Certify is cloud-based software for desktop and mobile use that aims to take the legwork out of expense management. With a packed set of features that can help automate most of the expenses process, and with tools that let business owners get a better picture of their finances, Certify already counts many large companies amongst its user base even during the coronavirus crisis.

- Want to try Certify? Check out the website here

However, alongside corporate setups Certify is also useful for small and medium-sized businesses thanks to its features, which can help improve efficiency, keep tabs on spending and cut down on time spent dealing with expenses. Thanks to its mobile-centric tools, which allow employees to track expenditure with ease, the appeal of Certify is that on face value it proves invaluable for both employees and employers.

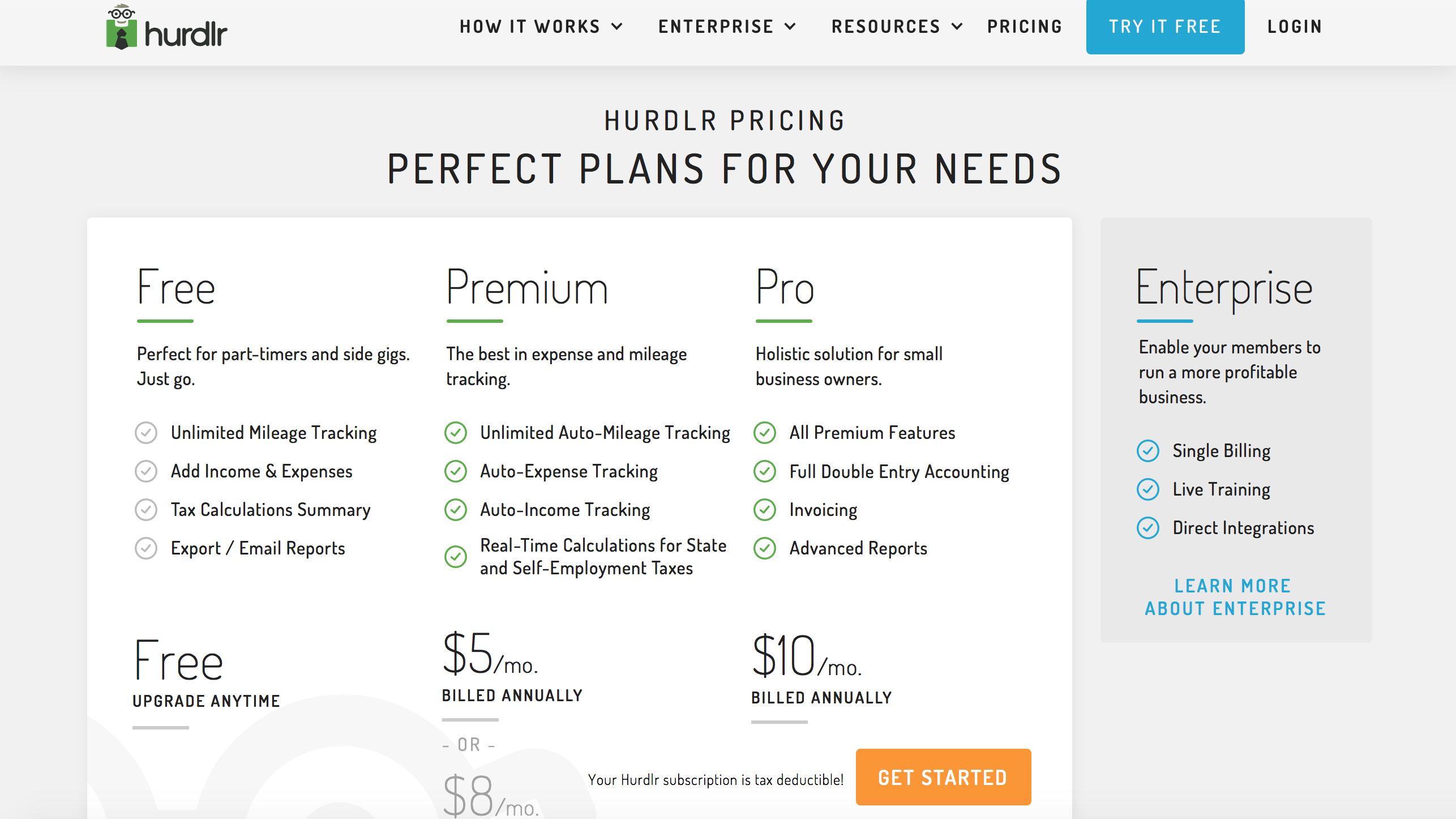

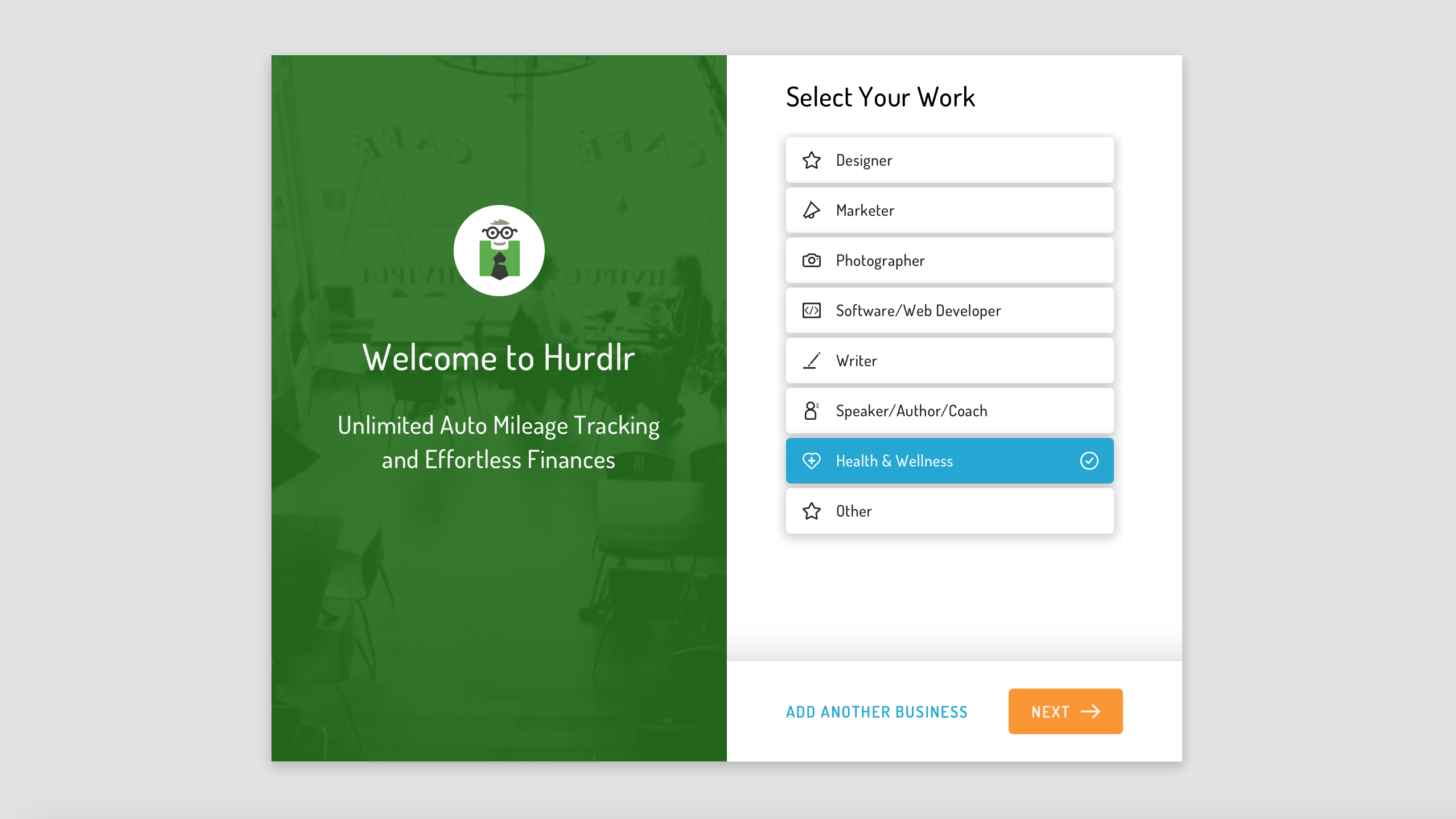

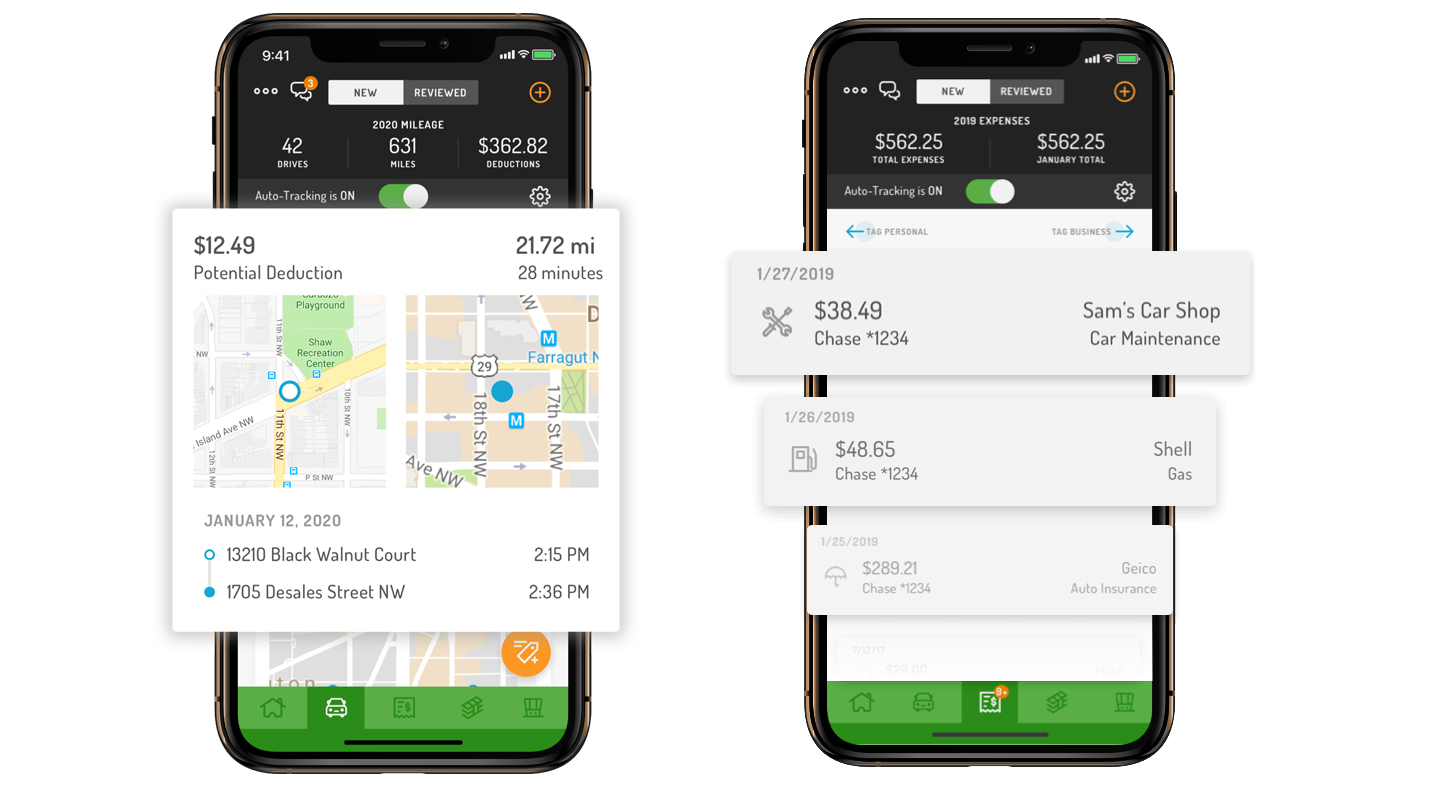

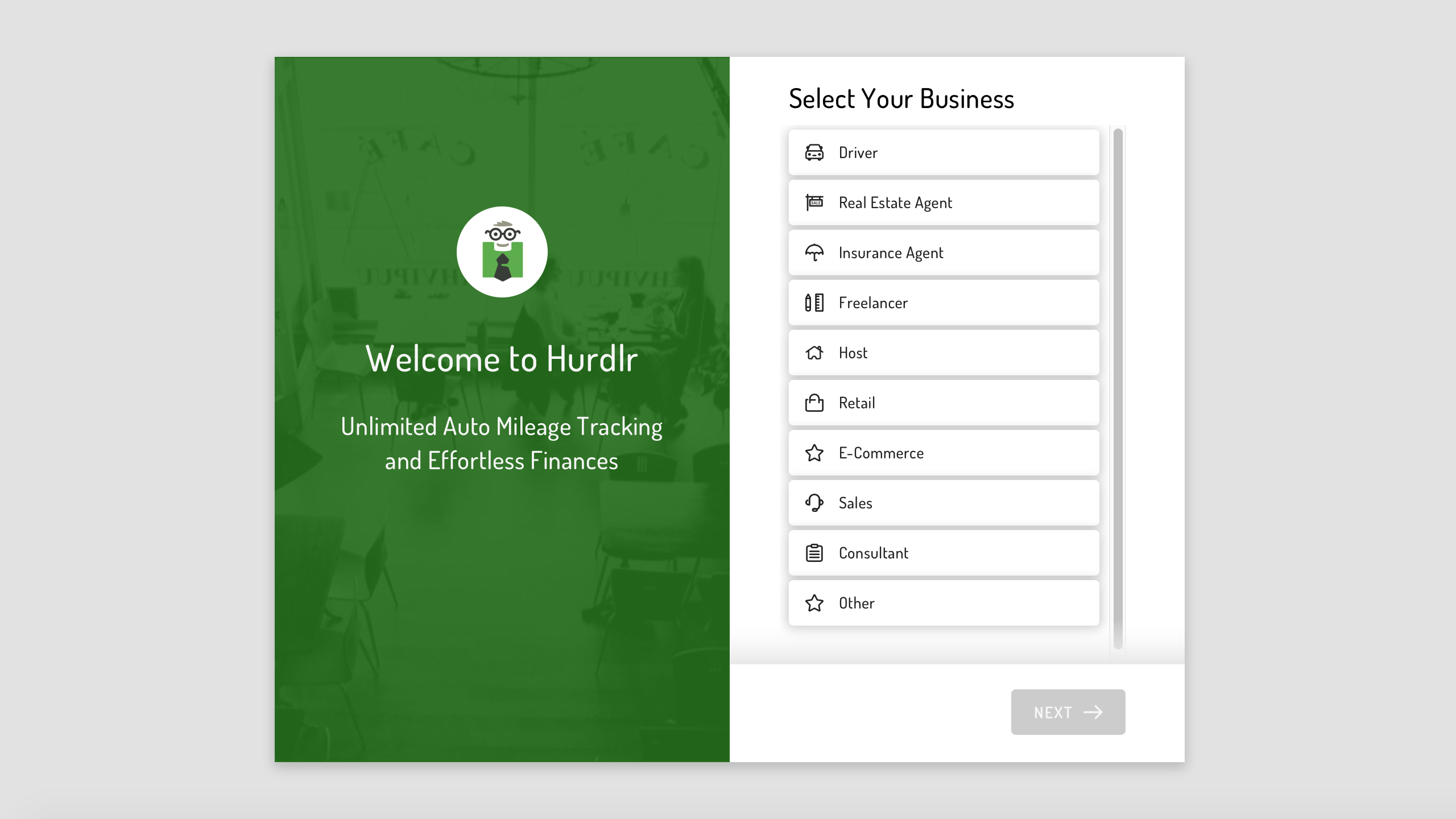

Other expense trackers in this marketplace include QuickBooks, Expensify, Hurdlr and Zoho Expense all of which are worthy of investigation.

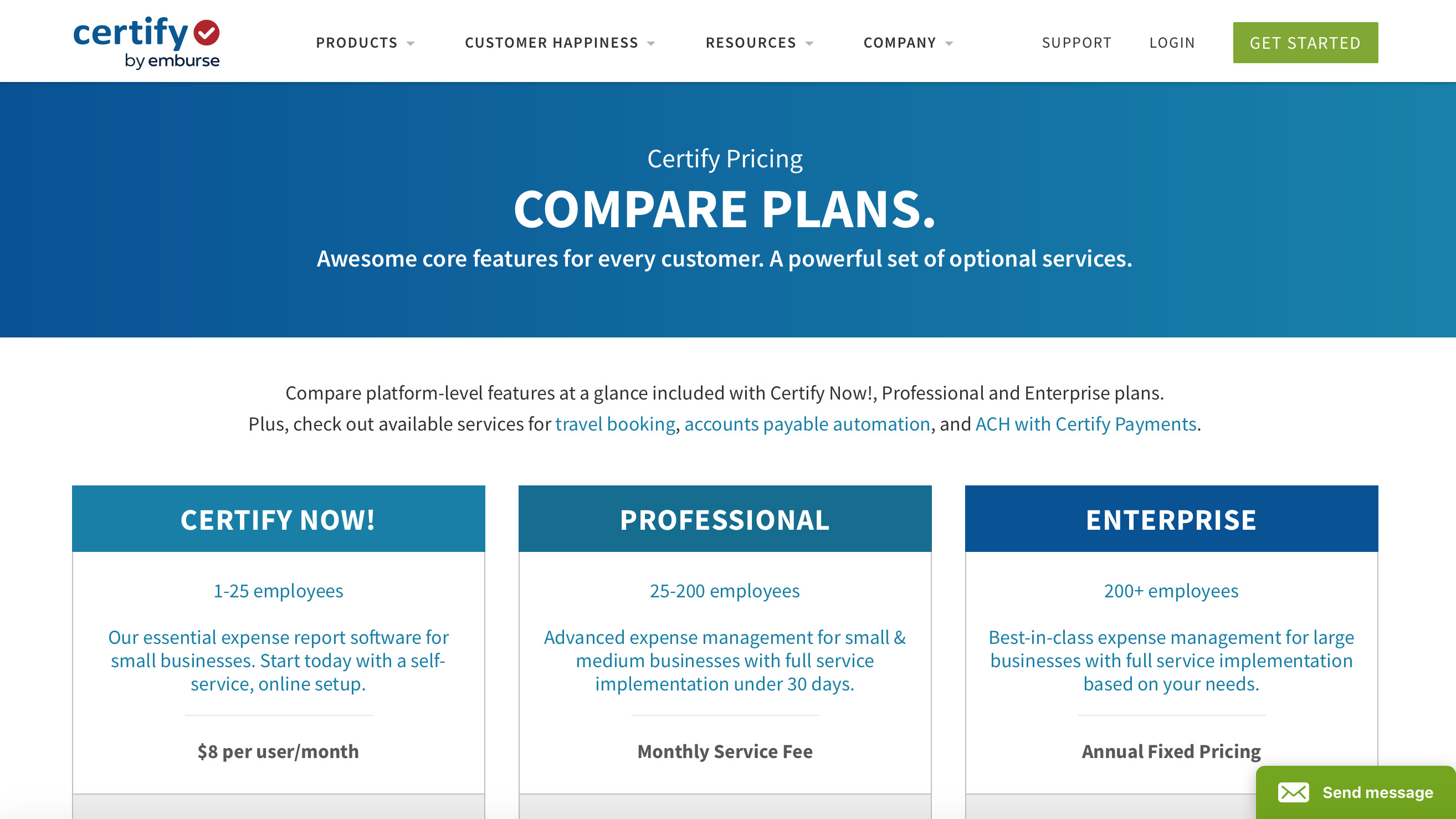

Pricing

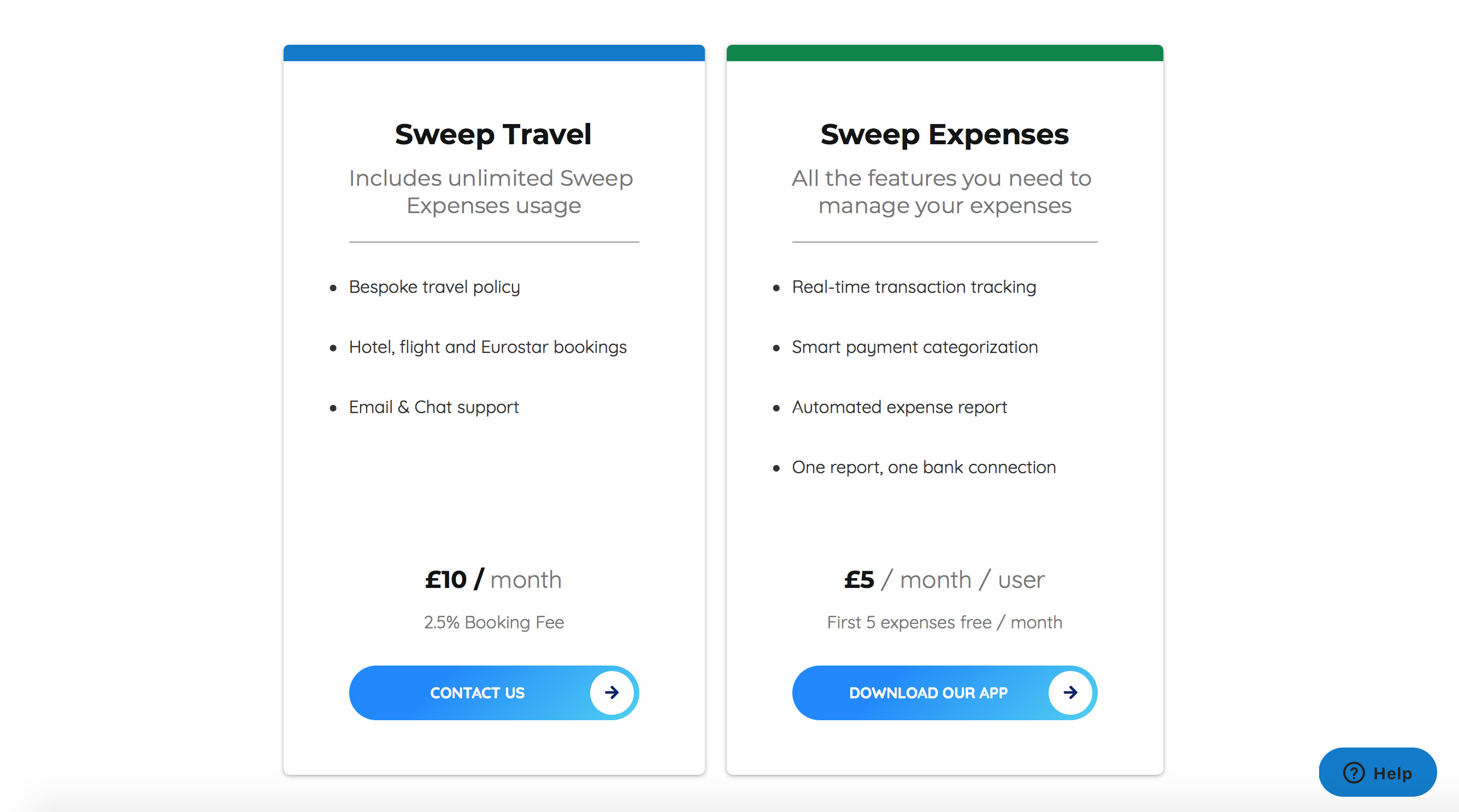

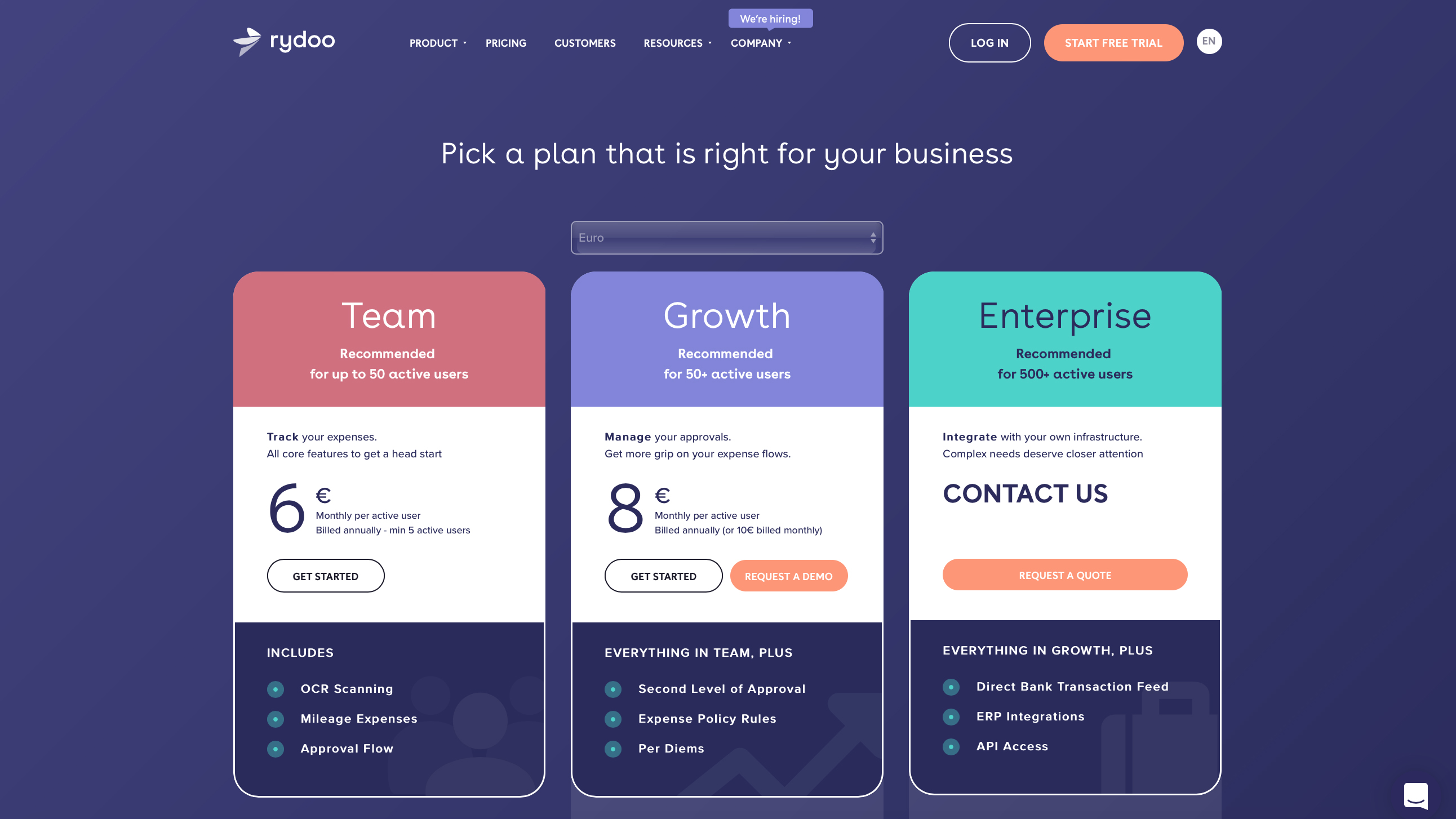

Certify is currently available in three different package options with Certify Now! being the entry-level option. Suited for businesses with 1-25 employees, this has all the tools a smaller-sized venture needs and can be setup online for $8 per user, per month.

If you’ve got a bigger business then the Professional package is aimed at companies with 25-200 employees. It features a raft of power tools for managing expenses and can be up and running in under 30 days according to Certify, for a monthly service fee.

Finally, Enterprise is a package targeting larger companies with over 200 employees and can be tailored to match the needs of individual businesses. That comes with annual fixed pricing.

Features

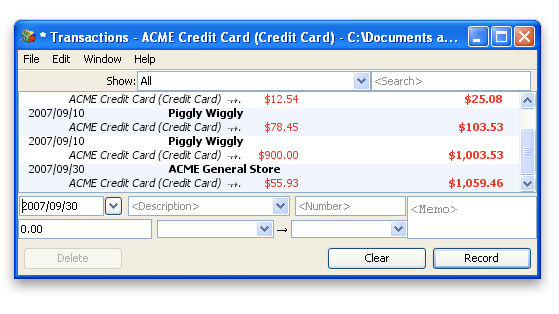

If you’re going to be using Certify via its entry edition, Certify Now! then you’ll find that it can be setup quickly and efficiently. Central to this is the instructional help you get in order to configure the program to work as you want it to, along with a Wizard to get you though all of the basics.

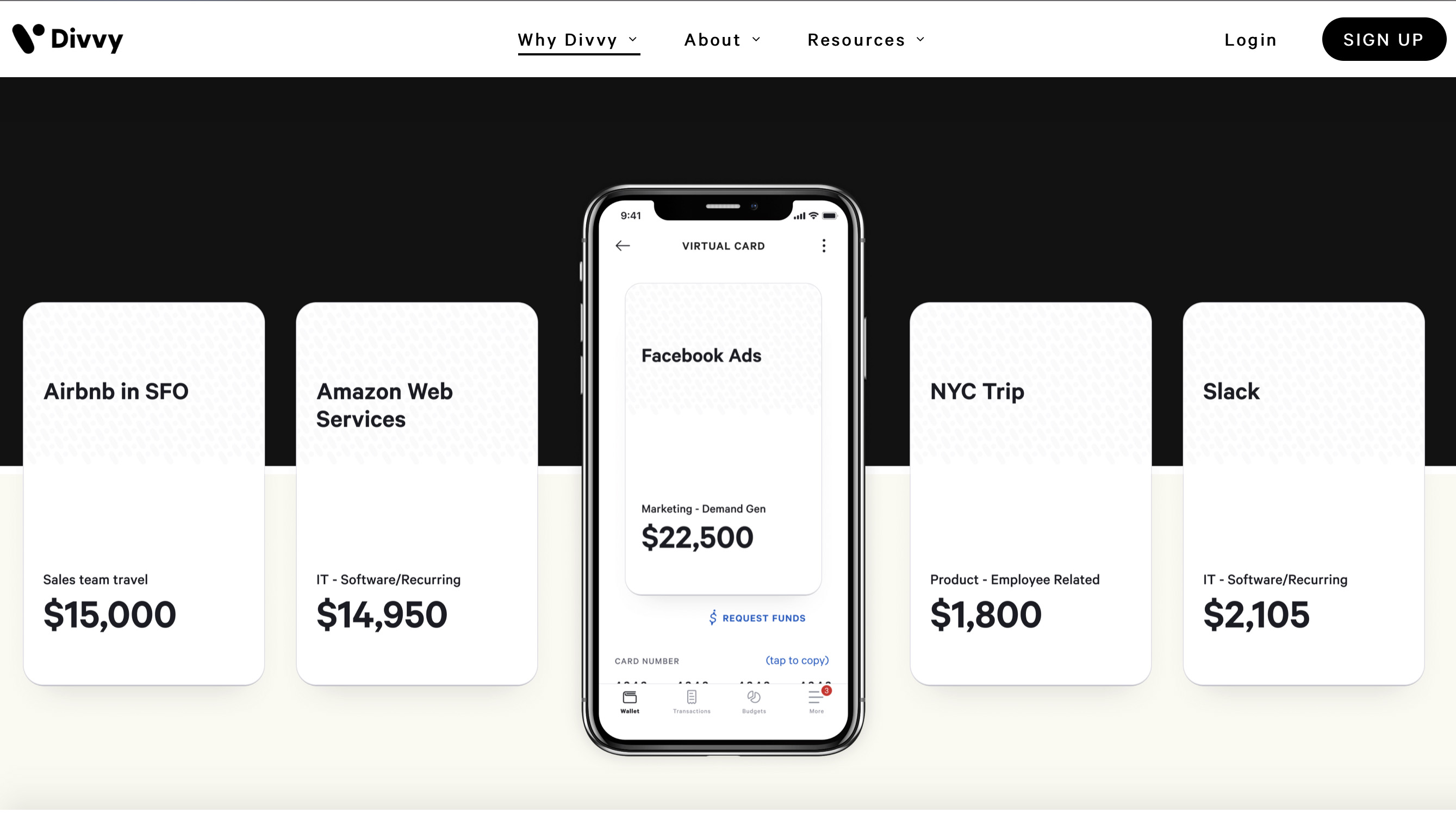

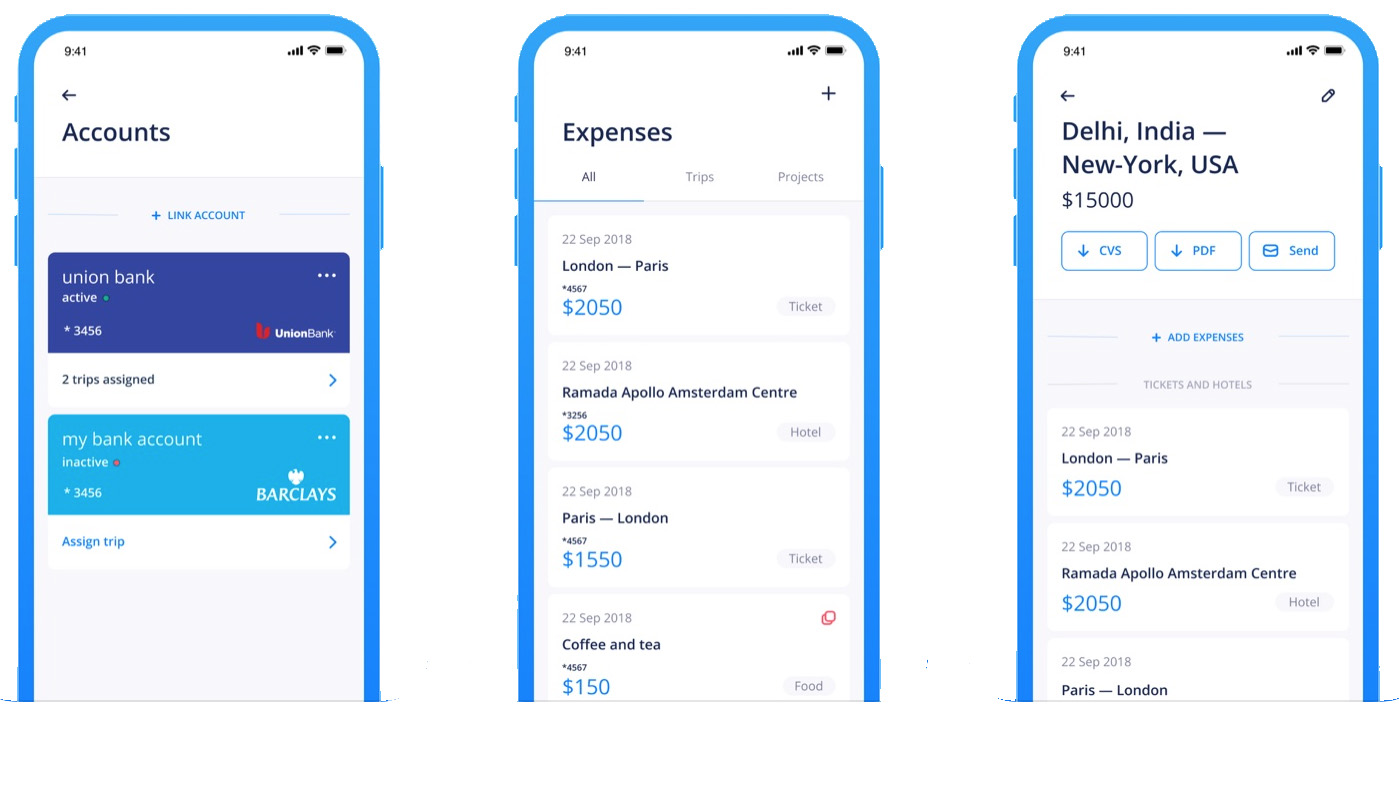

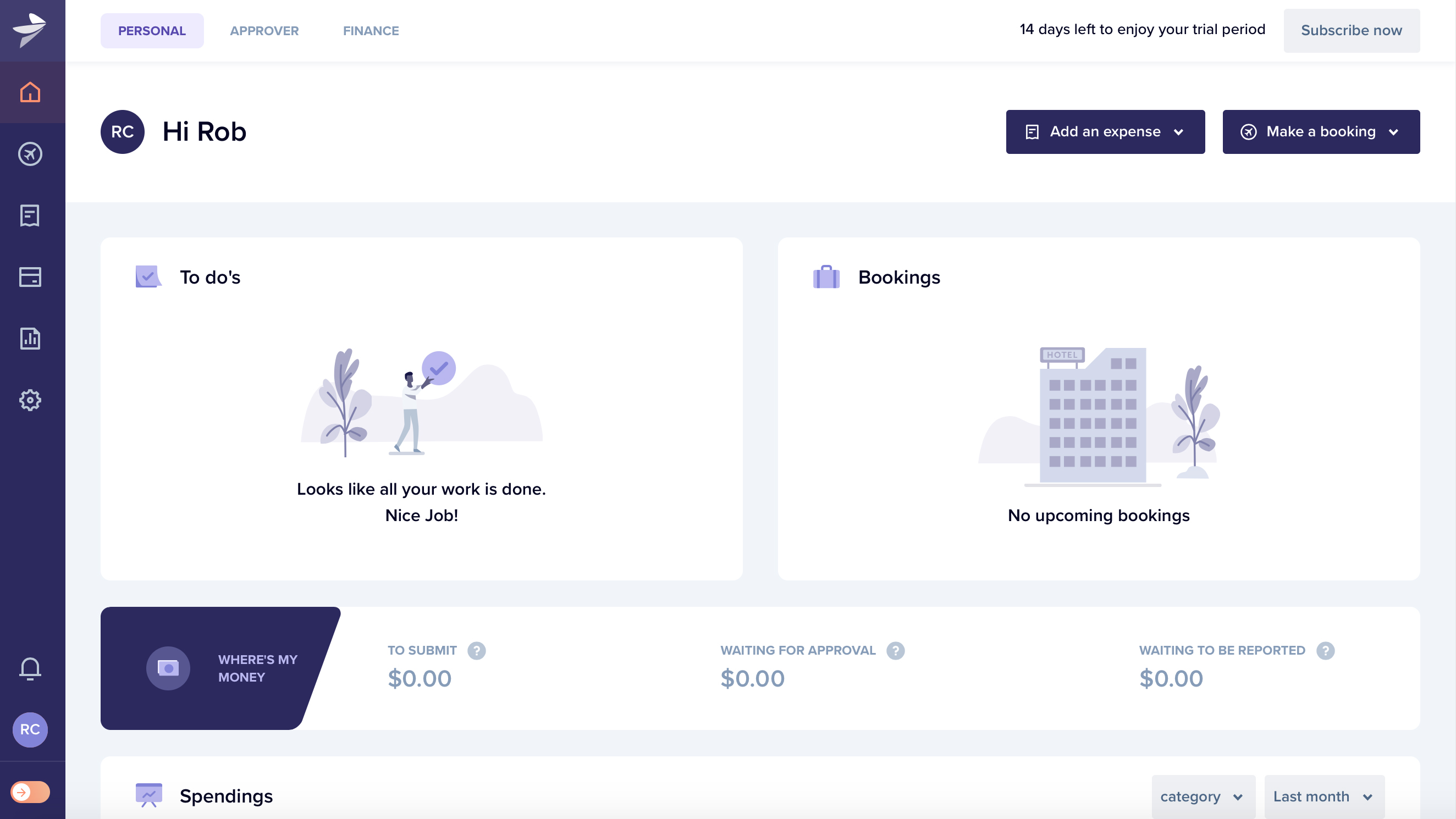

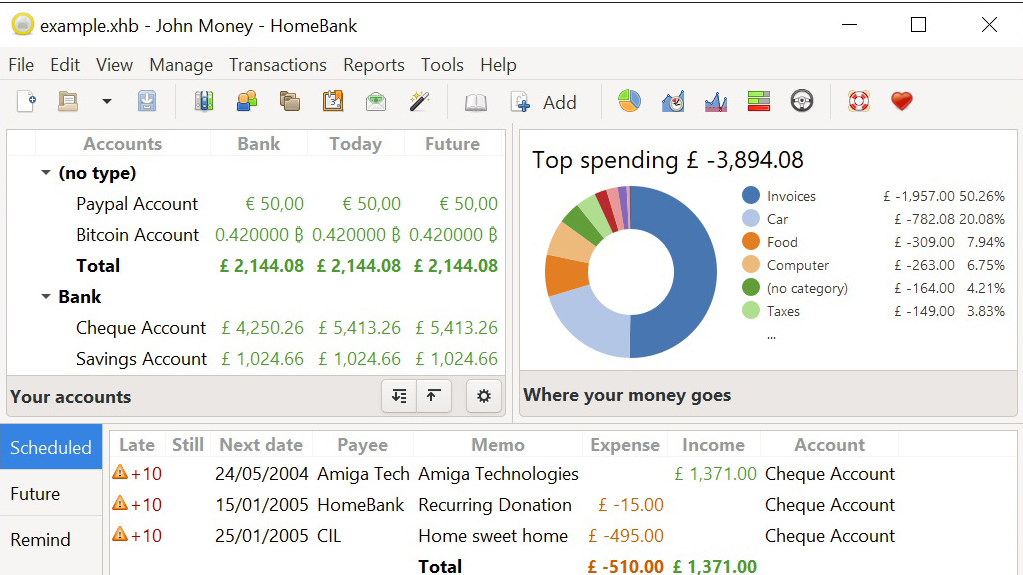

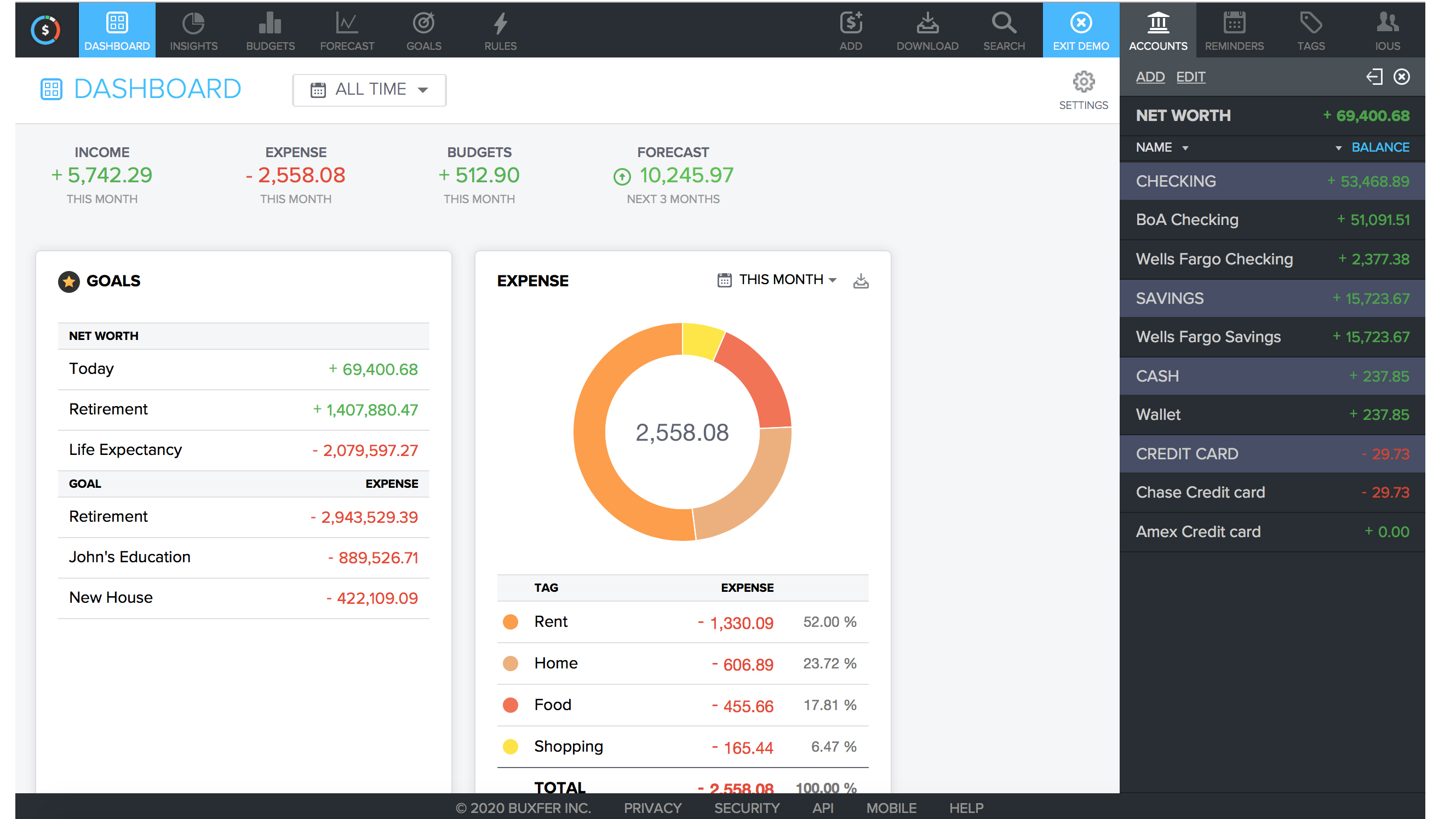

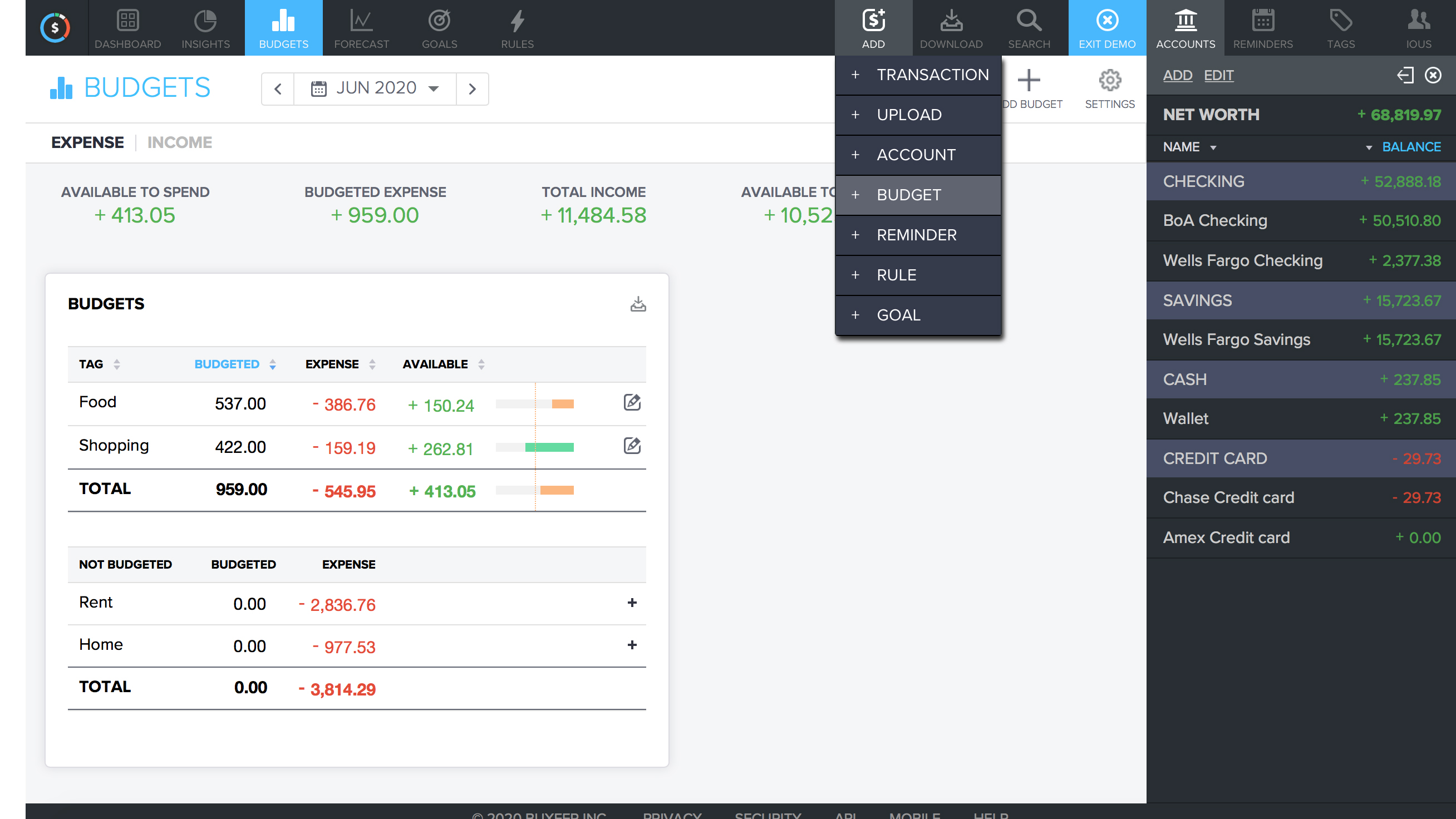

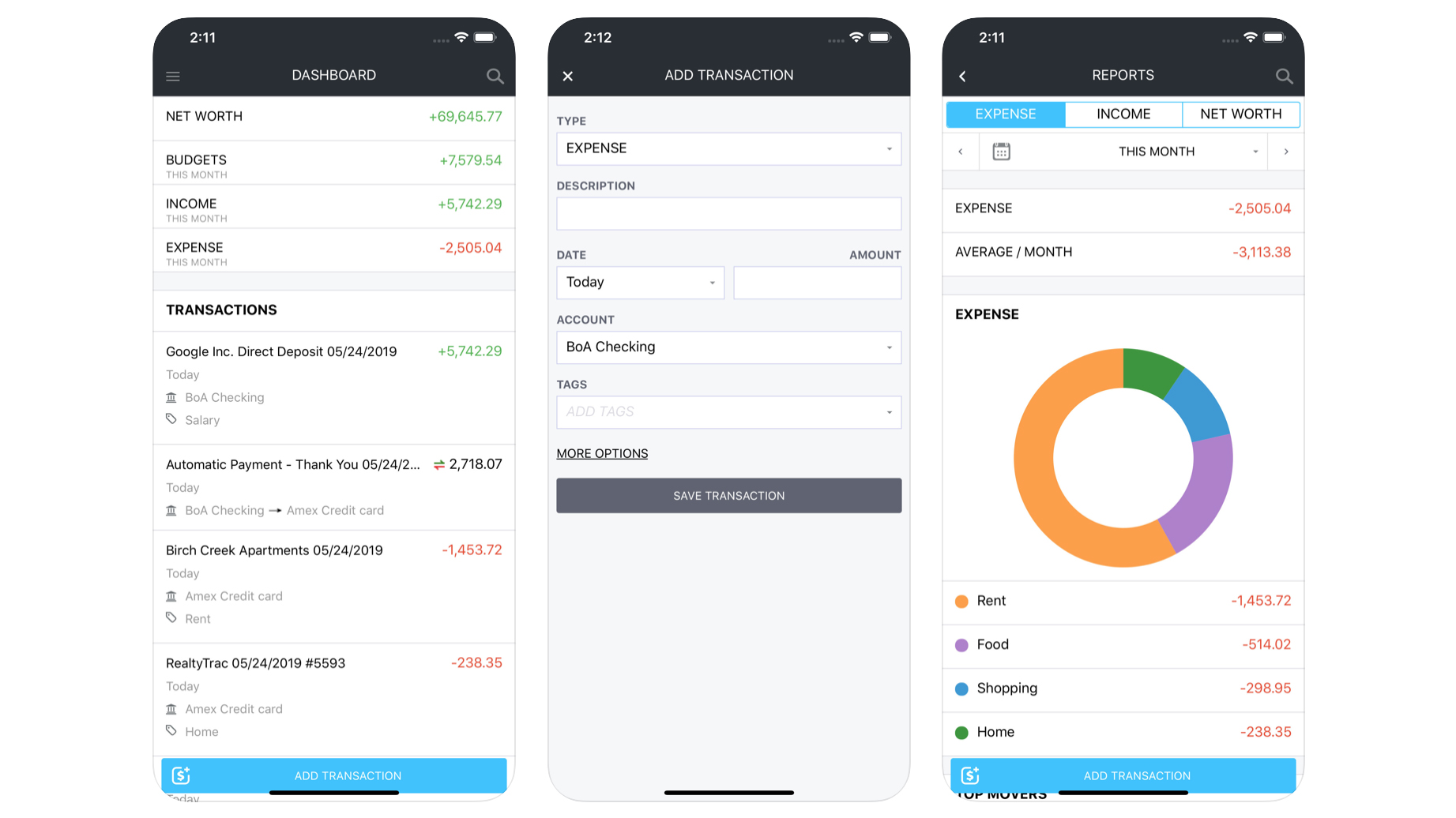

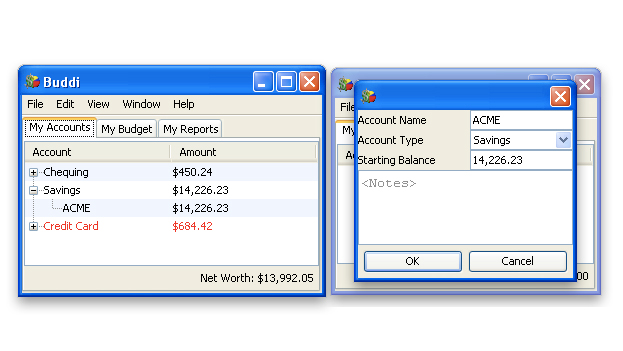

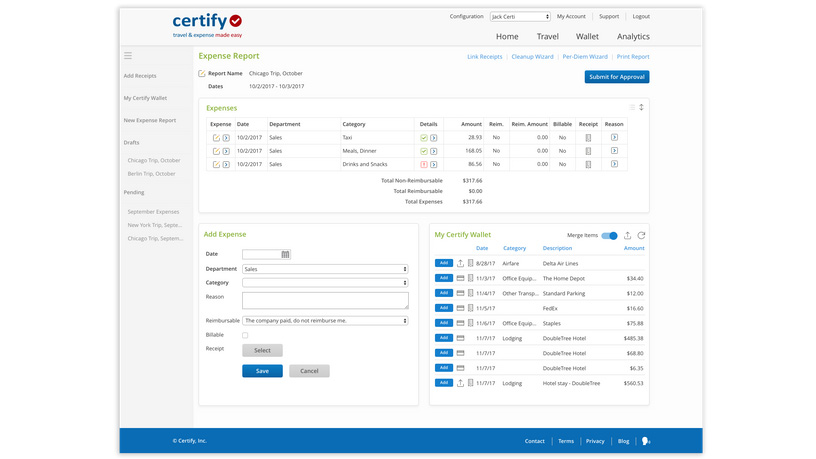

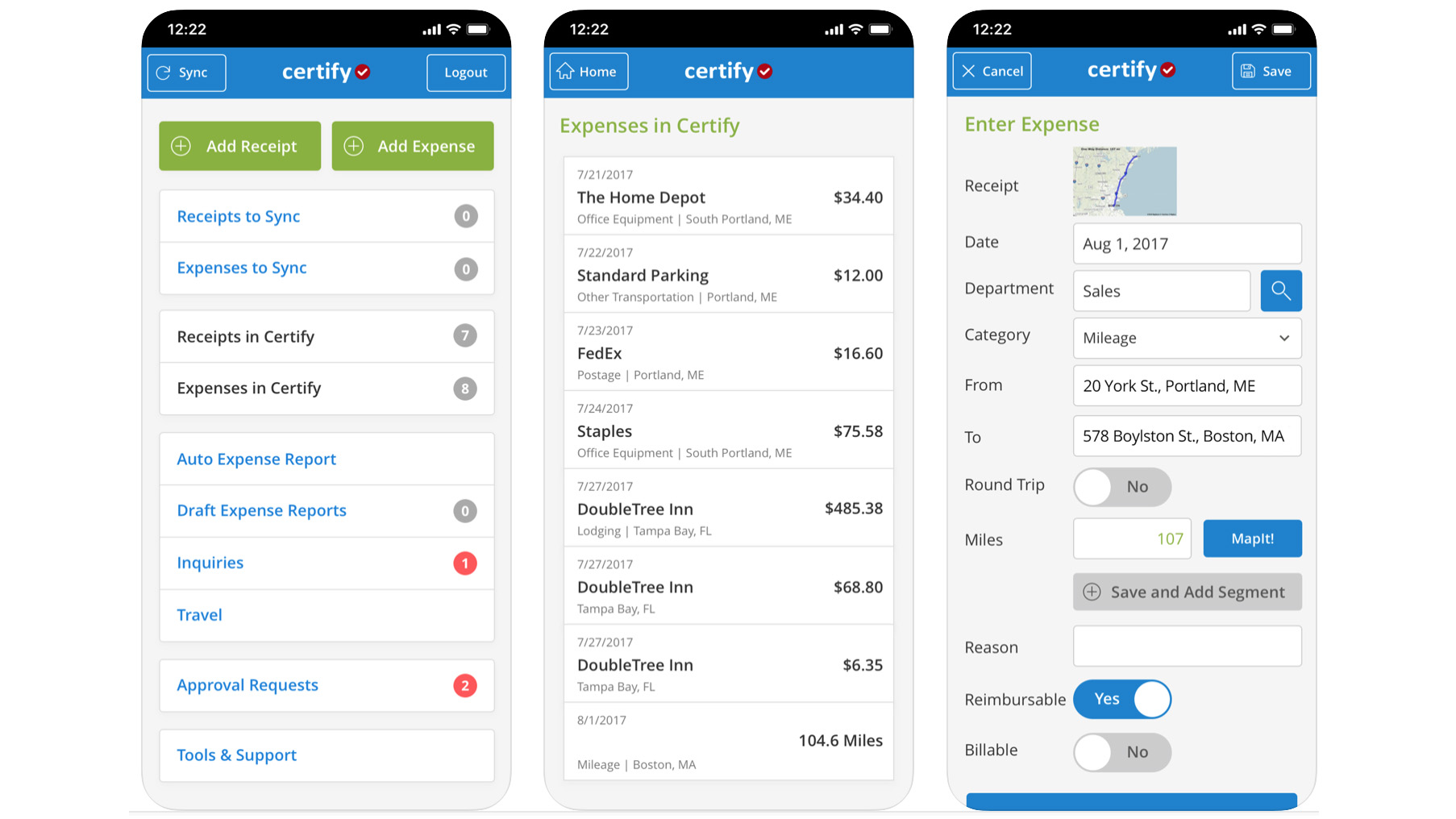

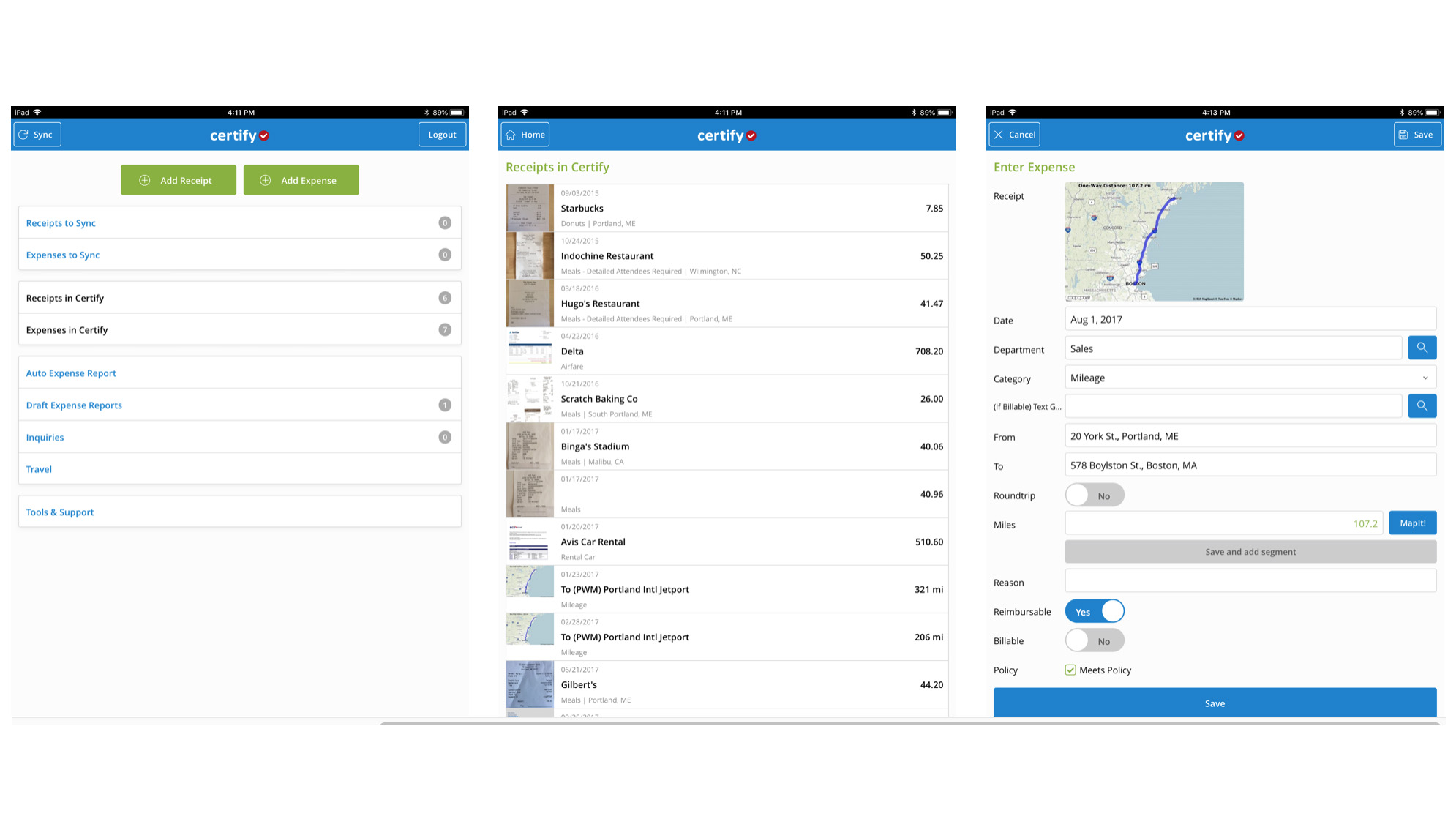

Once you’re done with the configuration all of the tools and functionality can be controlled via the main dashboard area. Employees will love the usefulness of the Certify app, which packs a pretty sizeable punch and allows them to log expenses on the go simply by taking a picture of their receipts on a mobile device.

Certify has a great selection of menu options that allows pinpoint management of everything too, with the ability to check approval requests and keep track of each user’s information via a Certify Wallet. Even if you're a small concern, being able to pop everyone into a relevant department within the software delivers precision tracking of everybody in the system.

Performance

You’ll be able to expect rock-solid performance from Certify, even if you’re using the edition at the lower end of the product spectrum. It’s been well put together and the desktop dashboard and app combination work in tandem to great effect. Certify is safe and secure too including Symantec SSL certification.

Ease of use

Employees often look at expense tracking as a real chore, although technology is helping to eradicate much of the hassle factor. Certify is no exception, with a supporting app for iOS and Android that lets you do a lot of the work from anywhere, while you’re on the go.

That works a treat, while the other appealing aspects of Certify are the high levels of auto-fill features and a detailed interface that allows for the easy population of data fields.

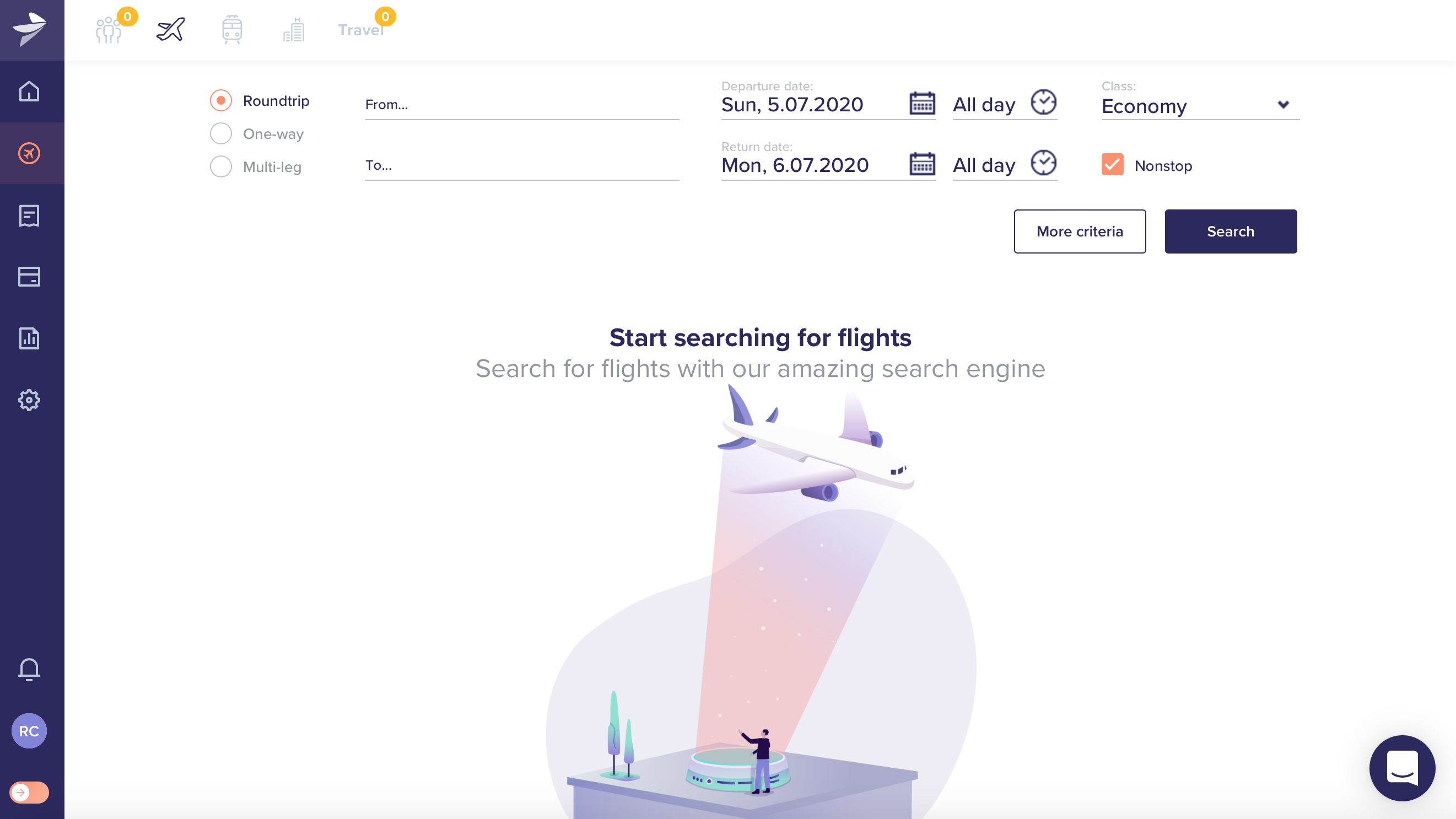

The app part of this equation in particular is very impressive, with the uploading of receipts while you’re on the move hugely practical. Certify also comes with other supplementary features such as travel and AP programs if you need additional resources to add to the excellent expense aspect.

Support

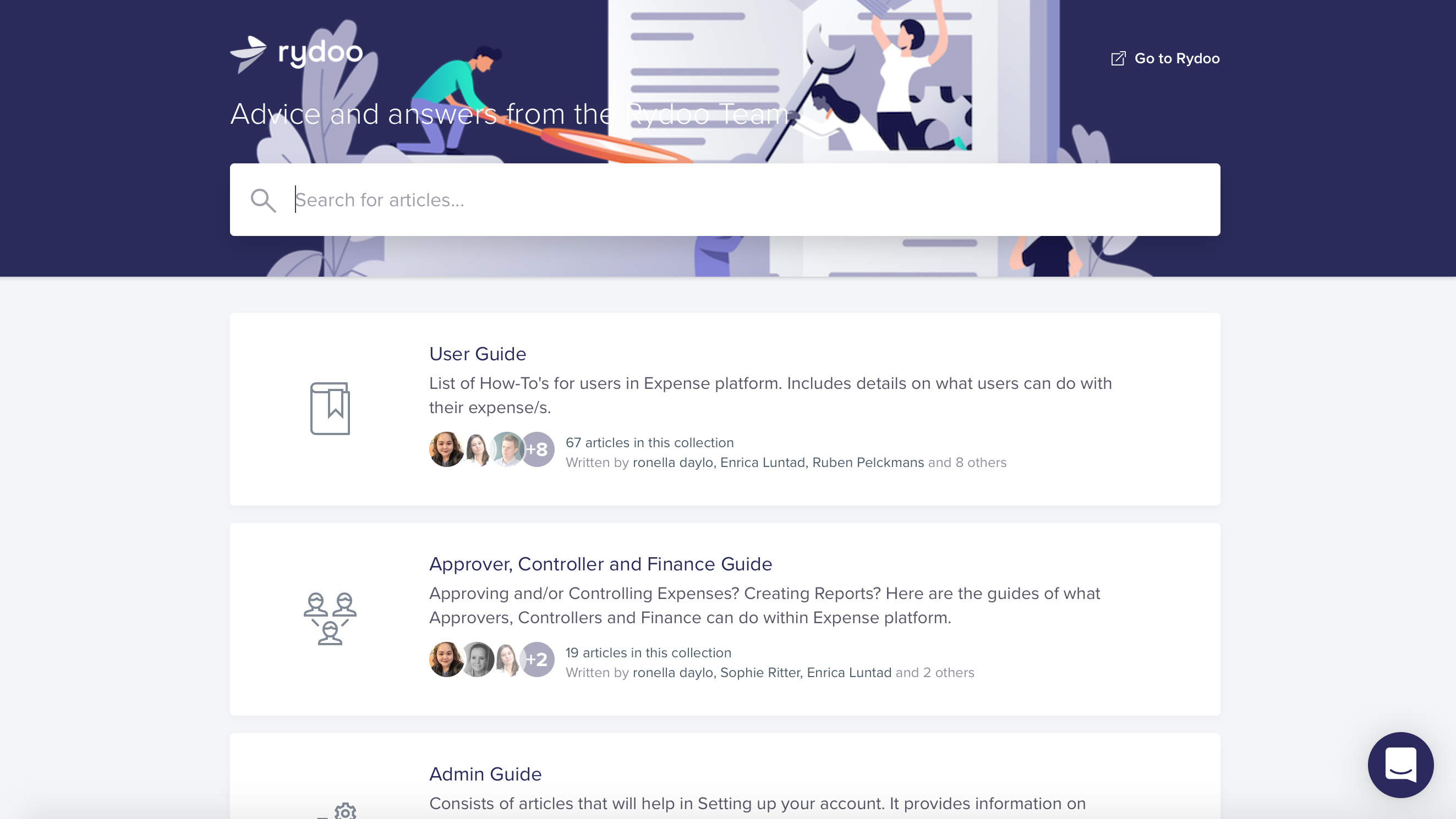

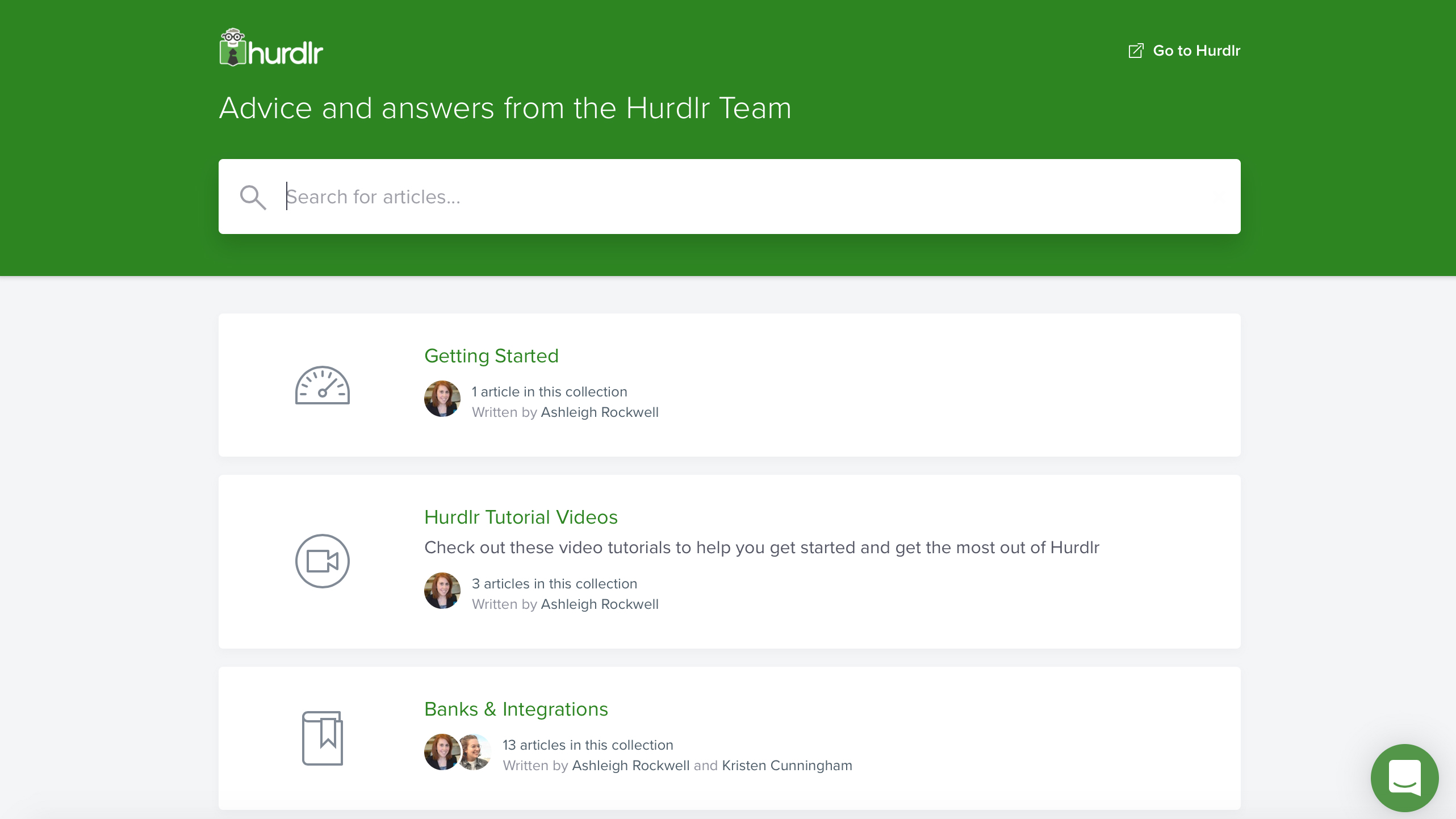

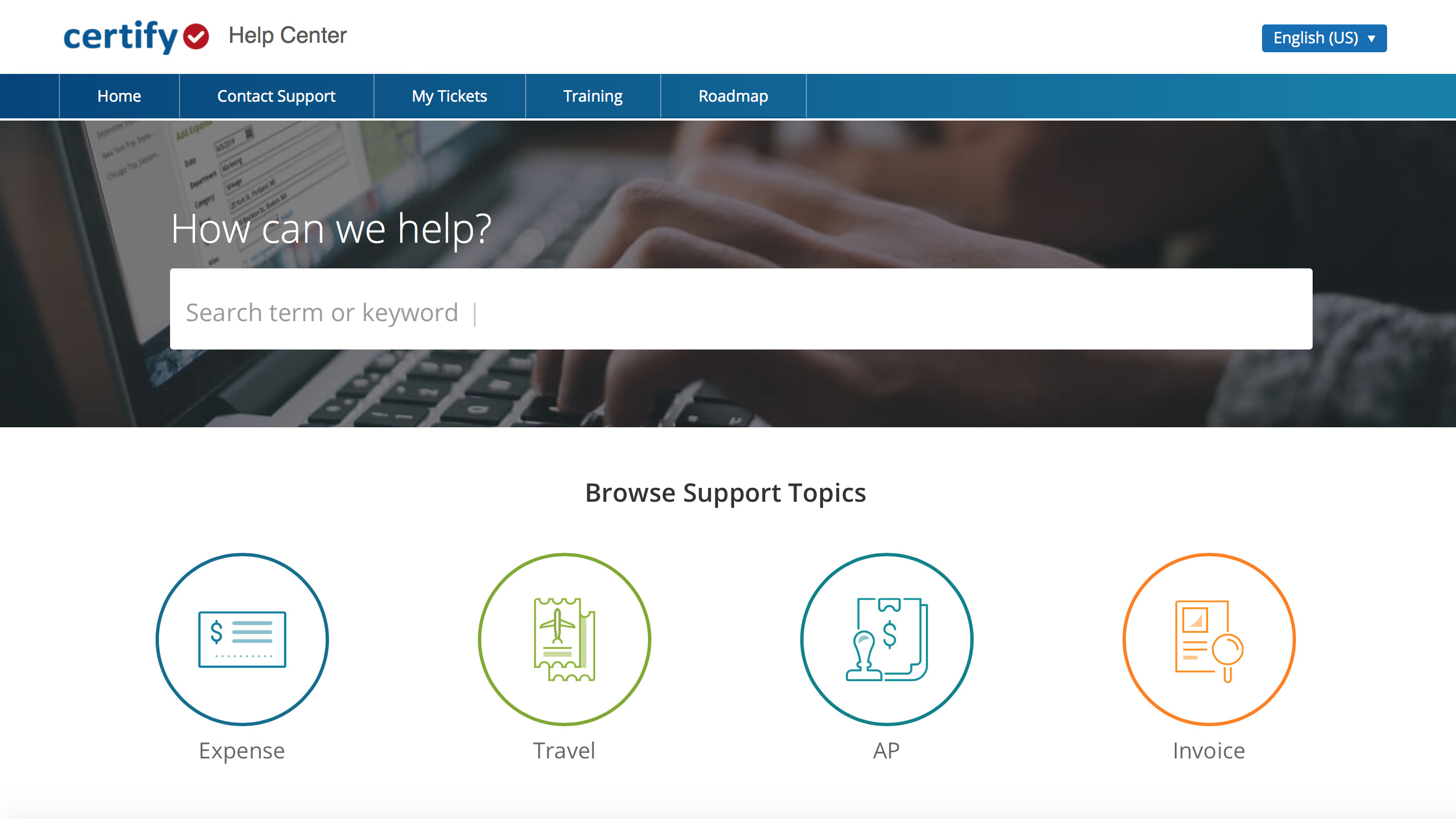

Unsurprisingly given that Certify is a large concern, the level of support for users is comprehensive and that begins at the company website. There’s a very good help center, which comes with lots of different guides and tutorials, including videos, on every aspect of the Certify experience. Be it expenses, invoices, AP or Travel, all of the supplementary areas of the software are covered too.

Being a global concern means that there are support centers around the world, which should mean that you can make use of the local numbers and contact forms suited to your own area. Certify says it supports up to 60 different languages and 24-hour live support is available Monday to Friday.

Final verdict

Certify will certainly appeal to smaller businesses with fewer employees as it can be implemented online and without fuss, with a price tag that’s decidedly good value. Larger companies will find there is just as much appeal, with a scalable edge to the bigger packages that makes it suitable for businesses of all sizes. However, the larger the package option the more complex the implementation becomes.

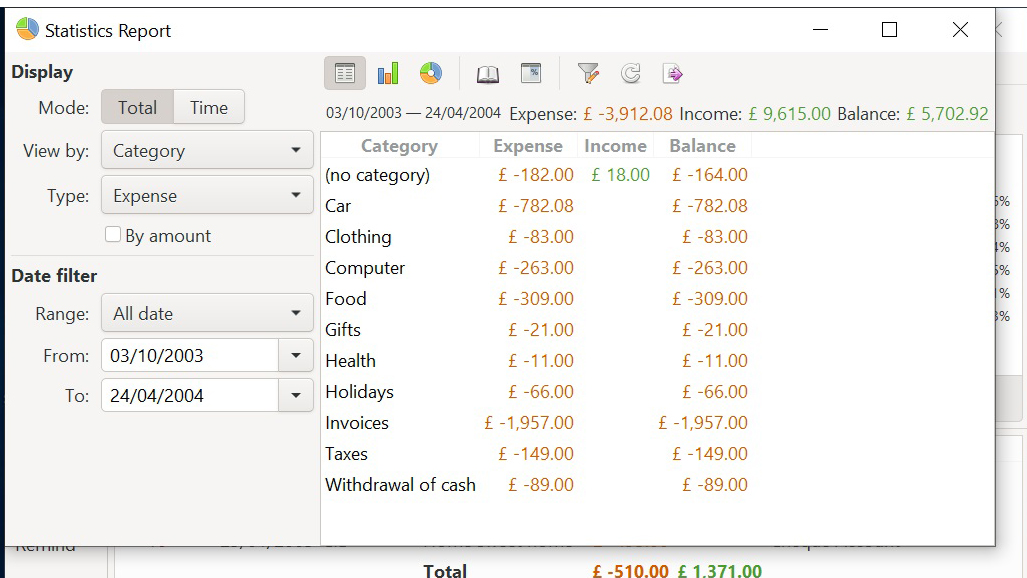

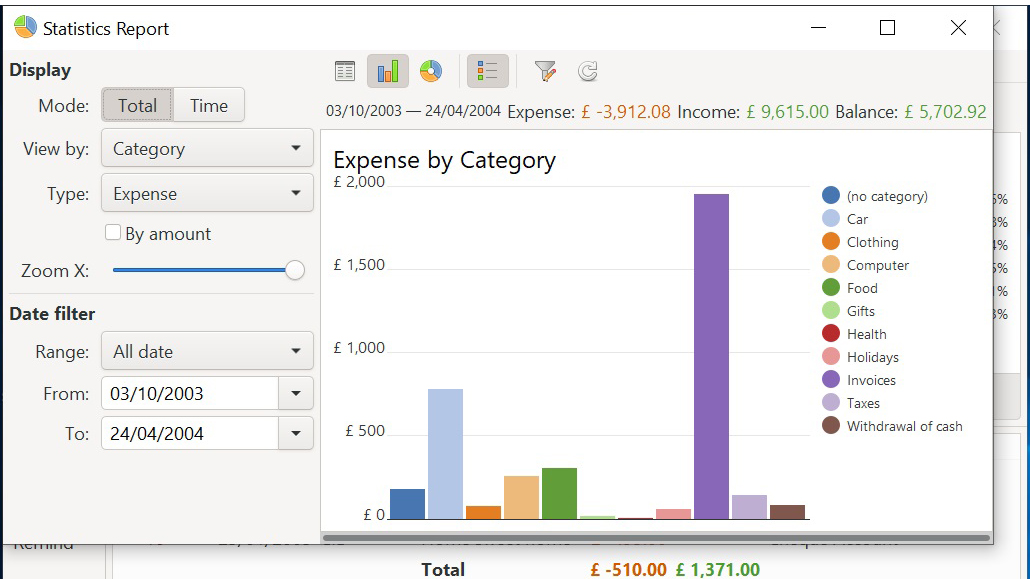

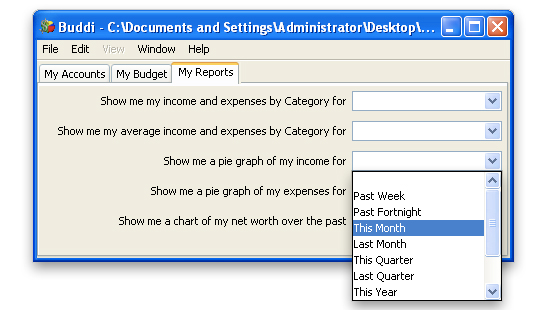

SMEs though will love the time saving features that sit within the Certify Now! edition, all of which remove much of the drudgery from everyday expense tracking. With strong app and desktop versions, plus an impressive set of reporting options, Certify comes recommended for anyone looking to tame their expenses.

- We've also highlighted the best expense tracker apps and software