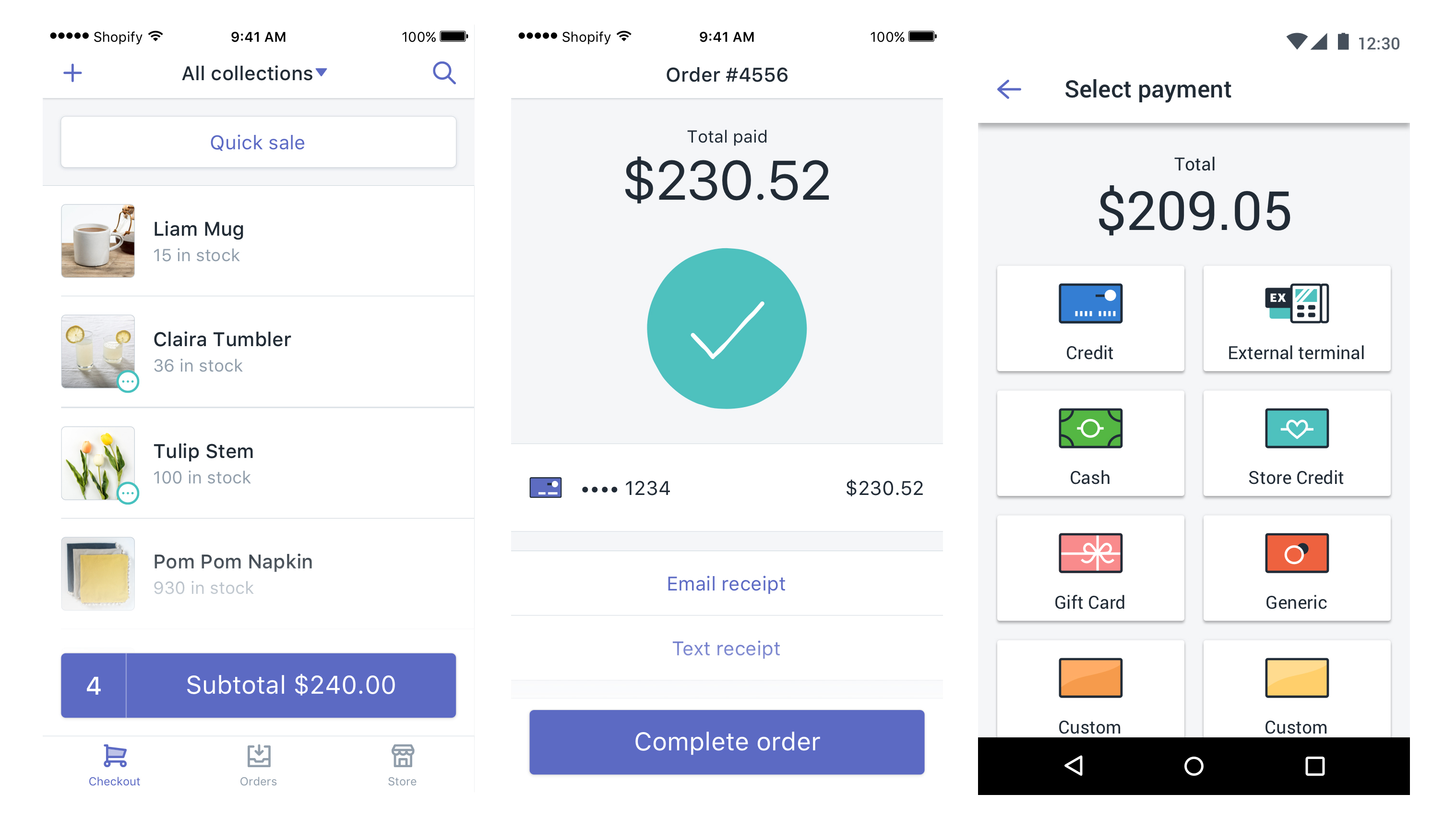

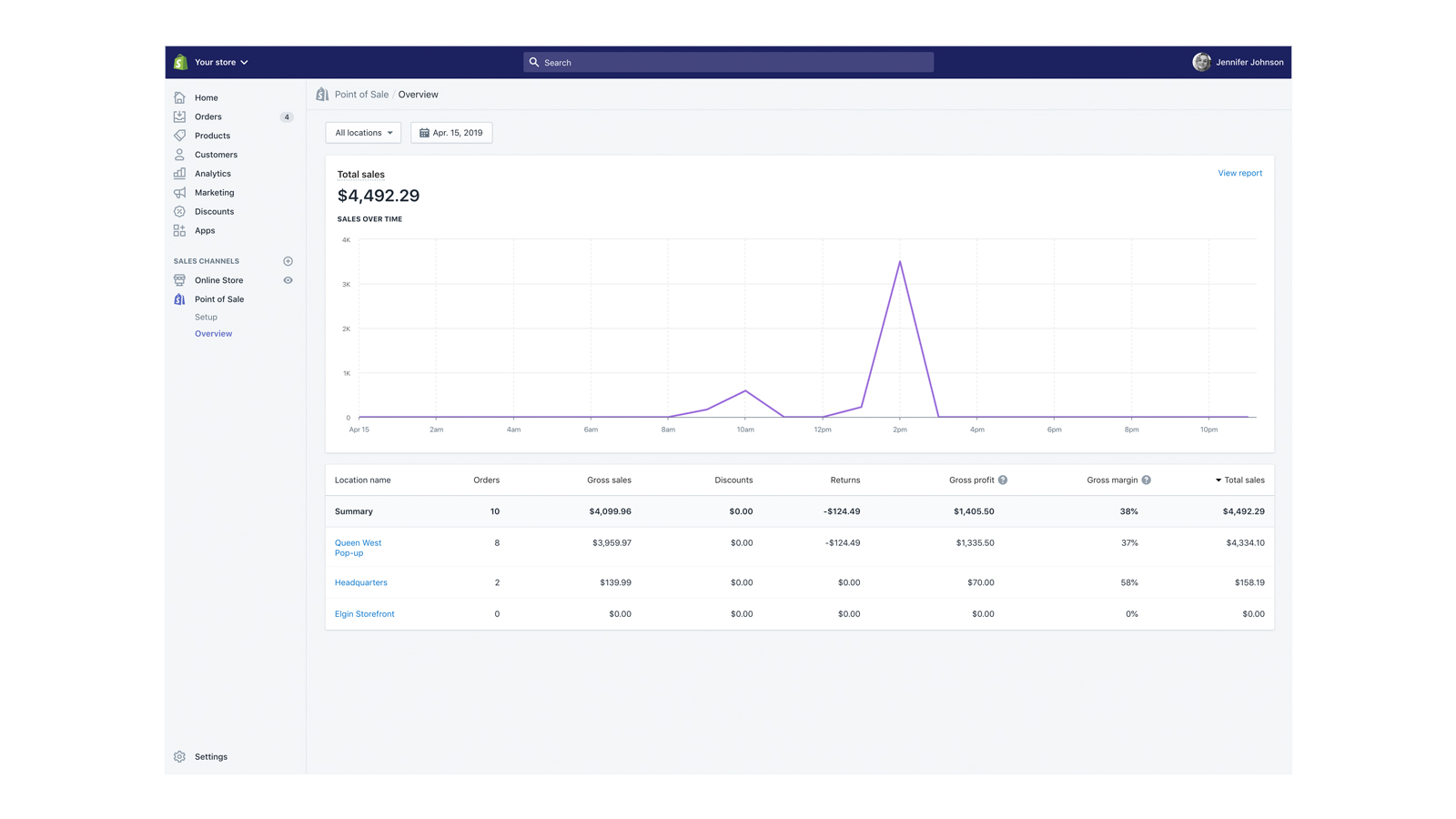

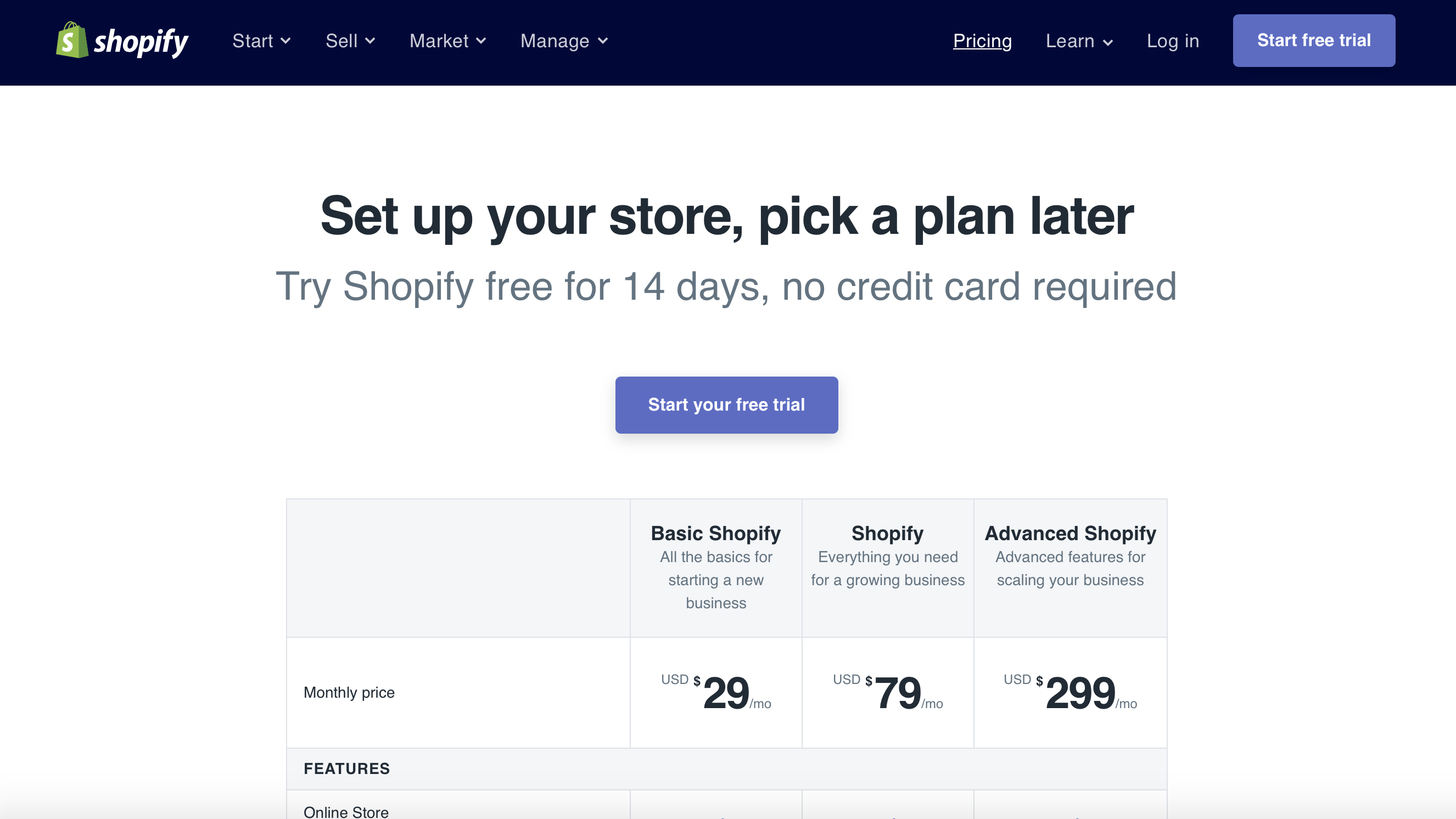

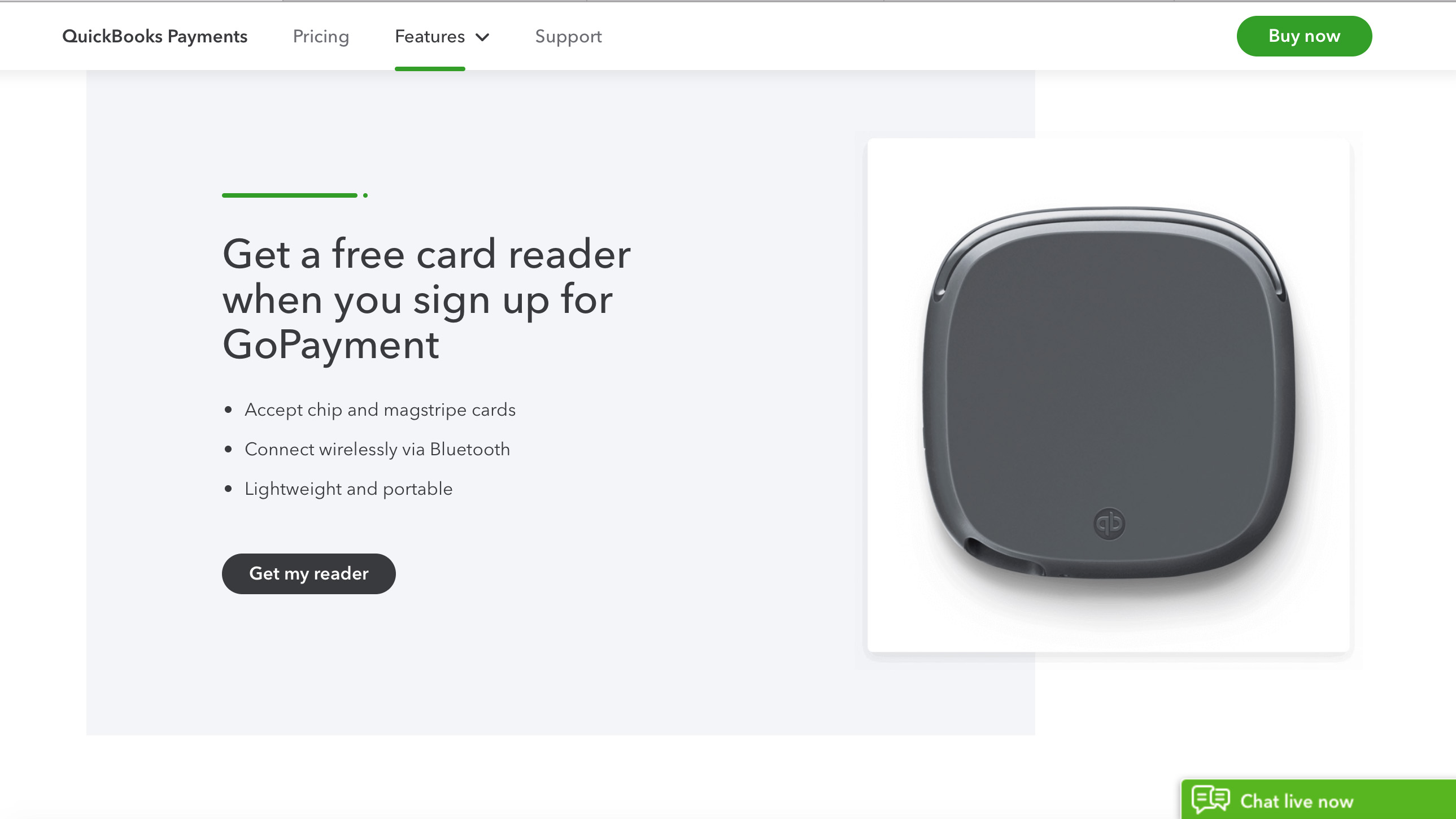

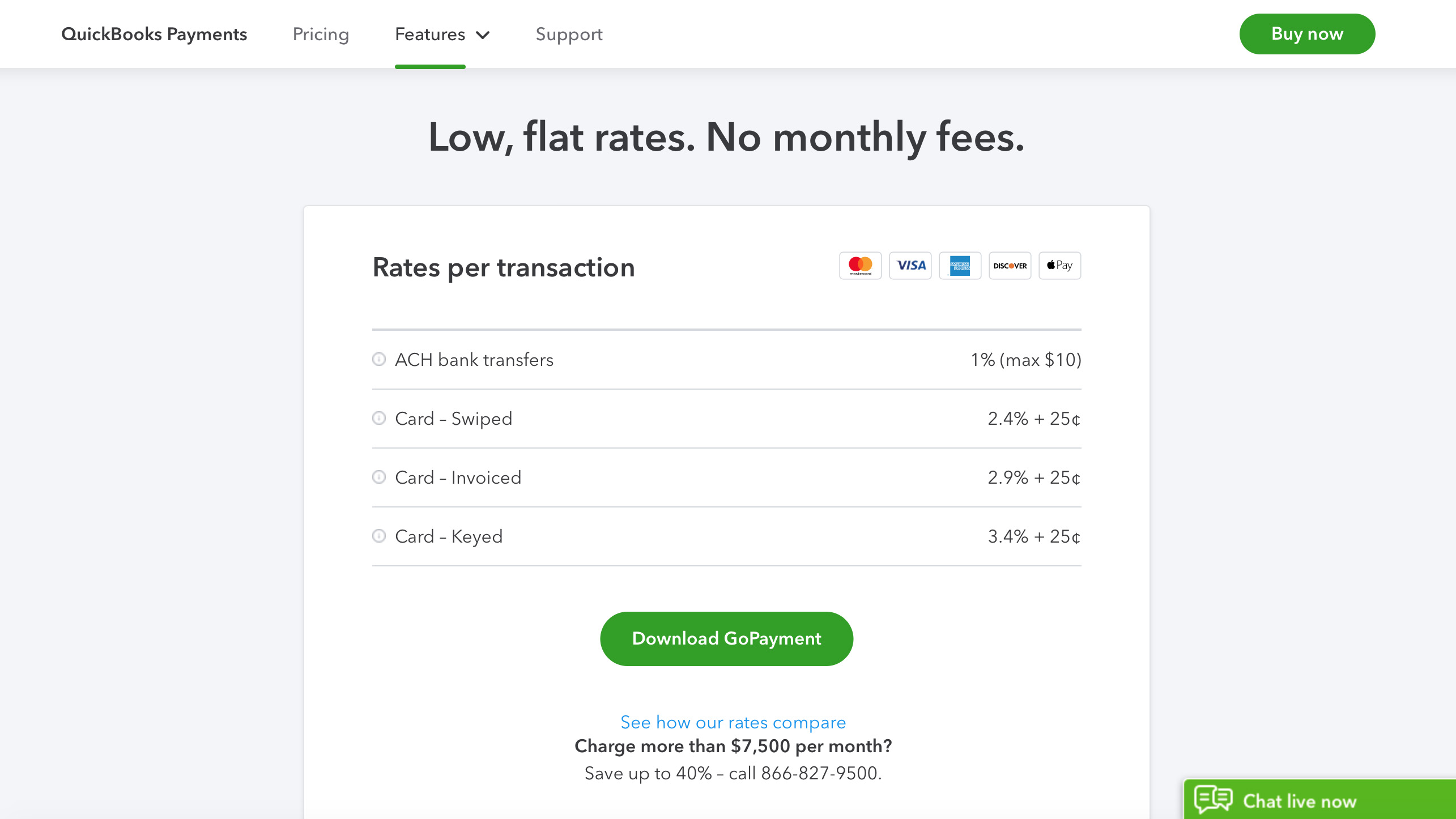

Similar products include the likes of Square, SumUp, QuickBooks Payments, Shopify and iZettle.

- Want to try PayAnywhere? Check out the website here

Pricing

PayAnywhere currently comes with two different packages for the mobile market, so currently you can opt for their pay-as-you-go package, which has a 2.69% transaction fee attached to it. That covers transaction processing of under 10k per month for swiped, dip or tap payments.

Meanwhile, keyed entries cost 3.49% plus $0.19 each while there’s also an apparent inactivity fee of $3.99 per month. However, PayAnywhere states on its site that this is applicable only to merchants who do not process a transaction for 12 months. When processing resumes, the inactivity fee will no longer be charged.

The other package, if you’re in the realms of 10k and over each month, involves a chat with PayAnywhere that will hopefully result in your business securing a reasonable fee base.

Features

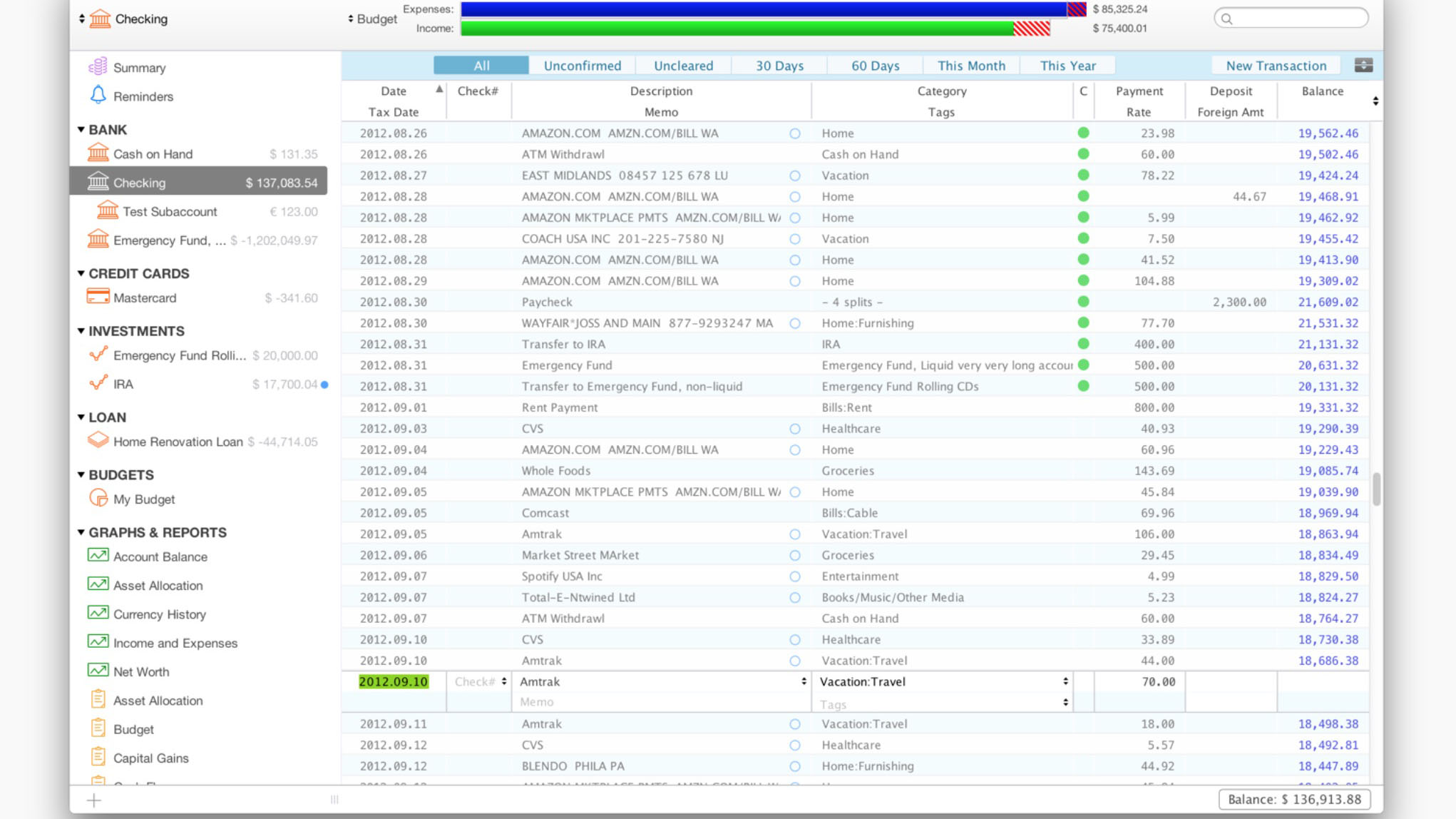

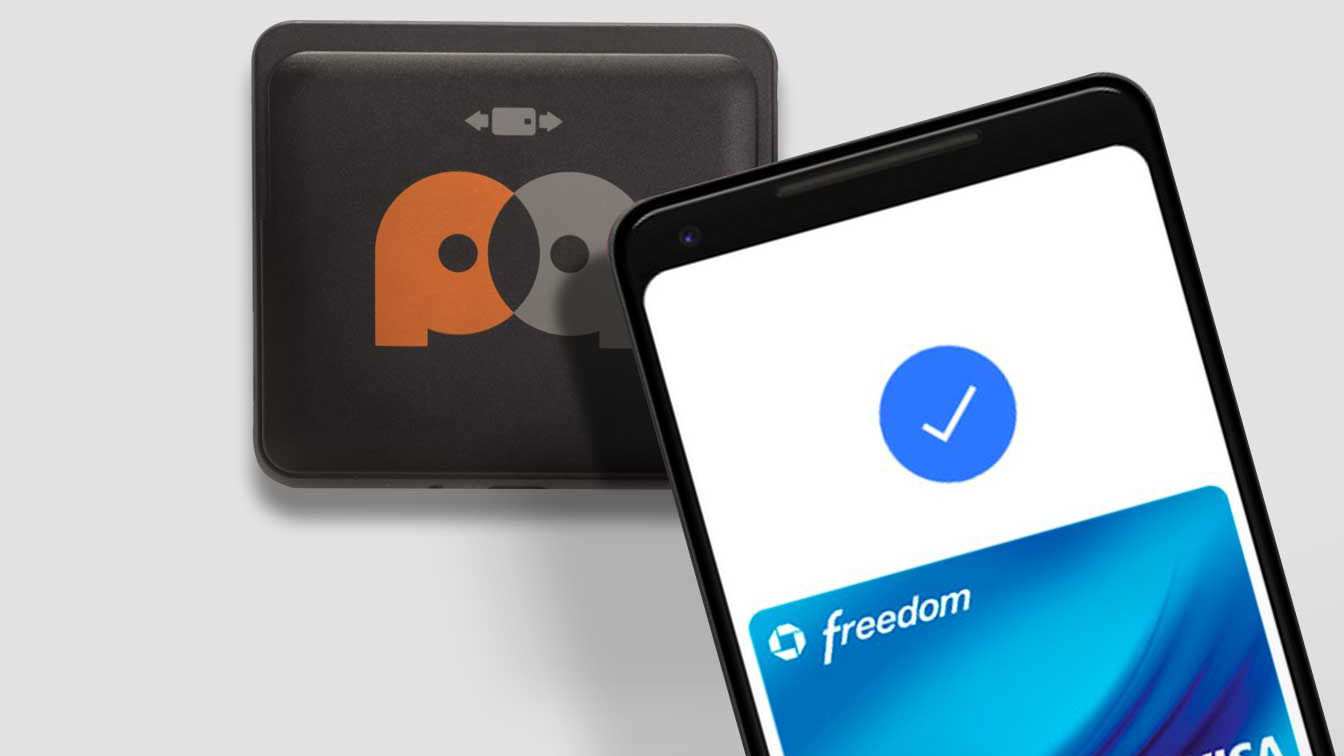

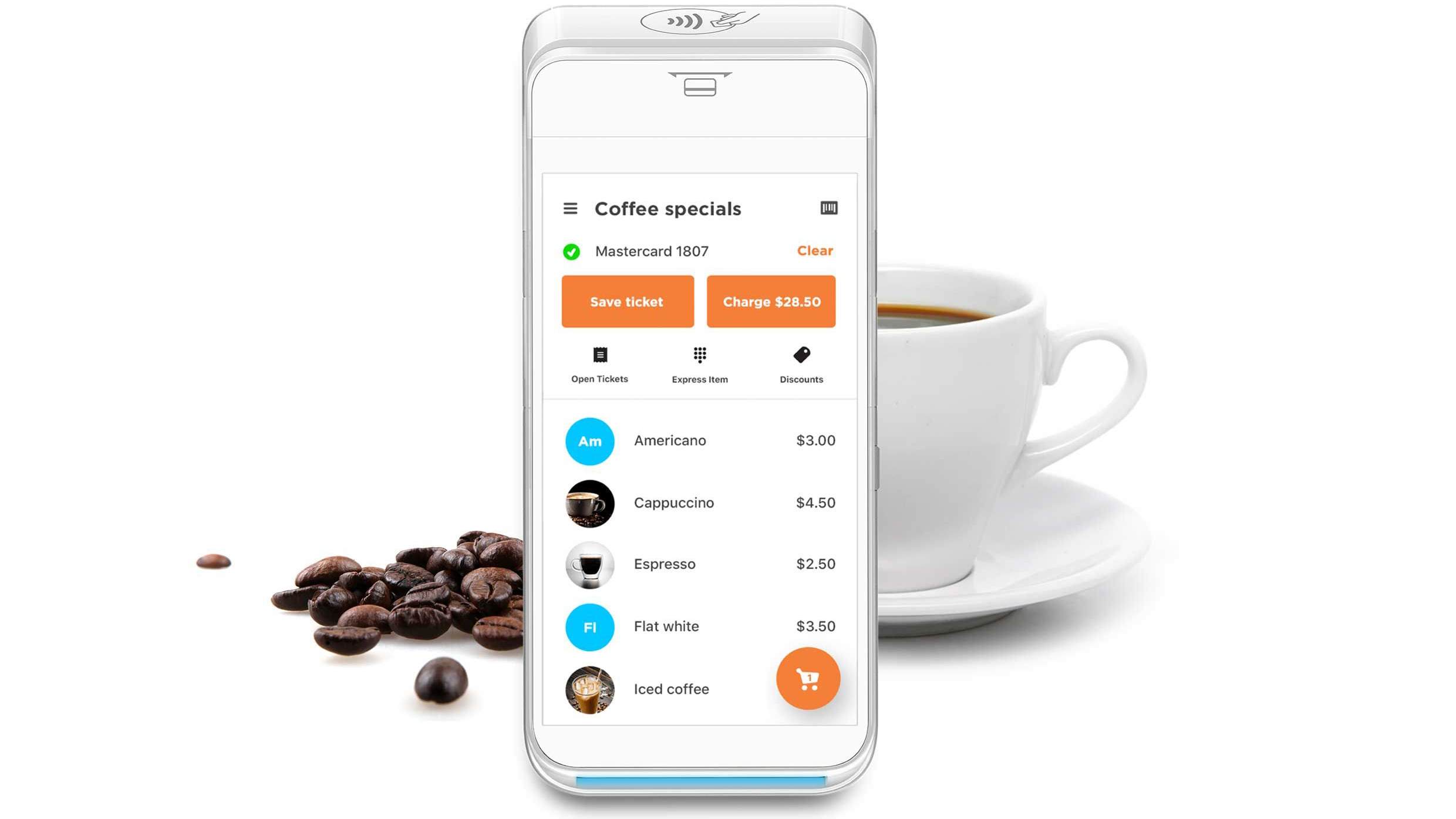

PayAnywhere certainly seems to be catering for business users right across the board as it currently has a whole selection of hardware devices to let you process payments. There are a smart terminals, smart point of sale devices, and in the interest of relevance right here, a brace of card readers. There’s the 2-in-1 option and a 3-in-1 reader unit too, as well as miscellaneous accessories designed to make the acceptance of customer funds all the more straightforward.

Of the two readers then the 3-in-1 obviously does that little bit more as it is able to process magstripe payments (swipe), EMV chip card payments (dip) and also handle NFC contactless payments including the likes of Apple Pay and Samsung Pay. Meanwhile, the Smart Terminal can process PIN debits, print receipts and has a built-in barcode scanner. Both the Smart Flex machine and the Smart Point of Sale hardware add on a customer facing second screen.

Performance

Mobile payments solutions invariably revolve around small portable card readers and PayAnywhere has two of these units that do the job pretty well it has to be said.

The 2-in-1 is compatible with iOS and Android operating systems and uses Bluetooth, but it can also talk to desktop computers, which is an added bonus. Simply pair it with your smartphone or tablet and it will be able to process payments from EMV chip cards and magstripe cards too.

The first reader comes free, while additional units cost $29.95 each. The 3-in-1 credit card reader is a little more beefy but essentially works along the same lines, while it can accept payments from EMV chip cards, magstripe cards and process NFC contactless payments from Apple Pay and Samsung Pay. It costs $49.95.

Ease of use

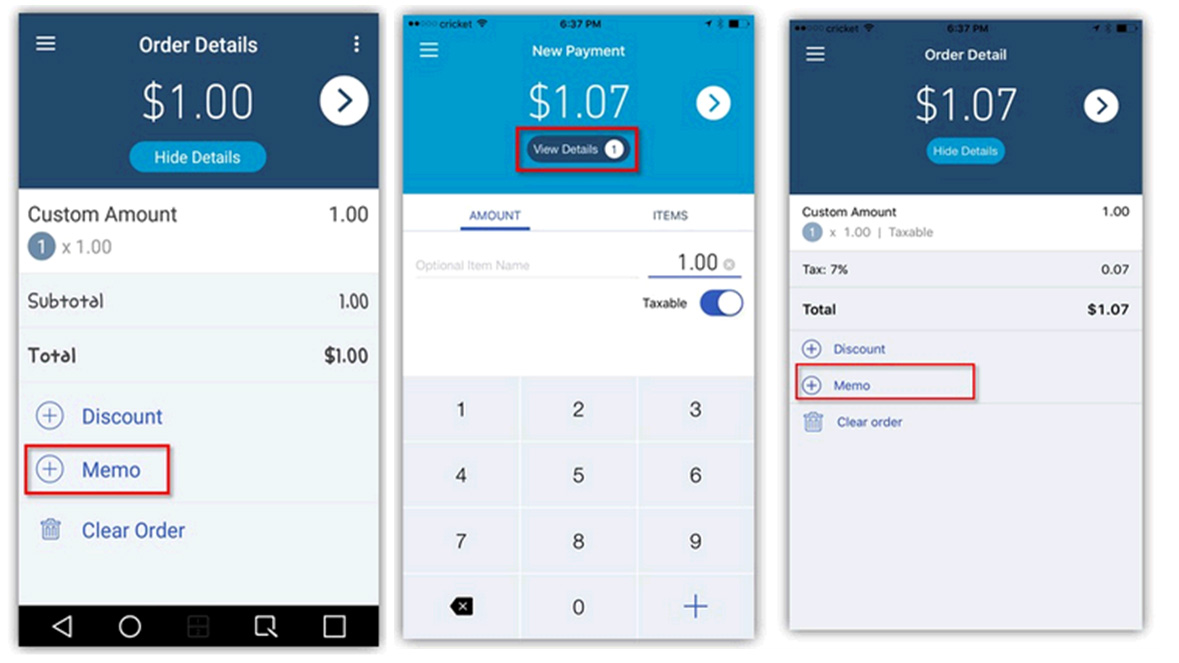

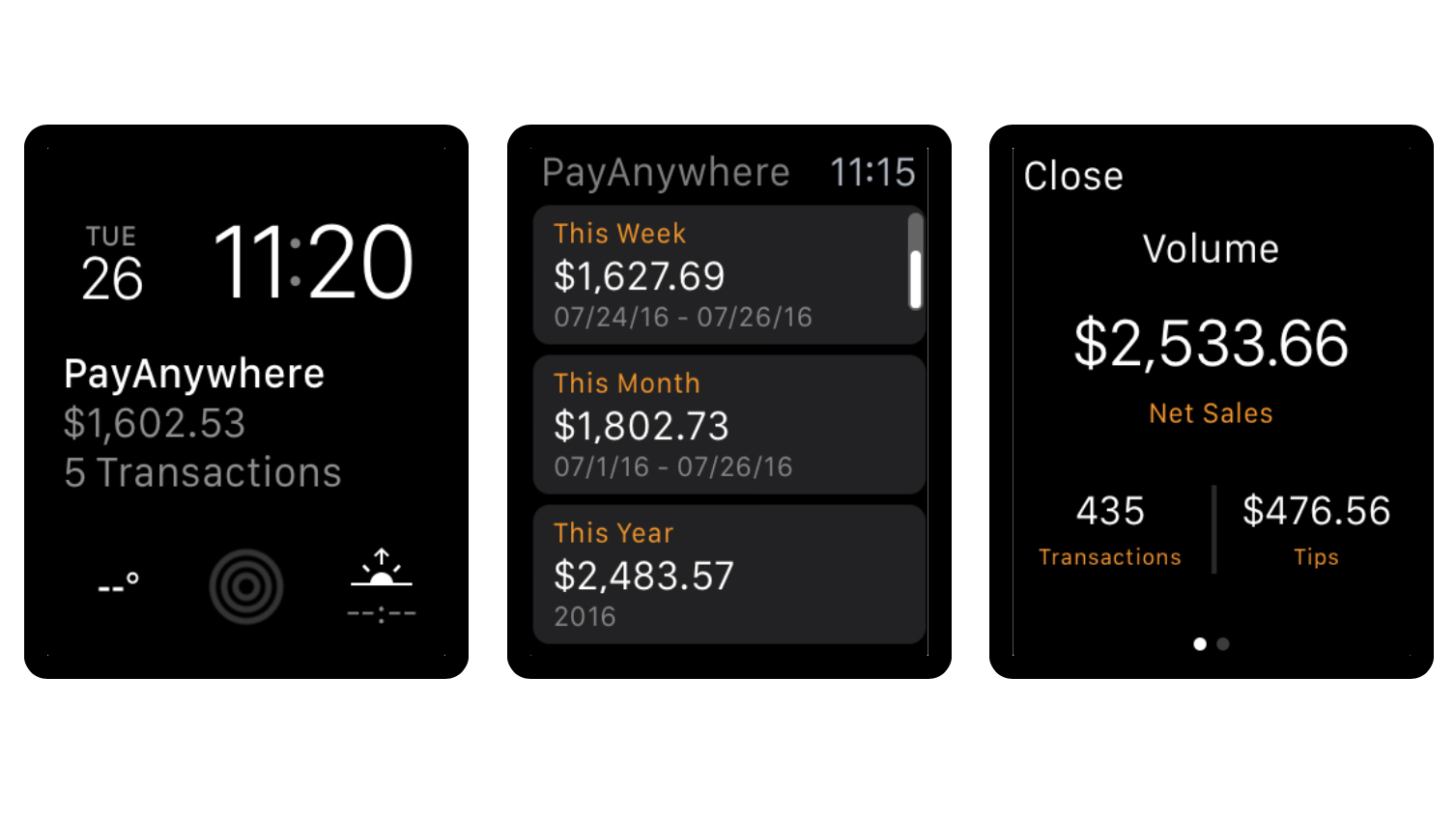

The PayAnywhere boffins have done a neat job in designing their systems to work across the board and with a variety of hardware. So you’ll be pleased to hear that, while the kit works with your iPhone or iPad, it’ll also work with desktop Macs, Windows and data is stored in the cloud.

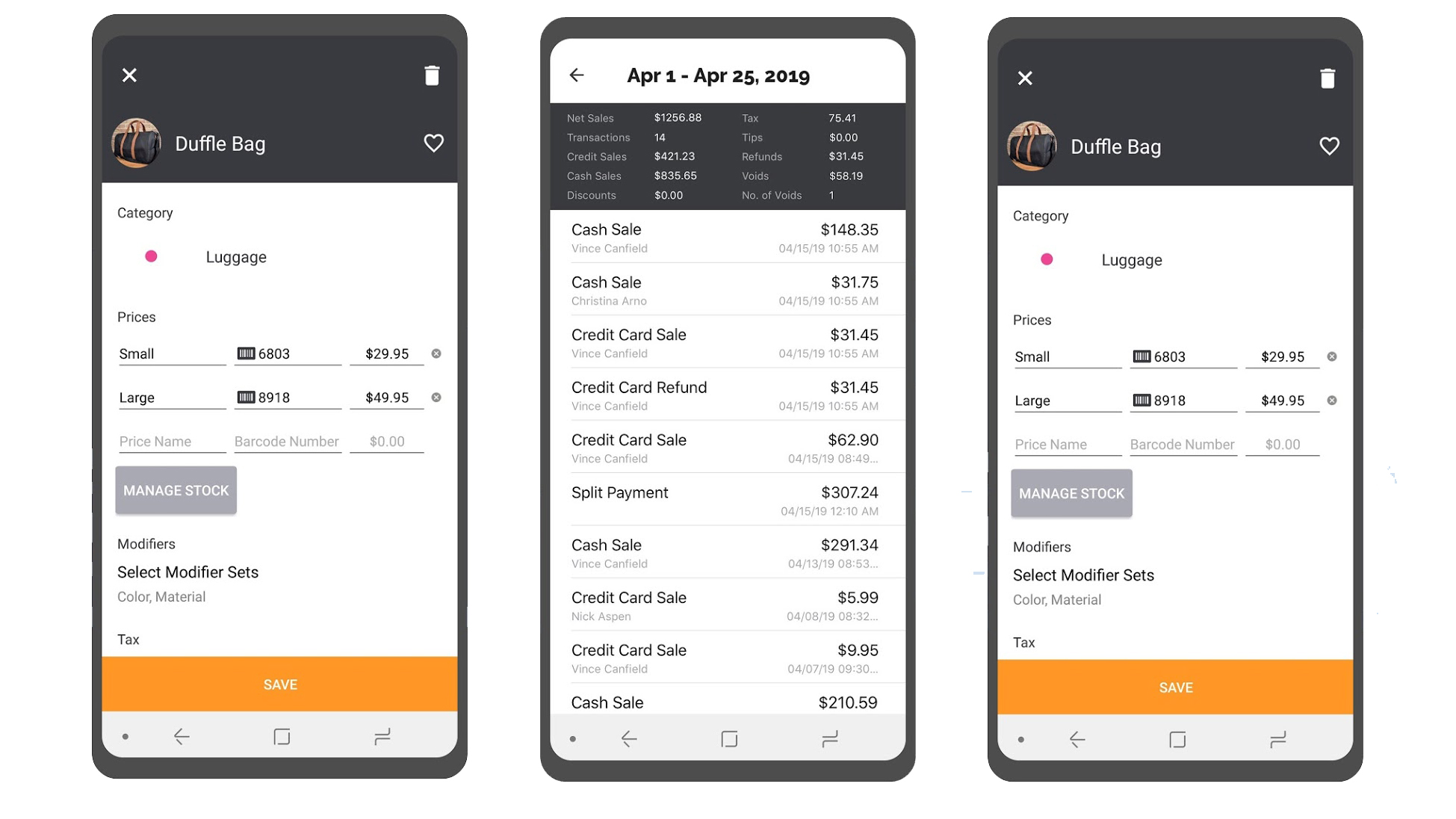

Therefore, you should find actually using the system pretty straightforward as long as everything is running as it should. As you’d expect, there’s a PayAnything app that works hand-in-hand with the hardware and when you add it all together there don't appear to be any real weak links in the payment processing chain.

A standout feature is its capacity for displaying a library of items for customers to see in addition to their purchase, thereby boosting the potential for extra sales and offer tie-ins.

Support

Customer support, or the apparent lack of it, used to feature quite frequently in old reviews of PayAnywhere, but it appears that things have changed for the better. PayAnywhere does use its slick bells-and-whistles website to indicate that assistance comes via email, phone and a live support source, which should help you get to the bottom of any issues you might have while using both its hardware and software.

Final verdict

PayAnywhere has worked hard to beef up its range of products and services, while retaining its original vision as a provider of payment processing for small, medium and large businesses.

Low volume turnover users, such as freelancers as an example, should find PayAnywhere an attractive possibility too just as long as you do your homework prior to signing up.

PayAnywhere also seems suitably robust in the security stakes, with data encryption and tokenization being used to protect each transaction, which is all the more reassuring in the case of processing mobile payments.

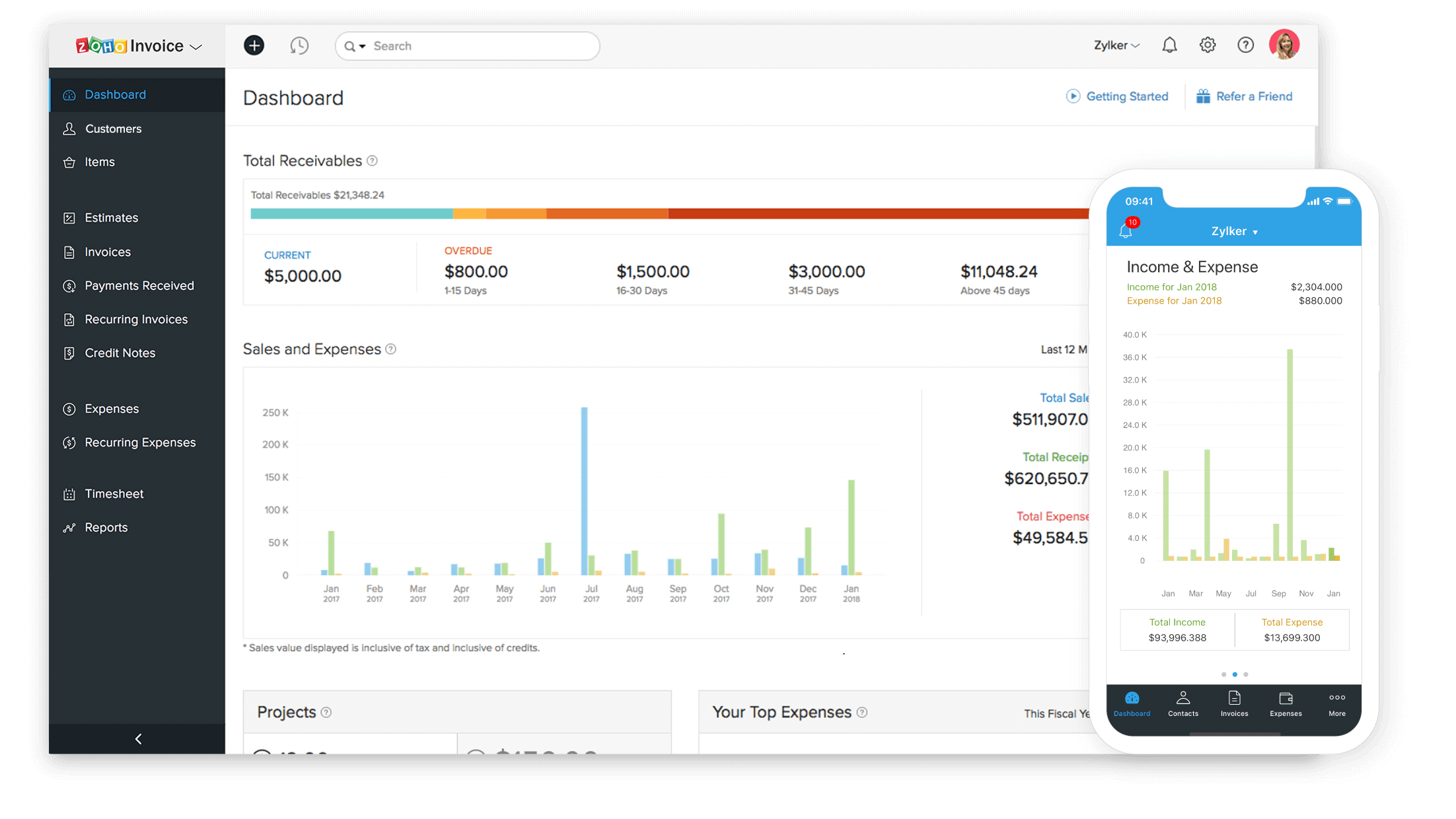

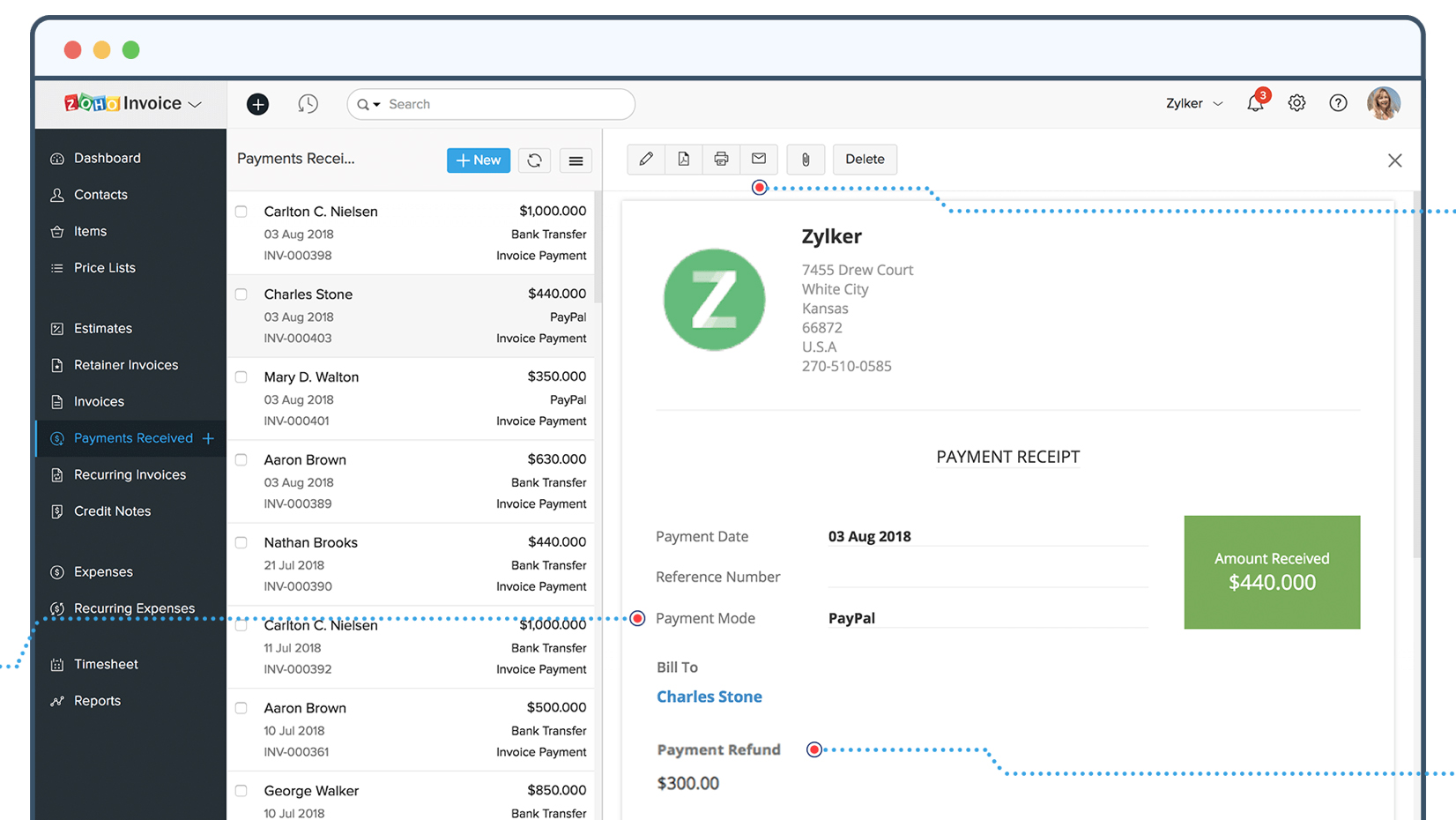

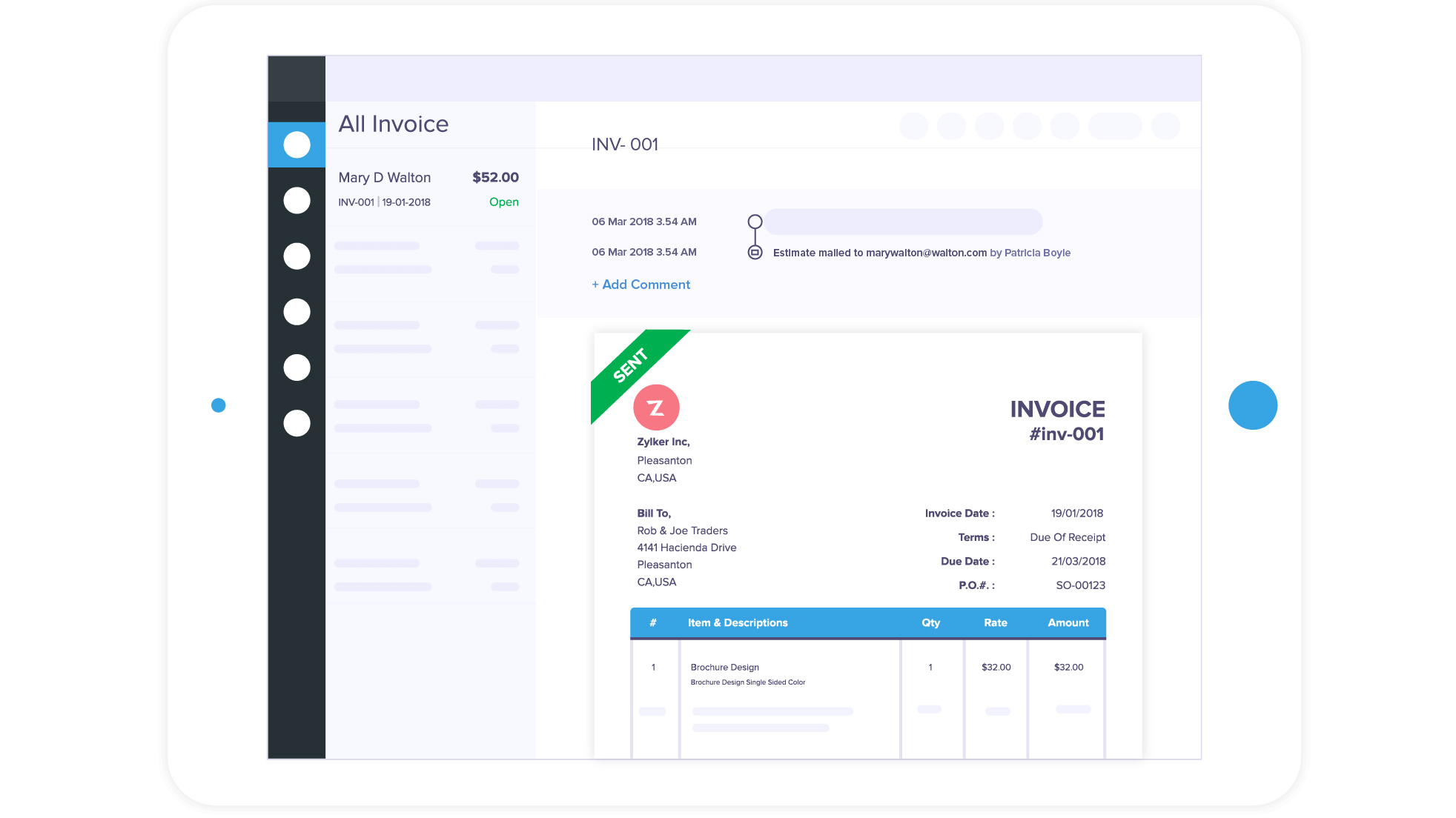

There are also a lot of additional features, such as invoicing and reporting that add value here, while we also like the option to bypass using the PayAnywhere hardware and simply process transactions on your phone instead if you prefer.

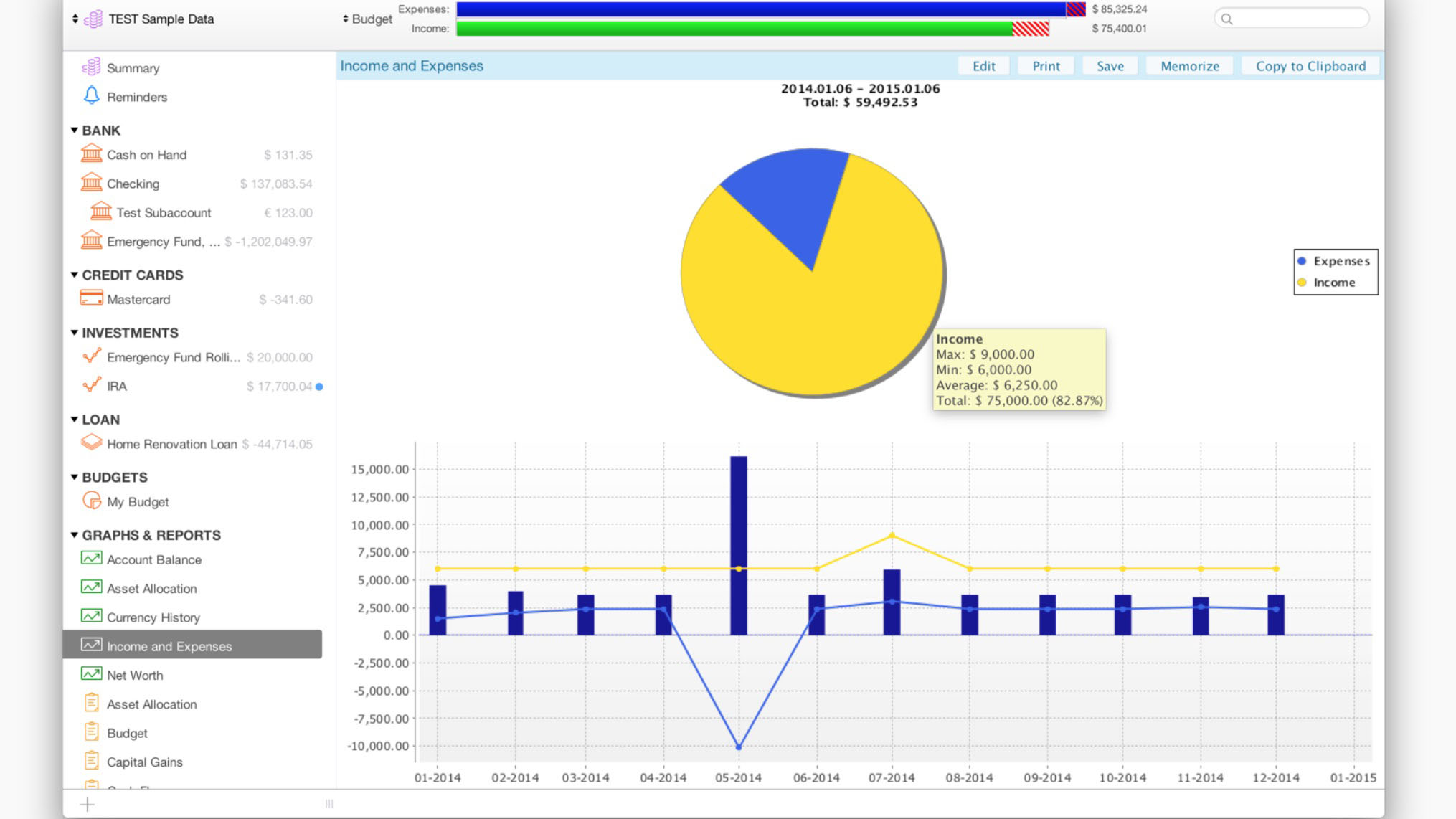

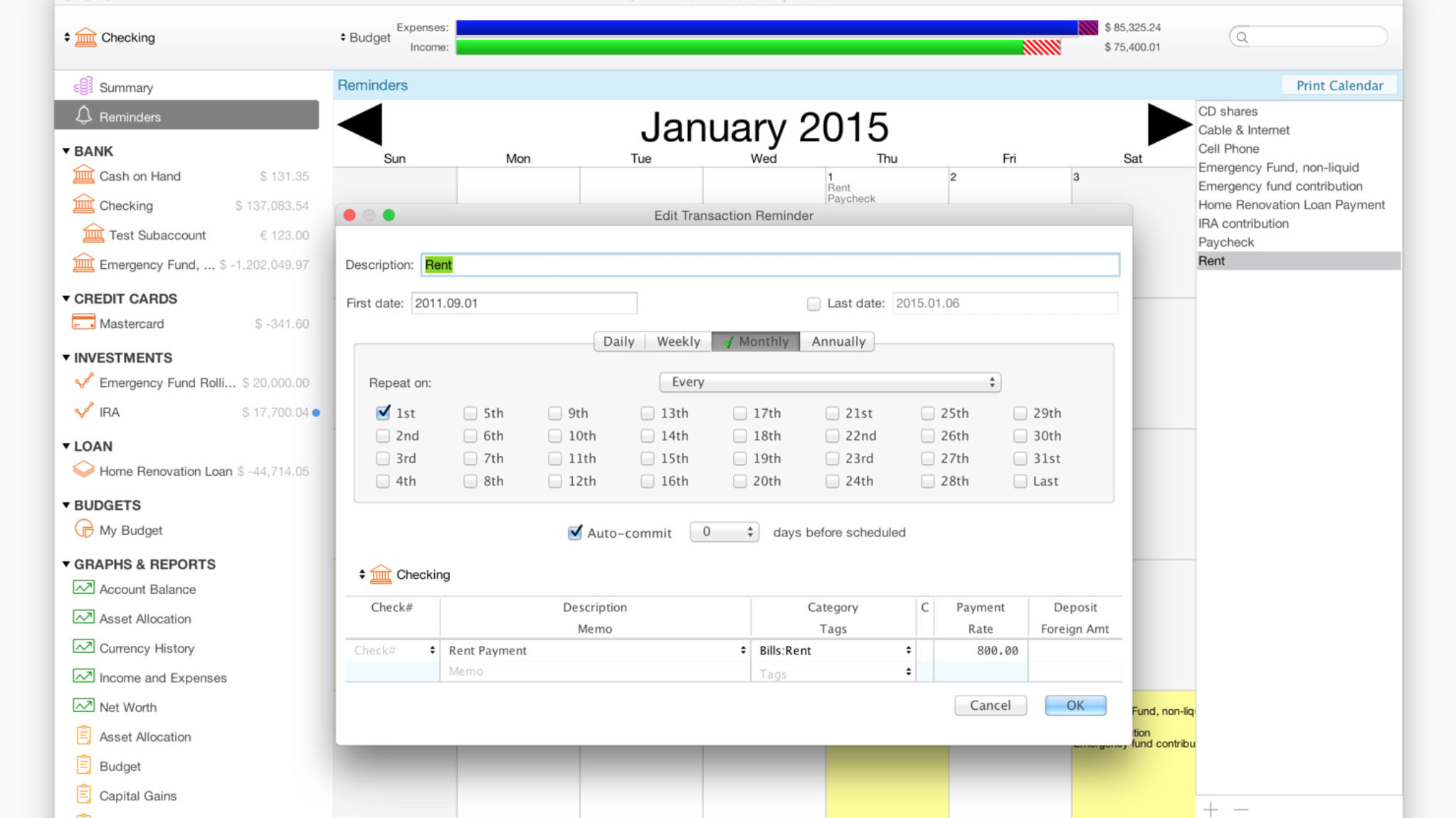

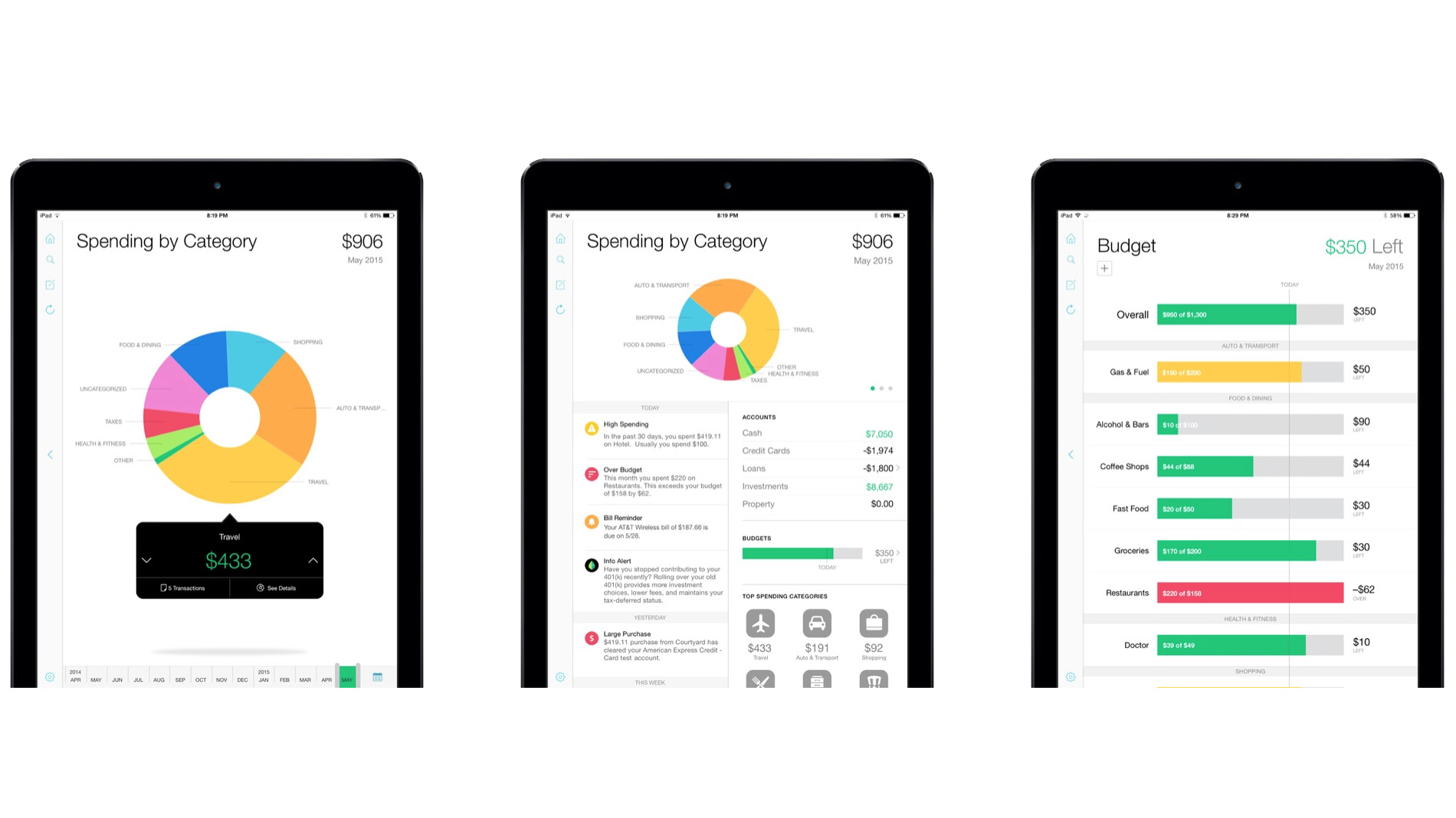

- We've also highlighted the best budgeting software