Xero is cloud-based accounting software that packs a real punch when it comes to features and functionality. Based in New Zealand, the multi-faceted package currently comes in three incarnations and is aimed at small, medium and larger-sized businesses.

With a regularly updated appearance, and new features being added all the time even during the coronavirus pandemic, Xero continues to expand its popular appeal and now enjoys a healthy following. If you’ve got a business that’s going places, needs dynamic accounting capacity and the ability to add in multiple users then the newest version of Xero requires further investigation.

Xero sits alongside the likes of competitors FreshBooks, QuickBooks, Sage Business Cloud Accounting, Kashoo, Zoho Books, ABC Self Assessment and Kashflow.

Pricing

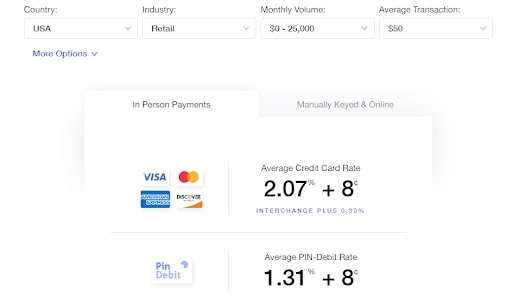

Xero looks to be shaking up its pricing structure and strategy in the coming months. Currently, if you’re looking to sign up with the service in the US then the Early plan costs $11 per month. This gets you 5 invoices and quotes, lets you enter 5 bills and reconcile 20 bank transactions.

Next up, the Growing package costs $32 per month and lets you send invoices and quotes, enter bills and reconcile bank transactions. Xero’s Established plan, meanwhile, is $62 per month and on top of the Established features includes multi-currency, expenses (capture and manage claims) as well as having Projects, which allows for project time tracking and costing.

Xero is available in many other territories, so a look at their website will reveal other costing changes, plus the price of several additional extras that boost its capabilities.

- We've also highlighted the best accounting software

Features

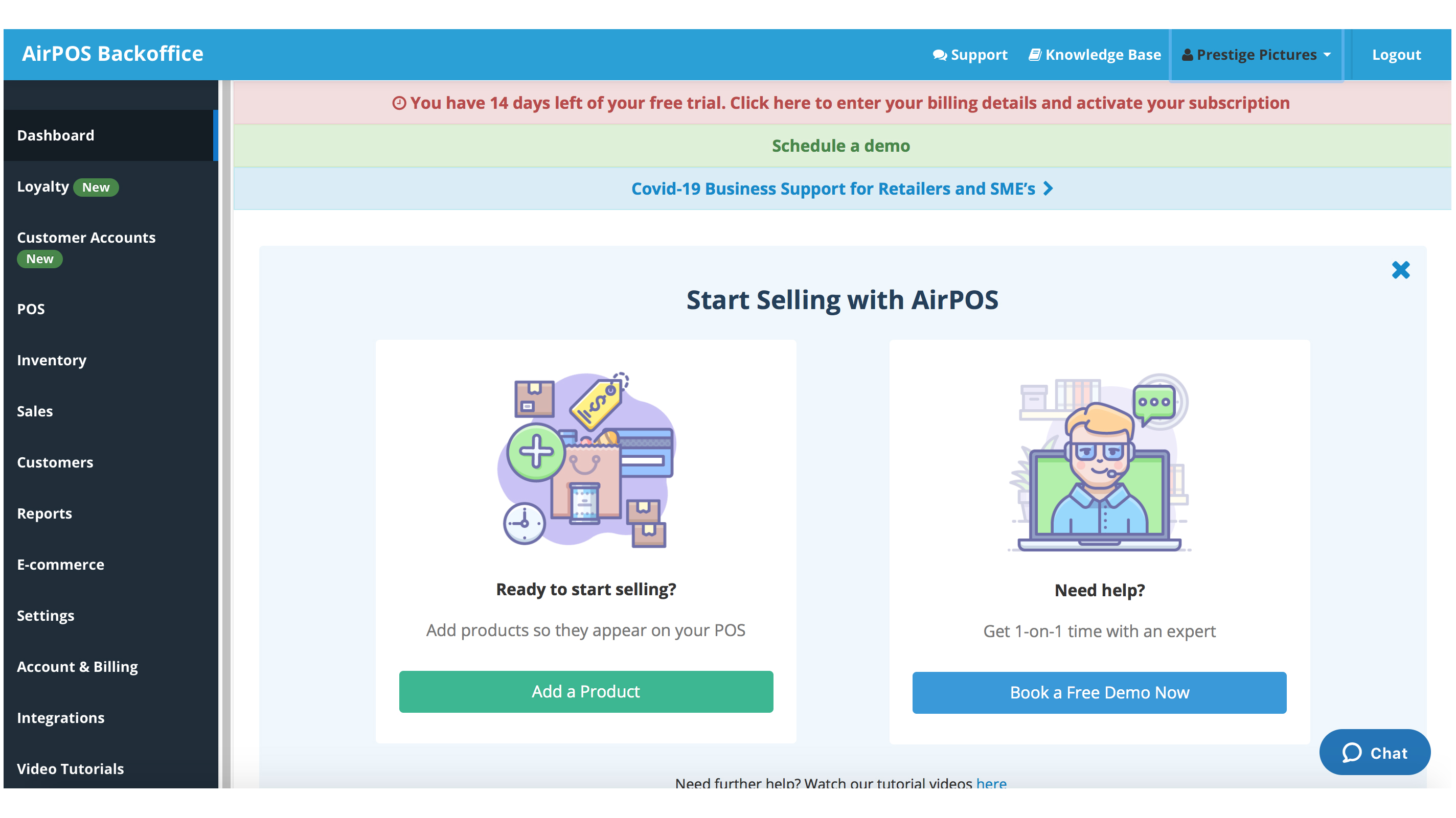

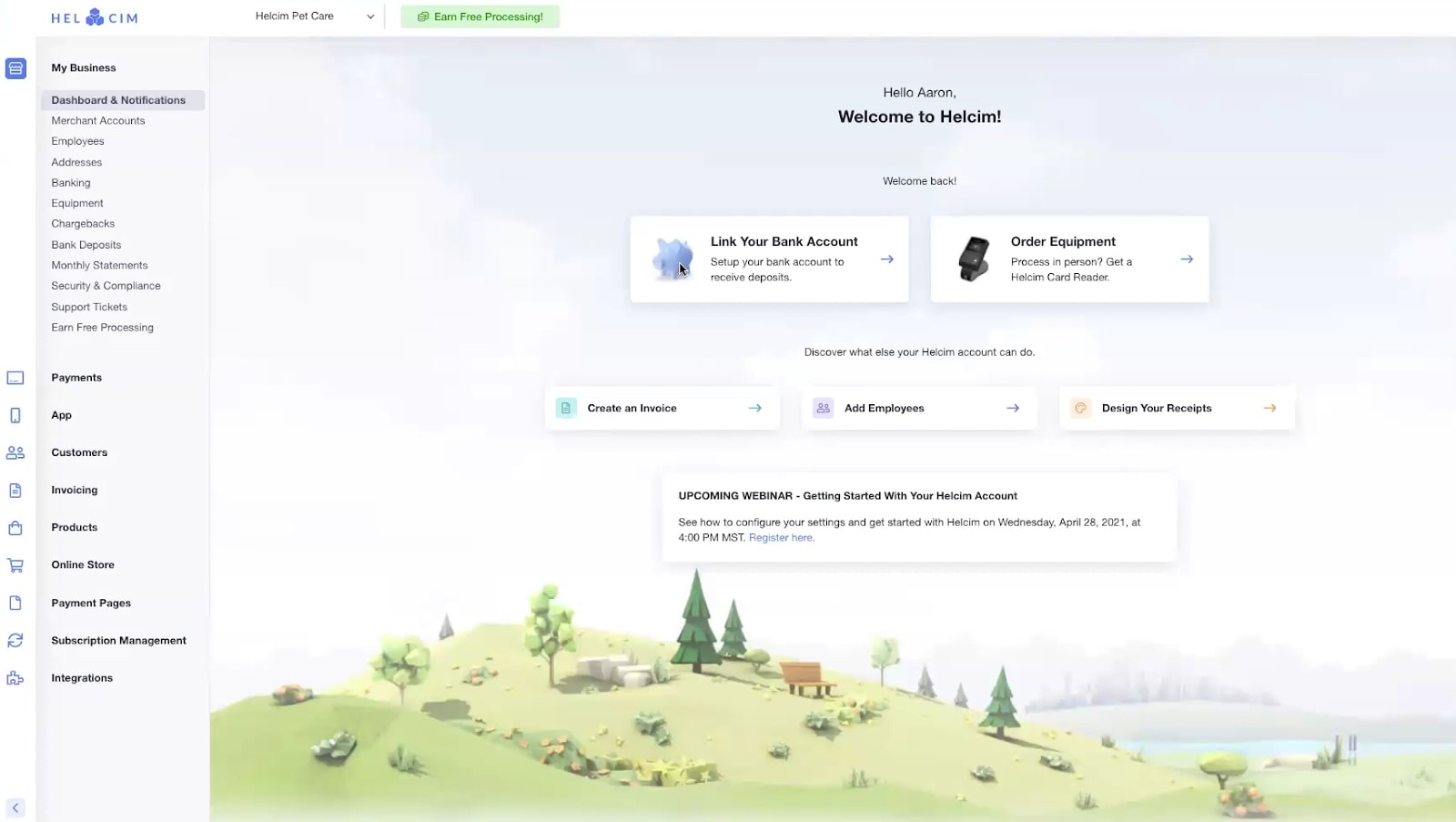

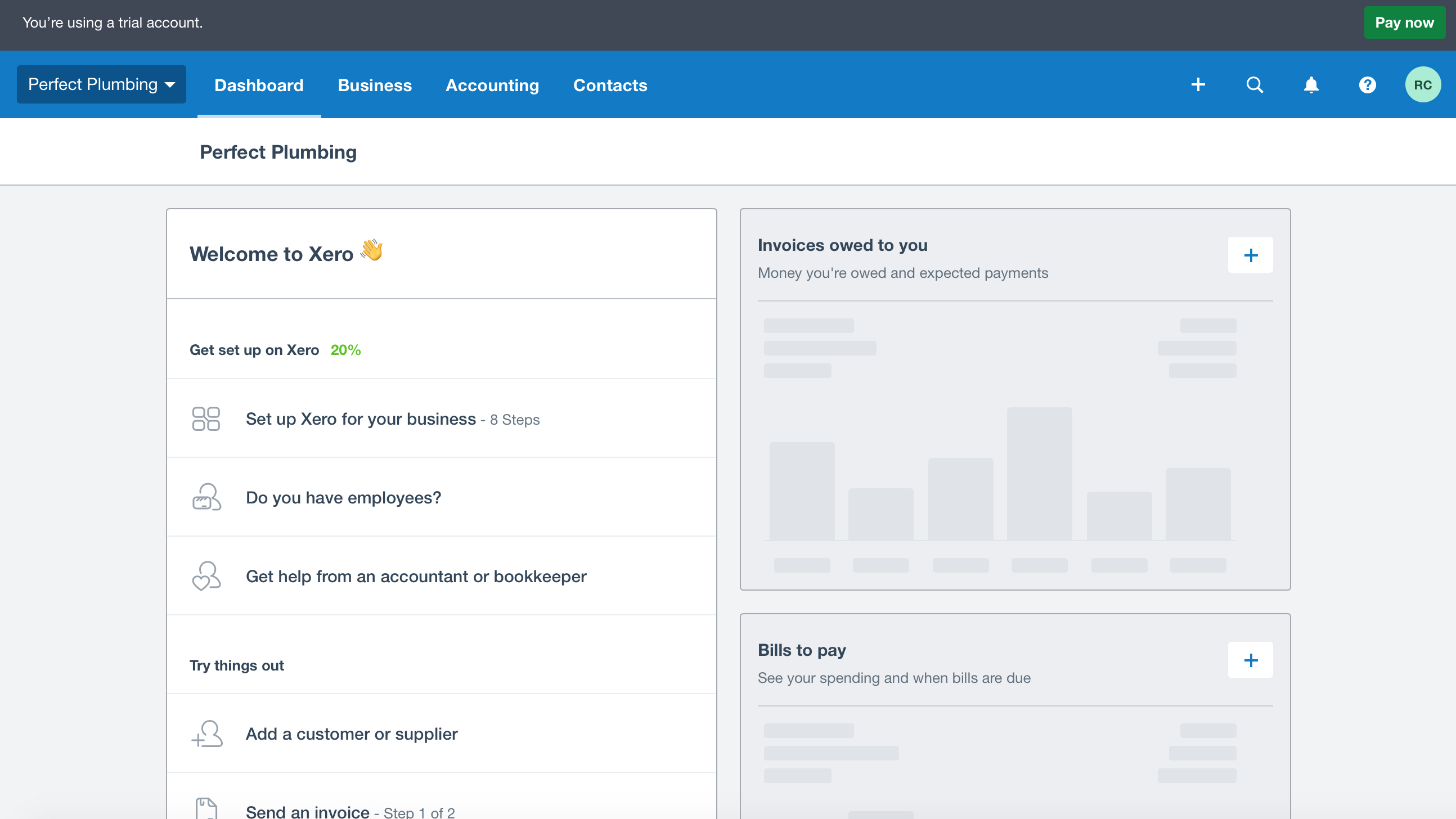

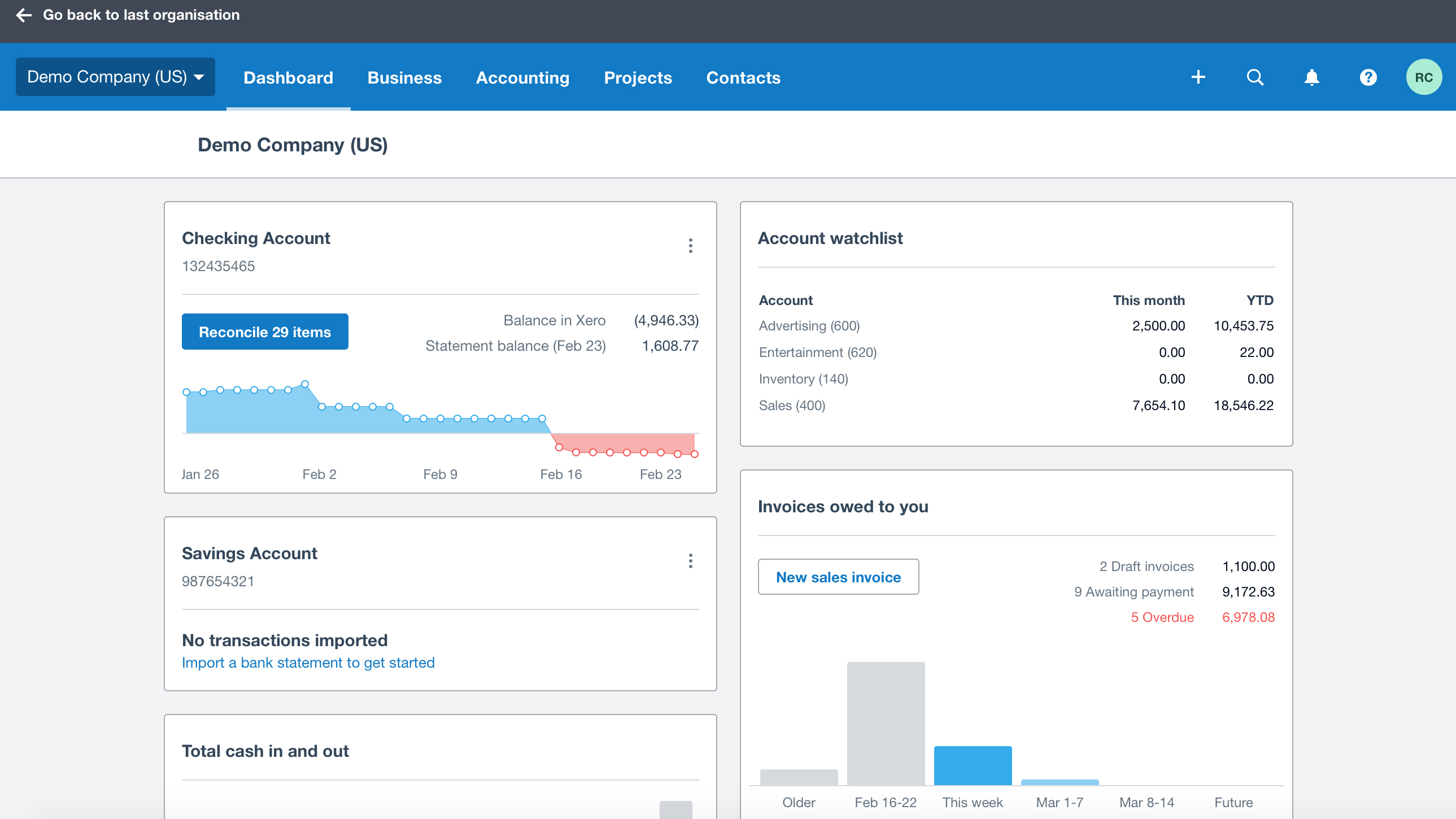

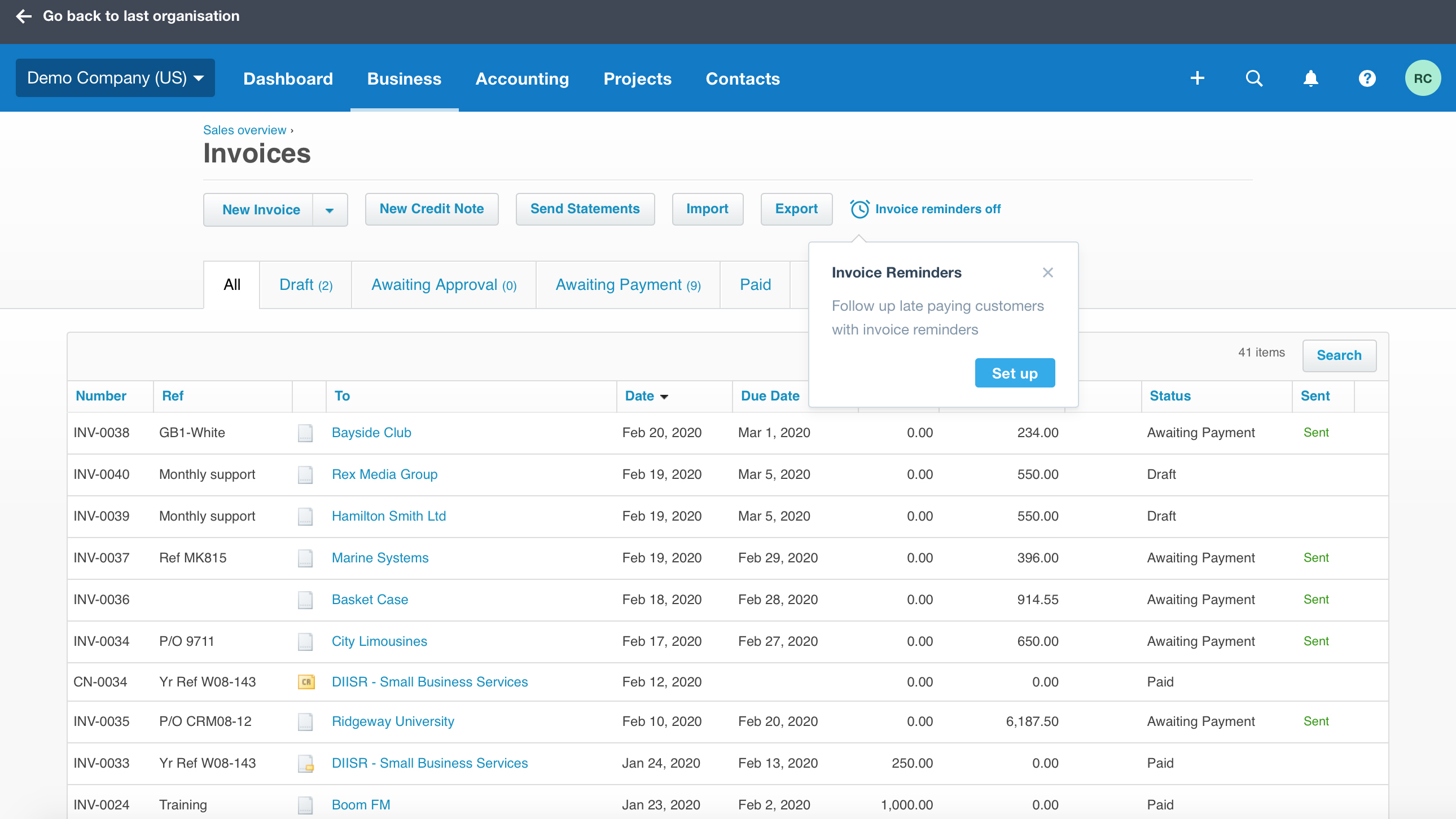

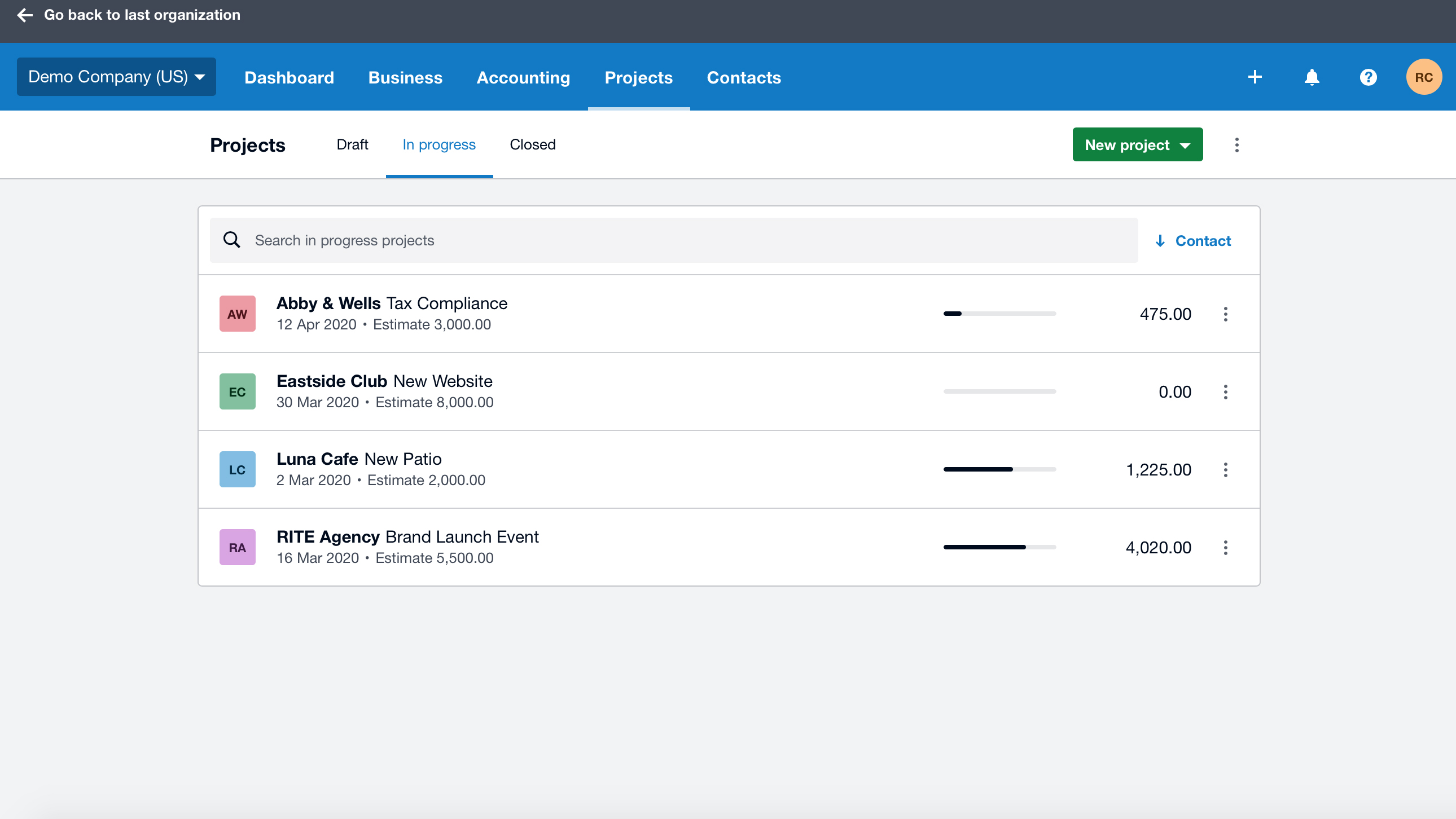

Xero certainly doesn't skimp when it comes to features and even more seem to come out of nowhere as you delve deeper into its hidden depths. Everything revolves around the Xero dashboard area, but we also love the easy way Xero lets you create a new part of your cloud-based experience with a simple ‘+’ button to the right of the screen. Here, you can produce invoices, bills, purchase orders and more besides, with one-click ease.

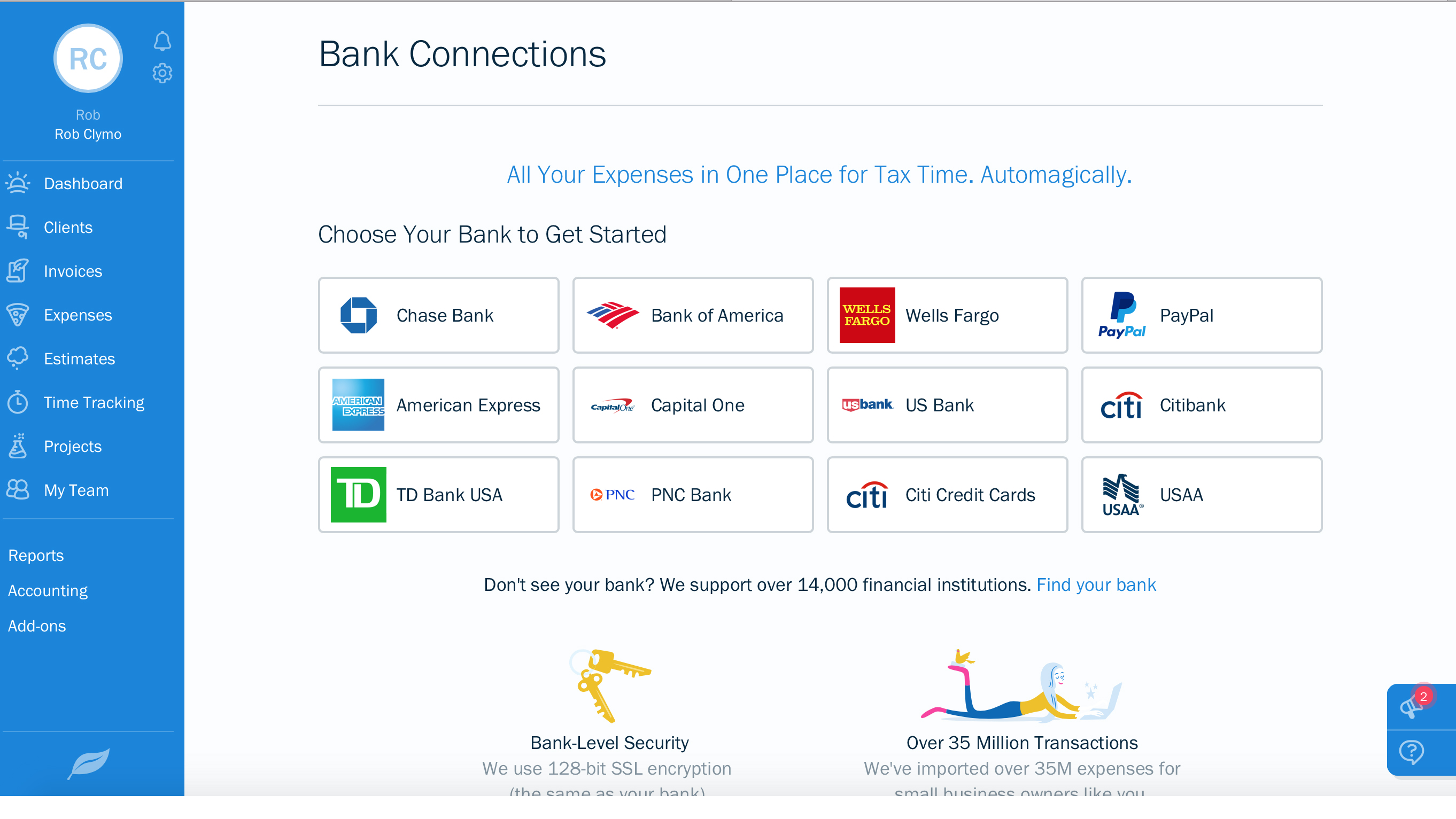

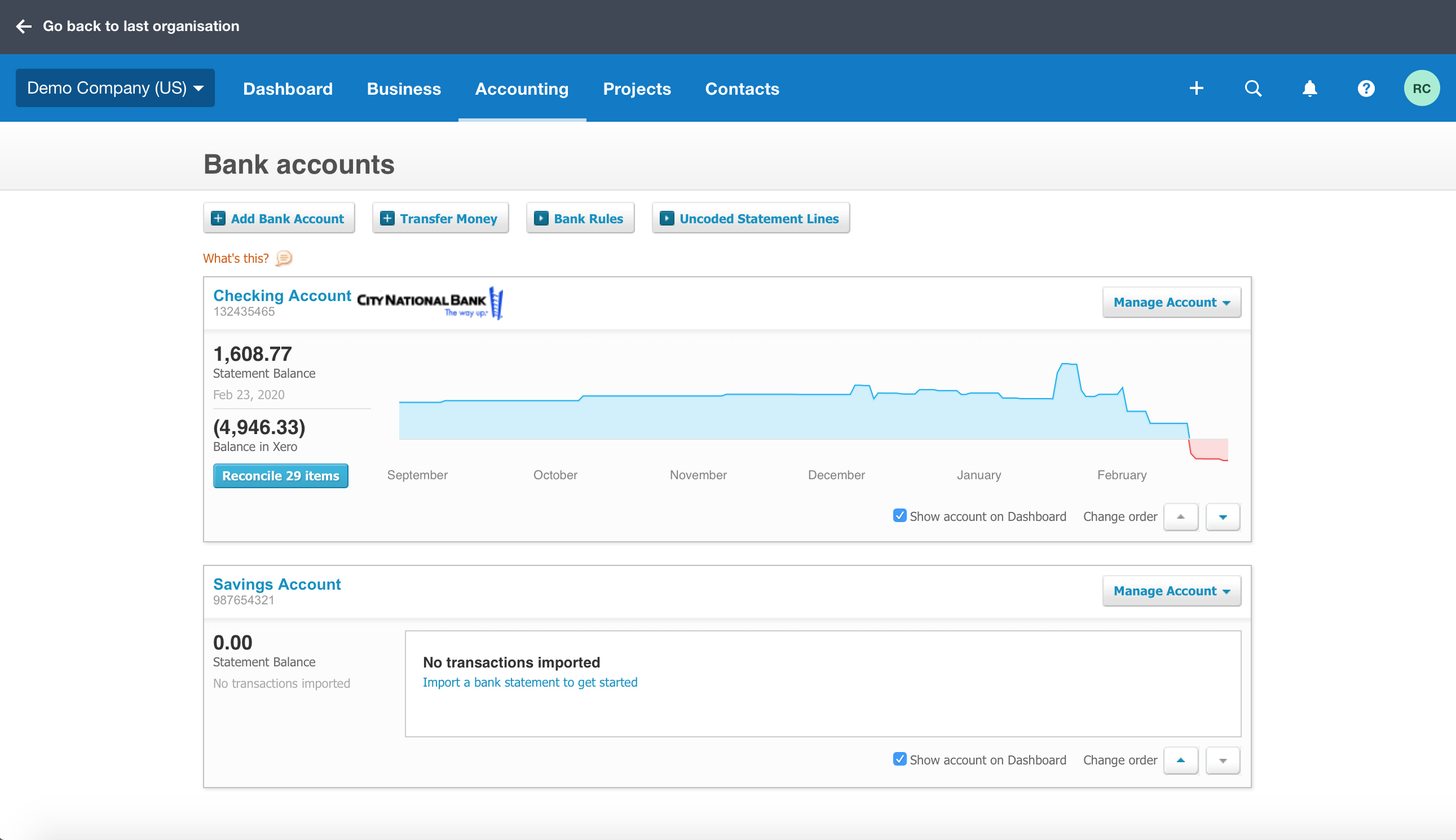

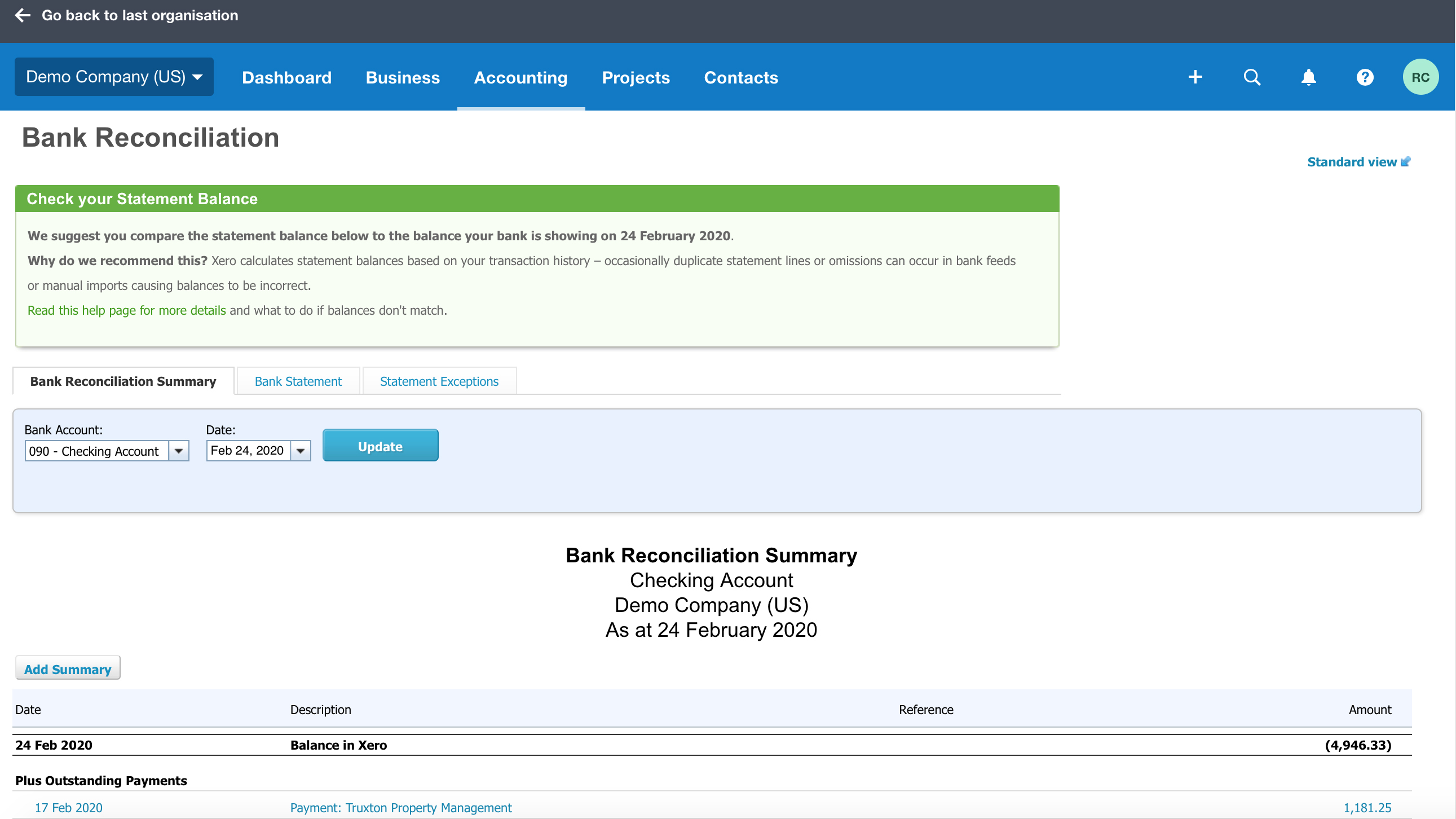

Due to the fact that this is a cloud-based service you also get automatic and secure backups, automatic bank feeds plus the ability to add in extra users who you might have on your team. In addition, Xero has an impressive capacity for integrating with over 800 apps that boost the feature set and allow you to include inventory managements, invoicing, time tracking, expenses and more features outside of what comes with the base-level package

Performance

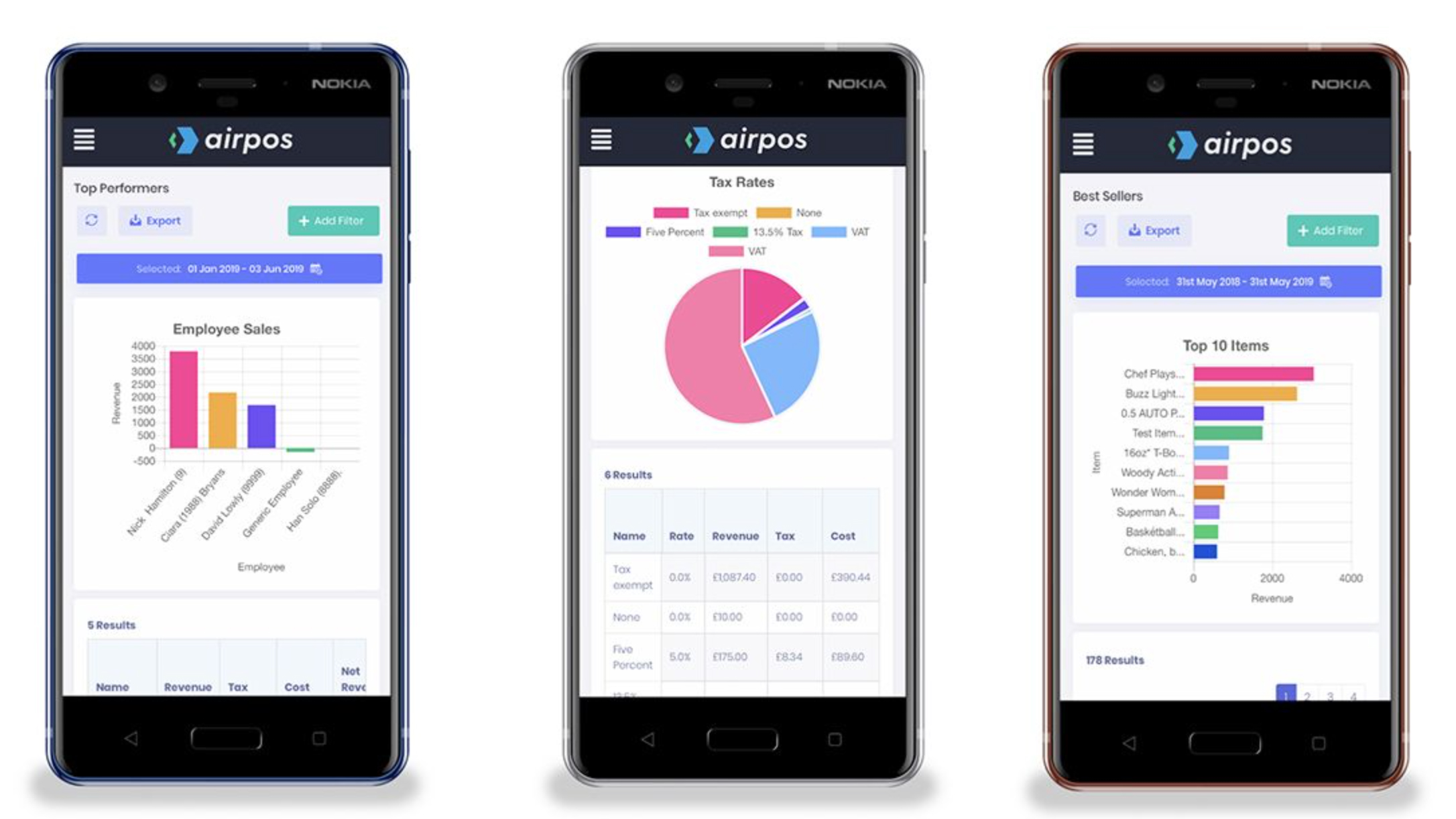

Being a cloud-based service Xero naturally works just as long as you are connected to the internet and use any one of the popular web browsers out there. You’ll find that Xero is similarly sprightly if you choose to use its app-based editions, which are available for both iOS and Android devices. In fact, the Xero experience on a tablet or smartphone seems to be generally good, especially considering its depth of data entry points.

Ease of use

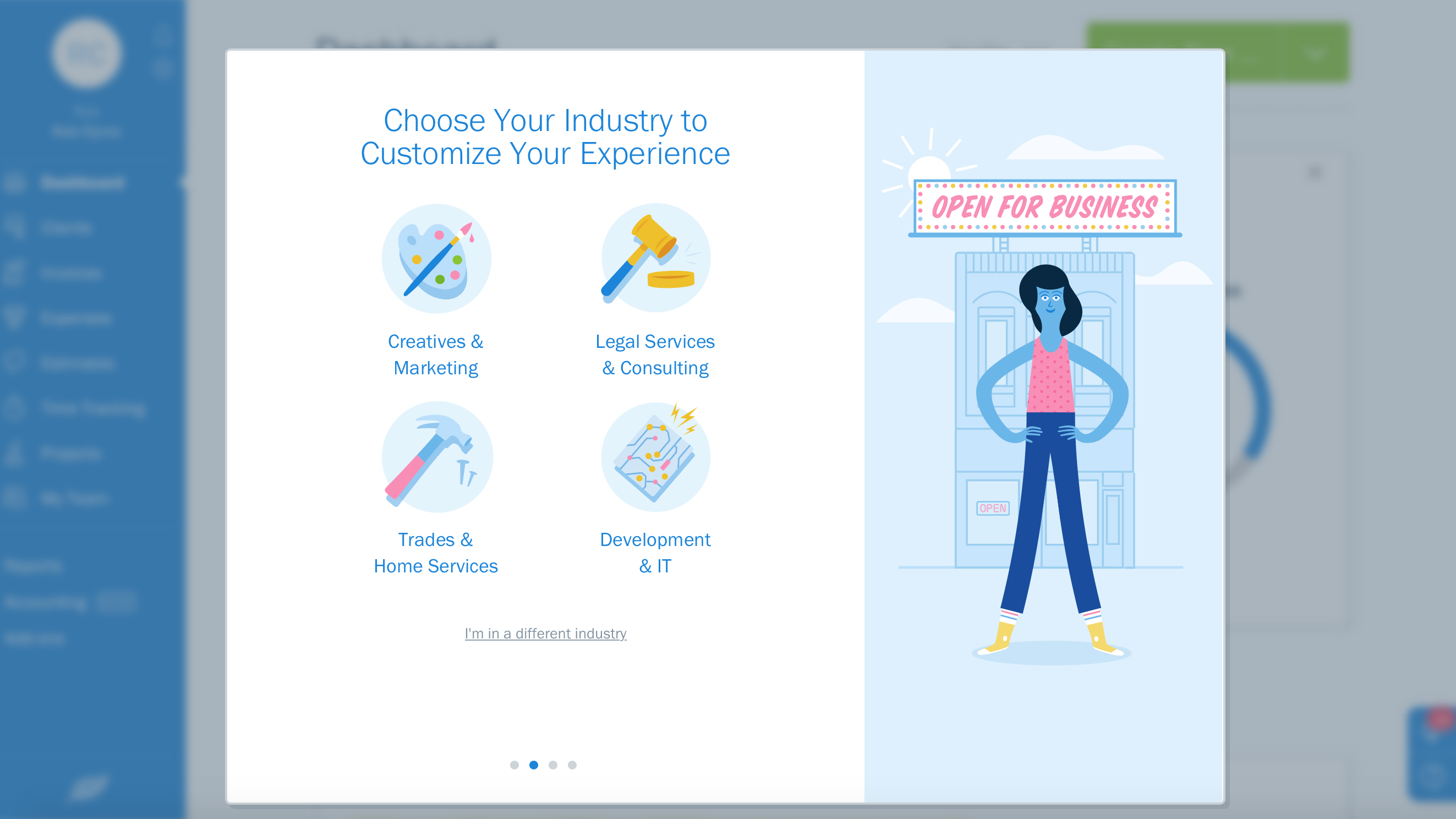

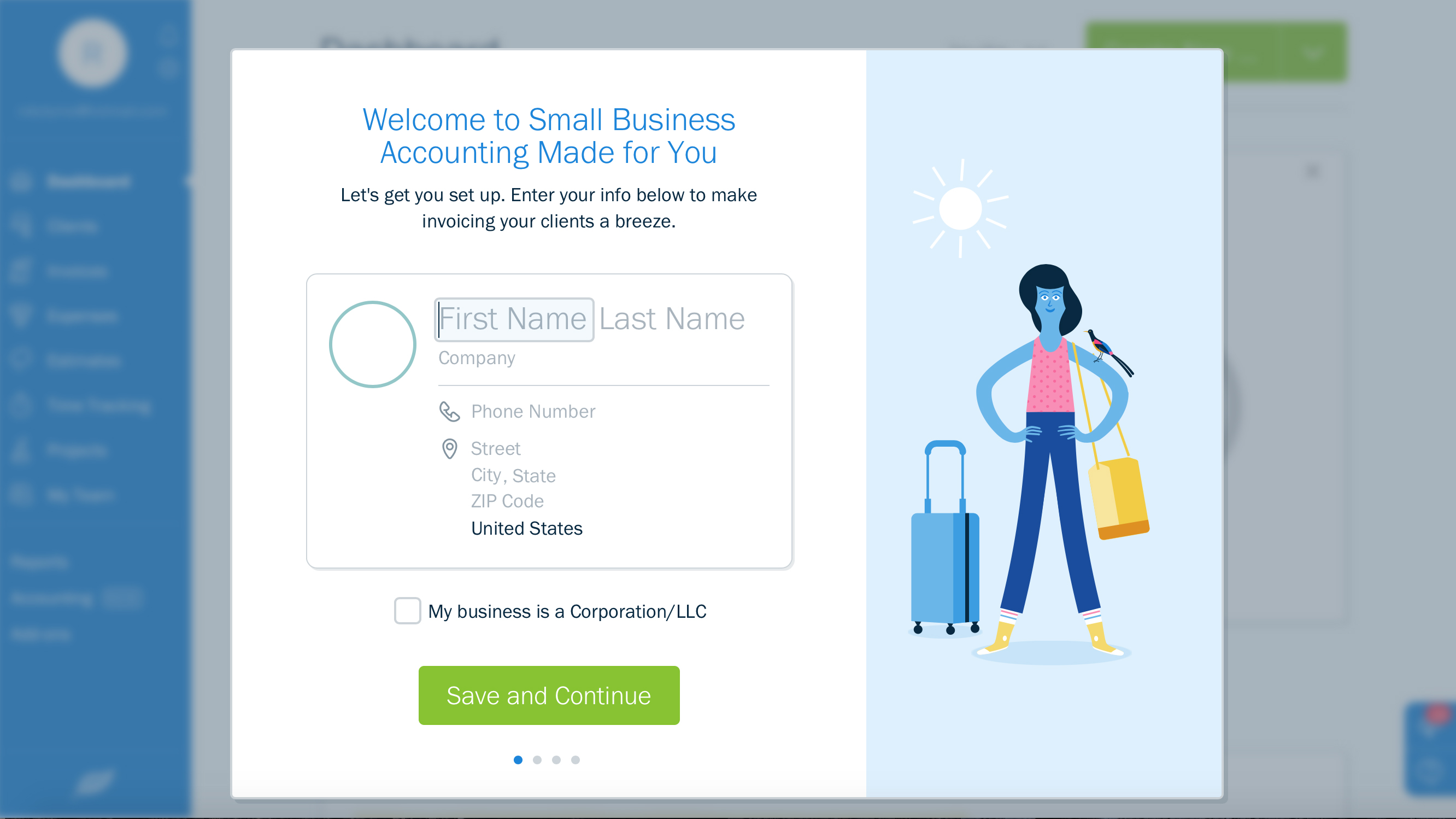

Xero has been nicely put together and if, for example, you choose to try out their demo site, which can be found once you’ve registered, there’s even help as you work. At the same time, Xero has evolved into a pretty meaty package, and as a result has many different areas that you’ll need to acquaint yourself with.

Some parts of the experience require time and patience to master. Even then you can tend to find yourself getting a little tied up in knots such is the powerful array of features on offer. In that respect the built-in help will pay dividends as you use it to navigate any of the trickier aspects of the cloud-based layout.

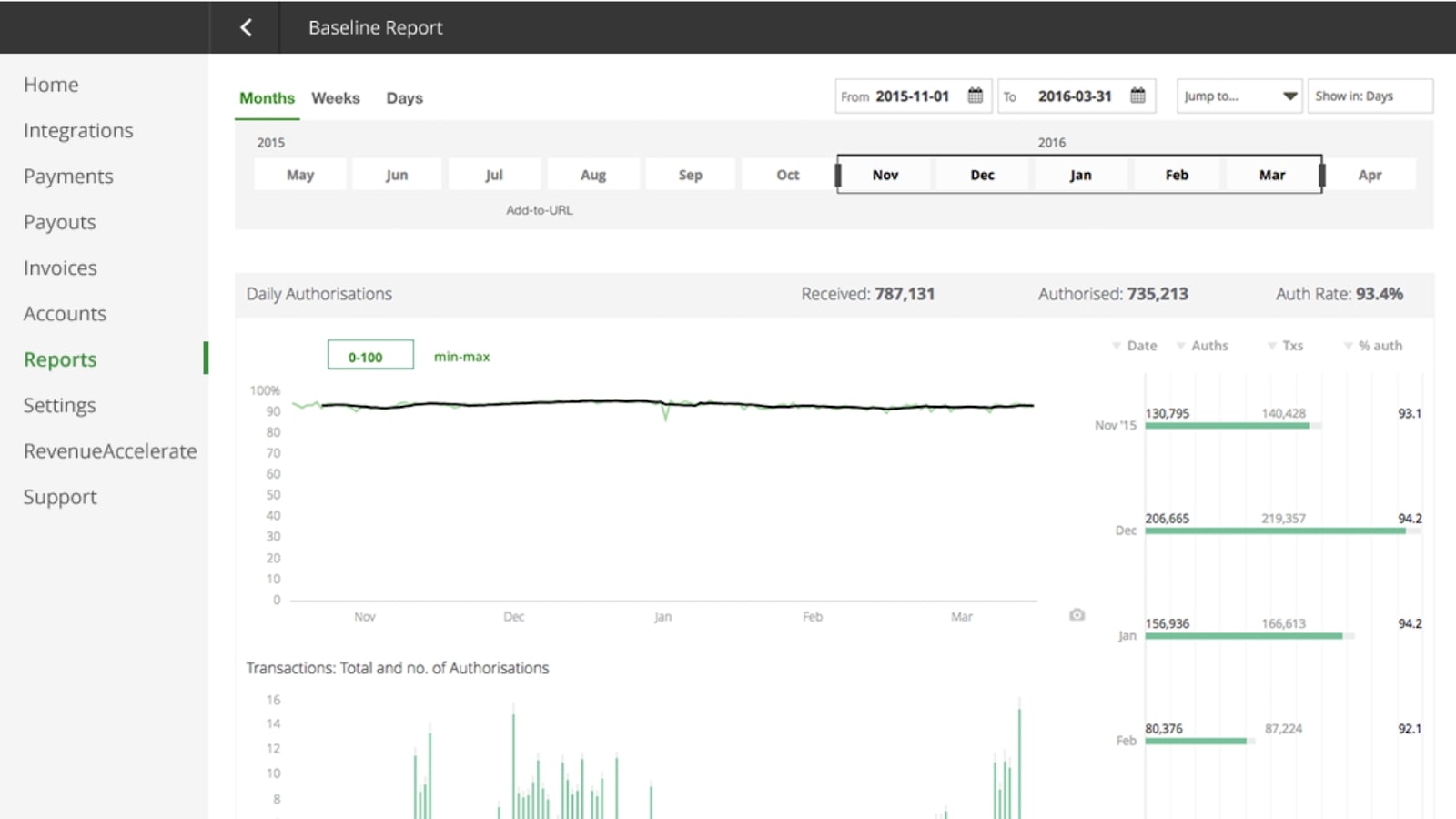

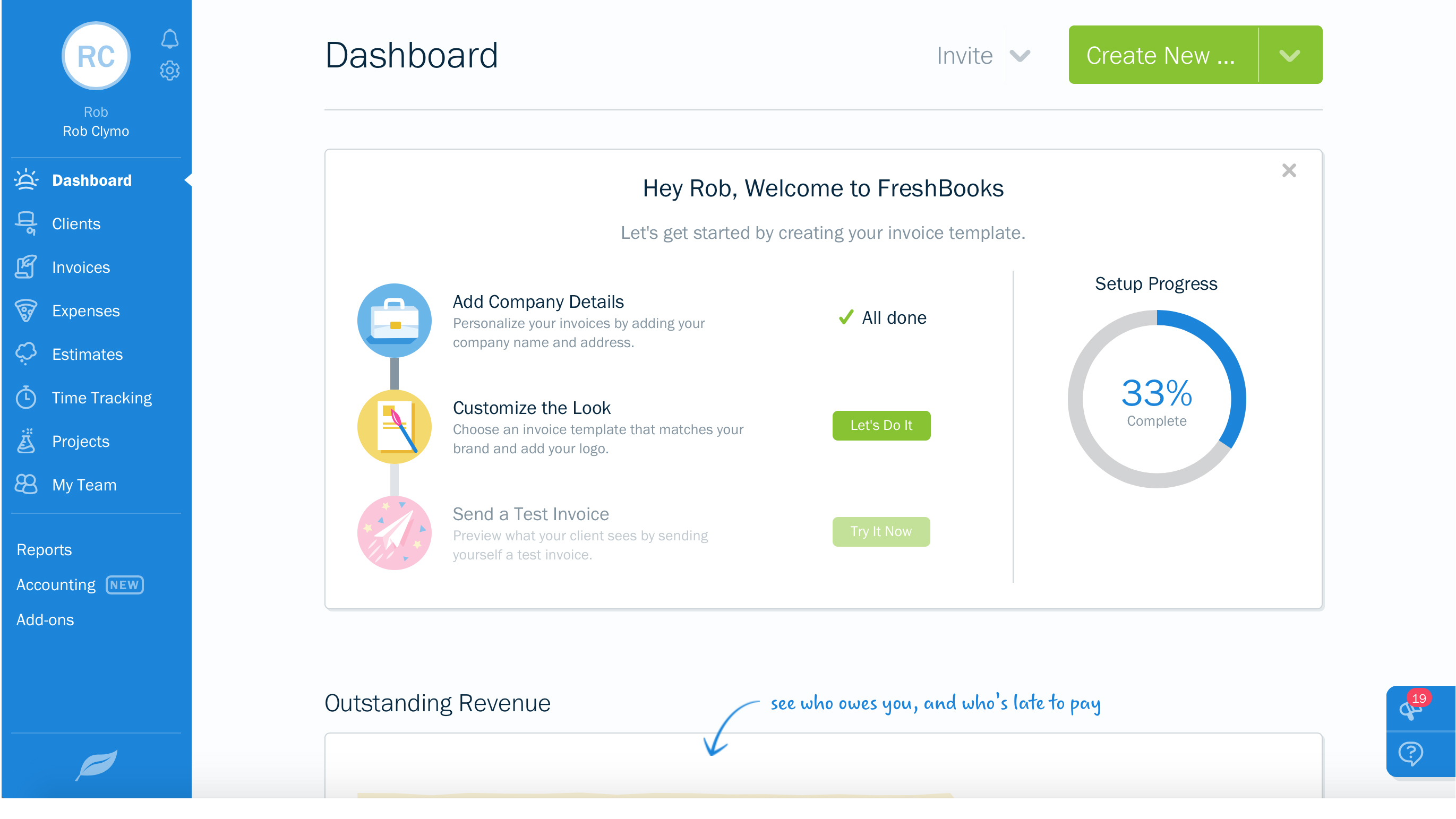

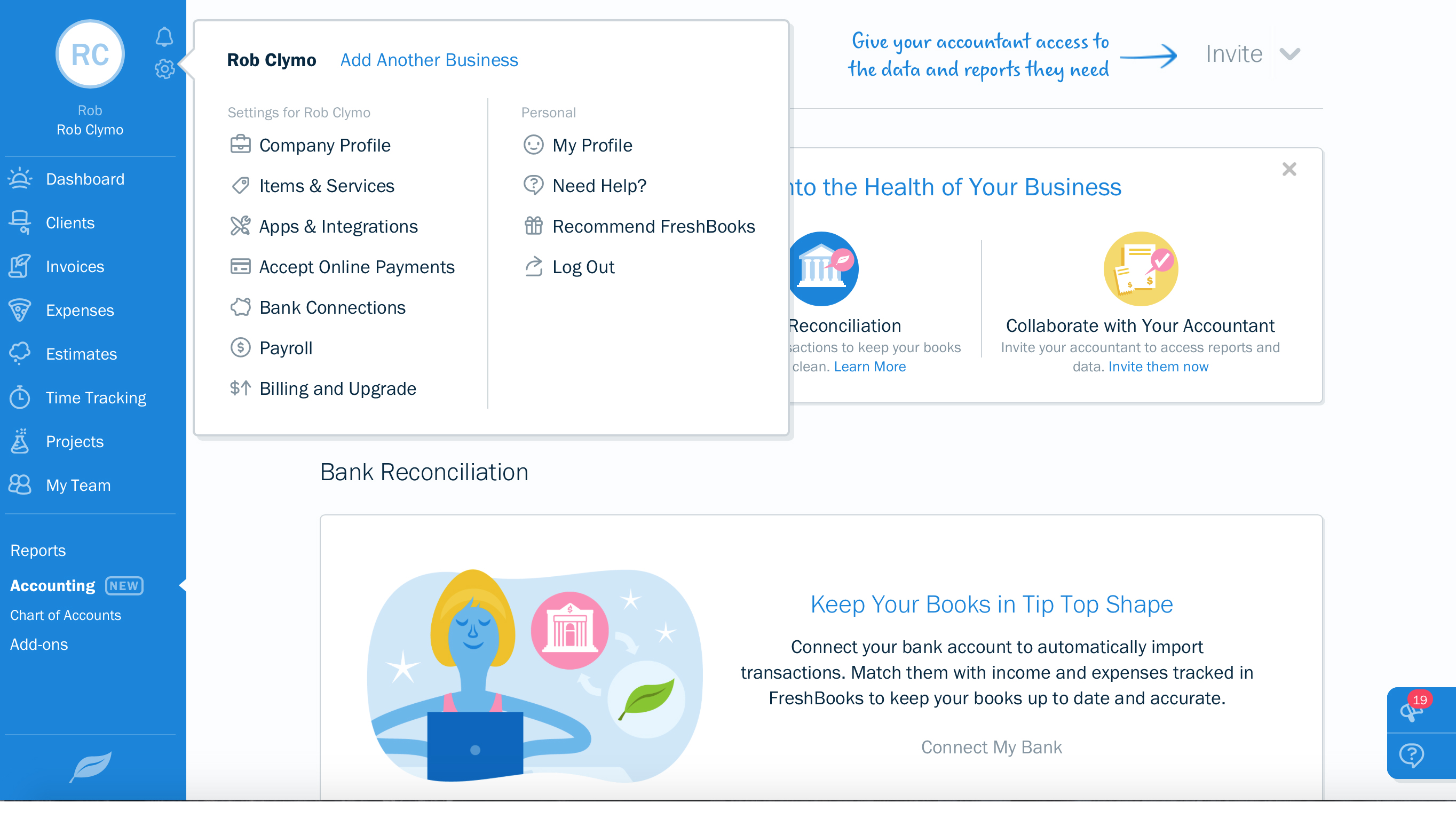

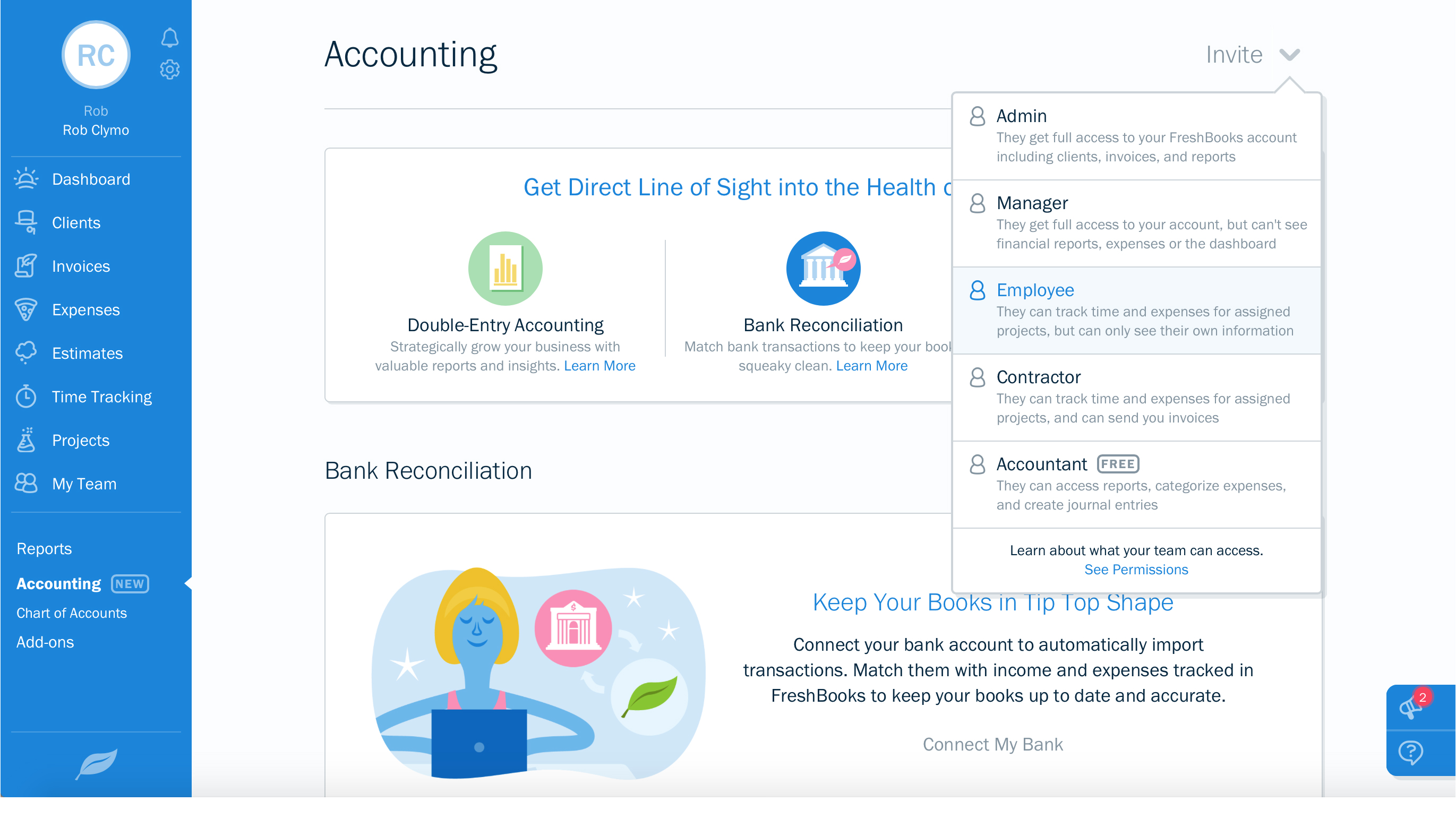

Things start out at the Dashboard, which is just that; the area that lets you move into the other sections of the site and from which you can manage the overall way it ticks. The layout is, on the face of it, pretty simple with a user-experience that delivers quick and easy access to core features. These are found via a top menu that houses not only the Dashboard, but Business, Accounting and Contacts options too.

To the right of your screen are less prominent but just as useful features, including Help, plus search and notification buttons. Work your way down through those root menus, however and you discover countless tools for tackling every aspect of your business.

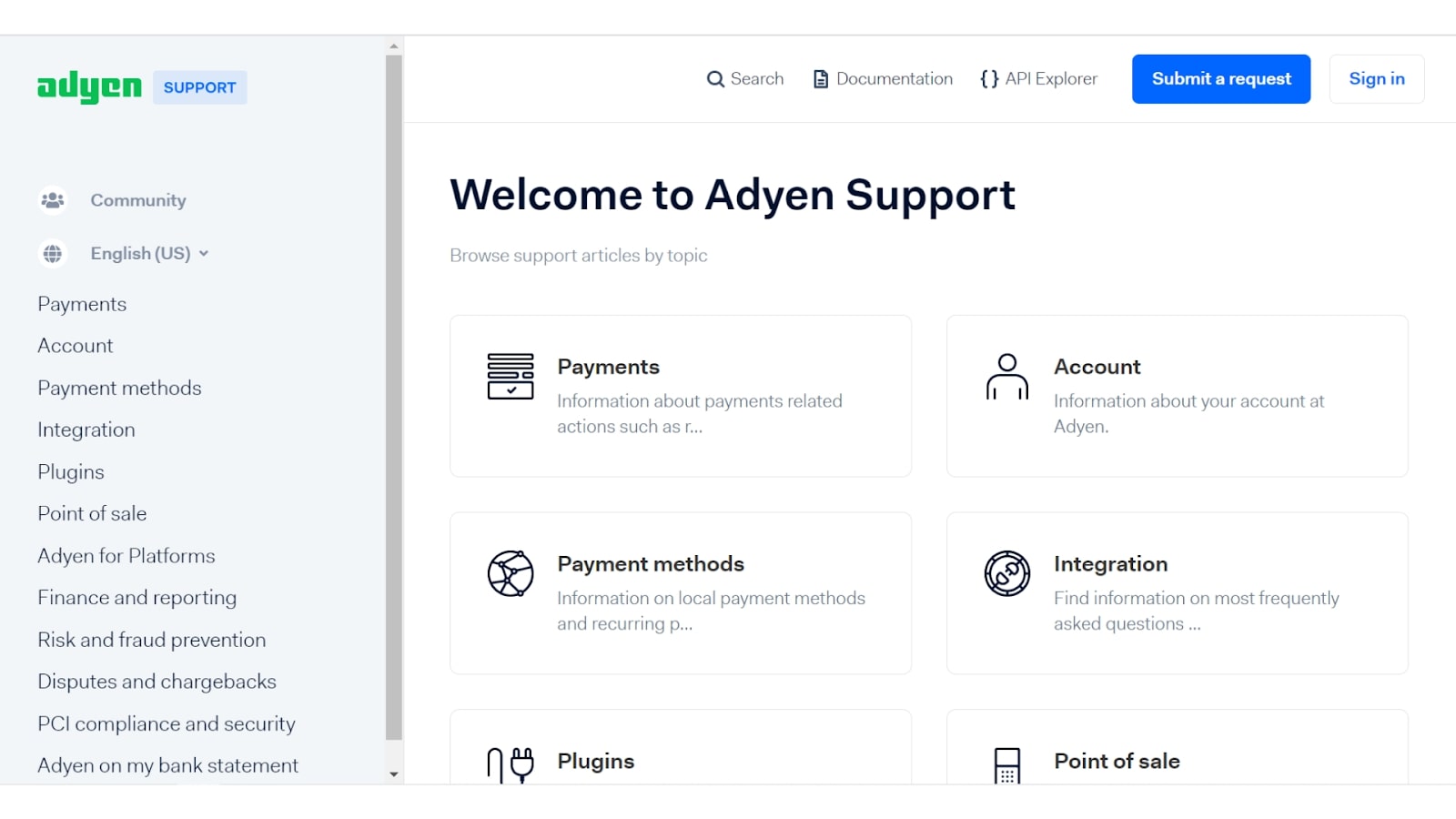

Support

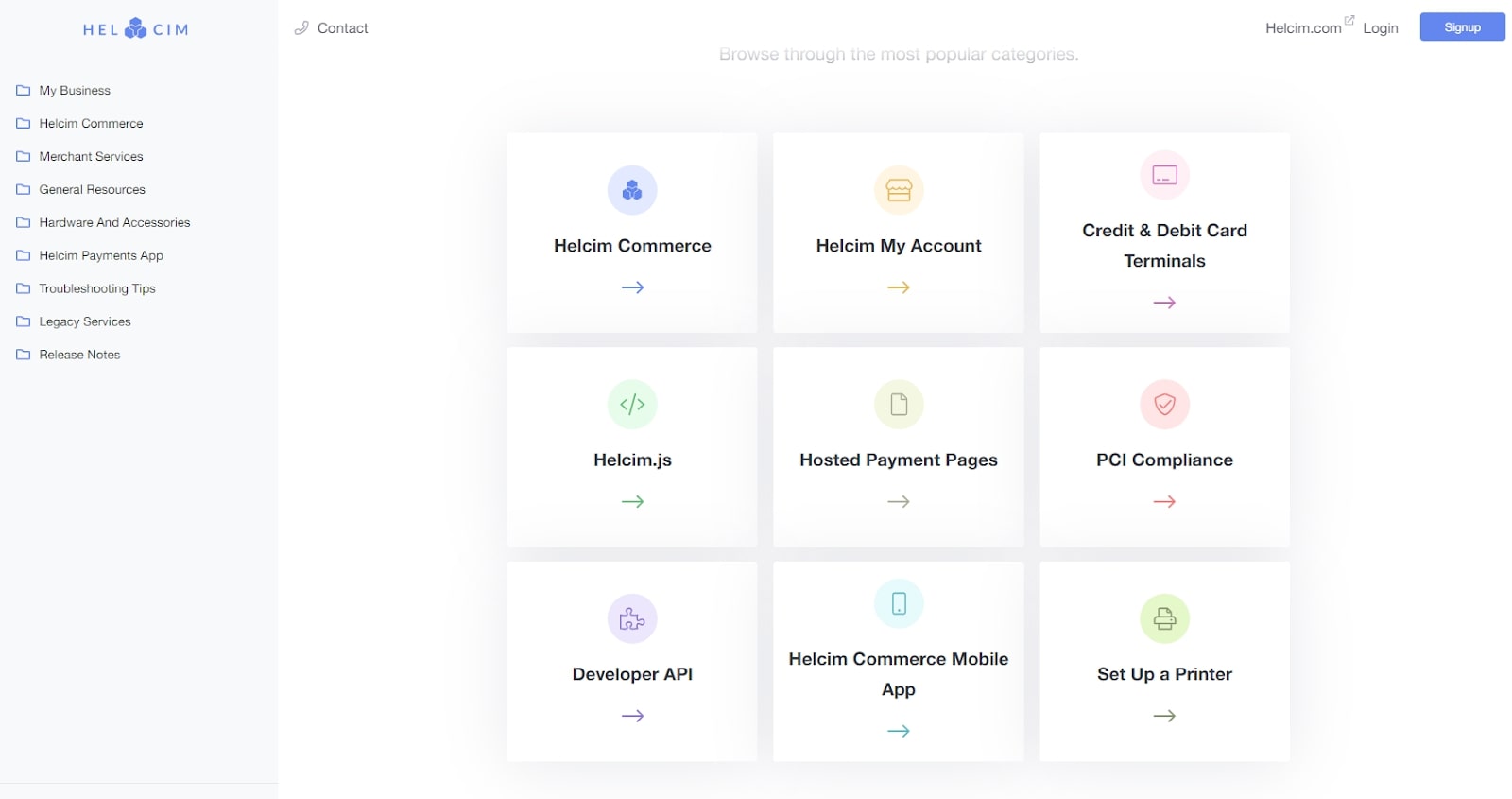

To its credit Xero does have quite a lot of help and support options at your disposal. There are handy built-in options that can get you around any minor issues you might encounter during setup. This is most notably handy thanks to the question mark up in the right-hand corner of the interface, which delivers and express-lane dialog box for solving many common queries.

Xero’s main website is also the source of many helpful videos and other documents that deliver primers and problem-solving solutions for most, if not all the sticking points you might encounter along the way too. There is also a lively community area that boosts the overall useability of the Xero experience.

Final verdict

Xero does a fine job of mixing an enjoyable and modern-looking user interface with a huge collection of accounting features and functions. For the money that makes it a pretty formidable package and with its cloud-based dependability and use-anywhere feel along with the ability to scale up its capabilities with app add-ons means that Xero is impressive on most fronts.

While the obvious lack of live support might not always be the best part of the overall package there is much to like with this service. If you take time to learn Xero’s ropes you’ll find that it soon starts to reward you by producing a comprehensive and slick picture of your business and its innermost workings.

- Also check out our roundup of the best accounting software for small business