ExpensePoint is a cloud-based mobile expense management tool that allows business owners and their employees to keep track of costs on the go. With its keenly-priced service options ExpensePoint offers good value, particularly for small businesses with lower volumes of expense claims to process each month during the coronavirus crisis.

- Want to try ExpensePoint? Check out the website here

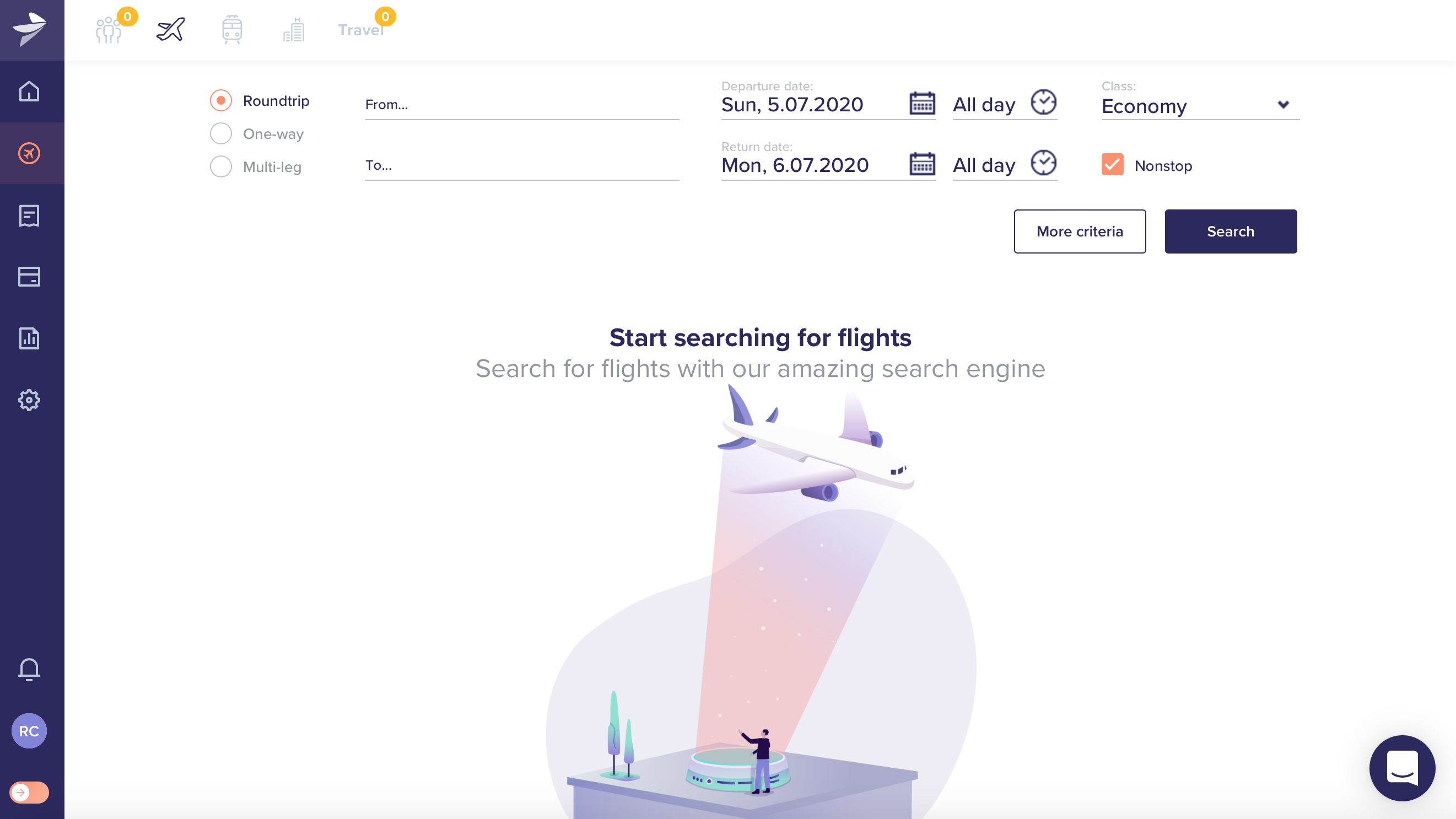

However, ExpensePoint has also been suitably well-built to allow larger companies with multiple employees to harness its suite of power tools to tame relentless expense claims. In fact, its back end administrator tools will definitely appeal to accountancy specialists. The service works with multi-currencies, can be accessed via any kind of device and with its ability to allow submitting, approval and reporting of expenses from one location makes it a great one-stop option.

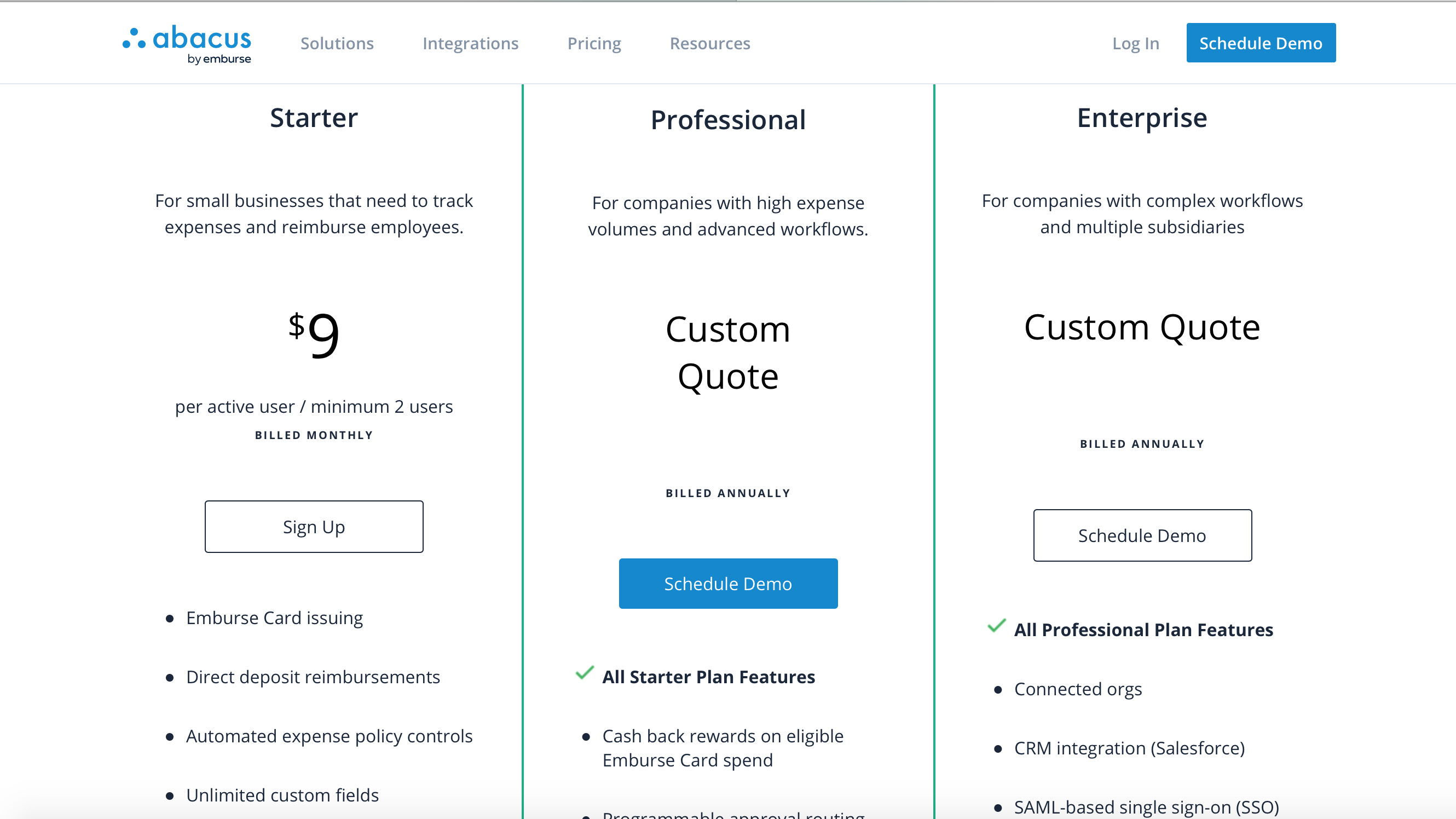

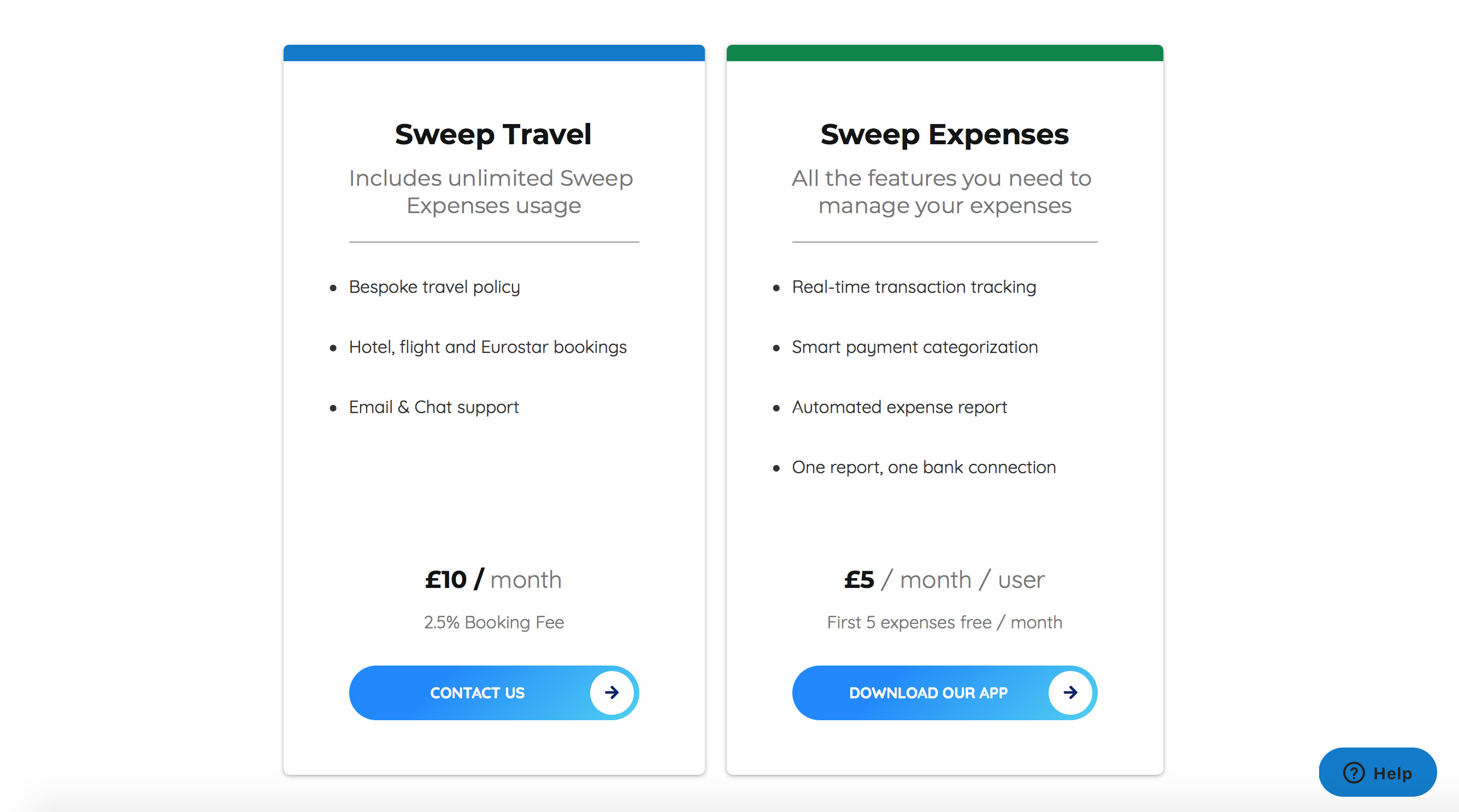

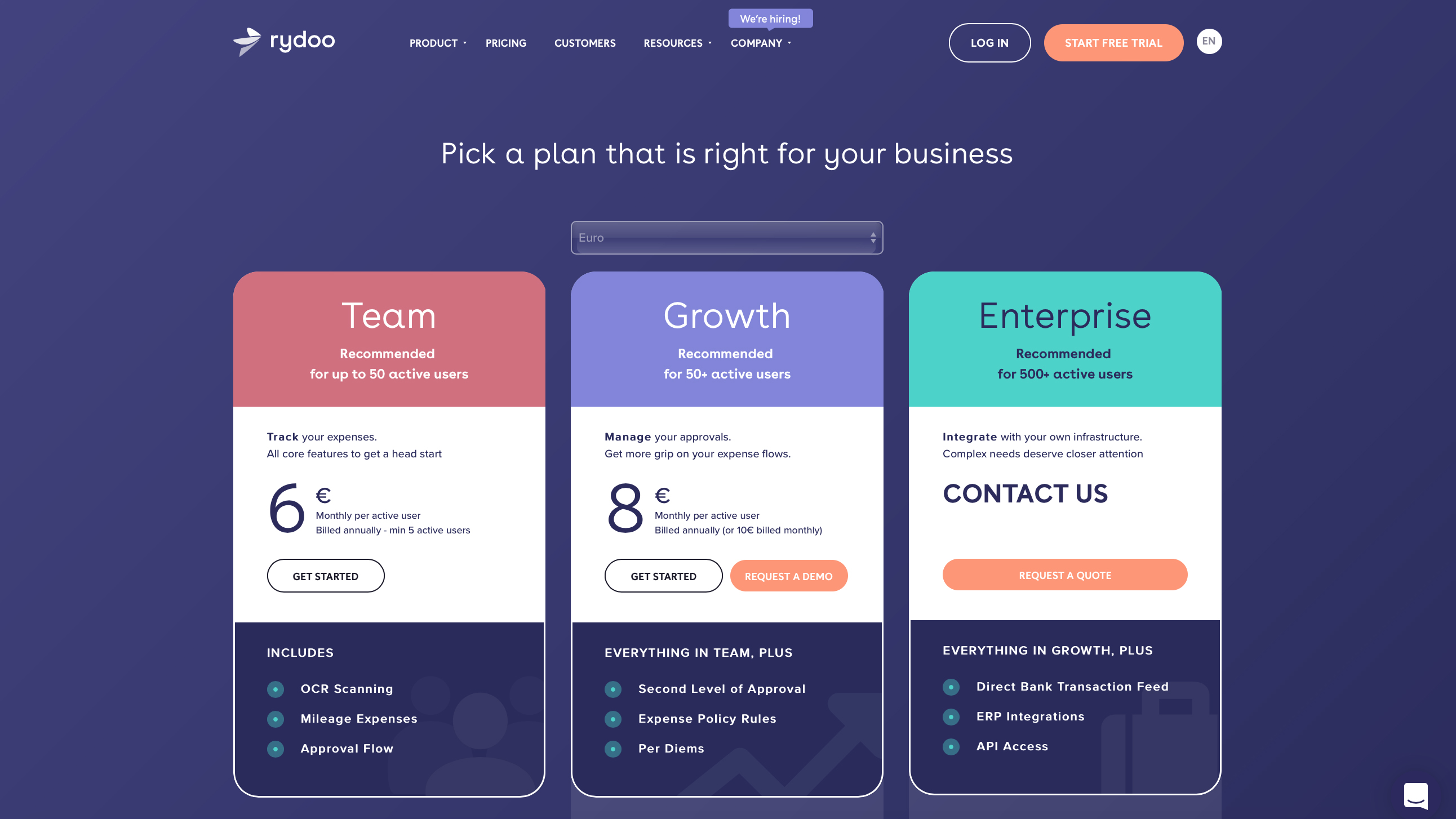

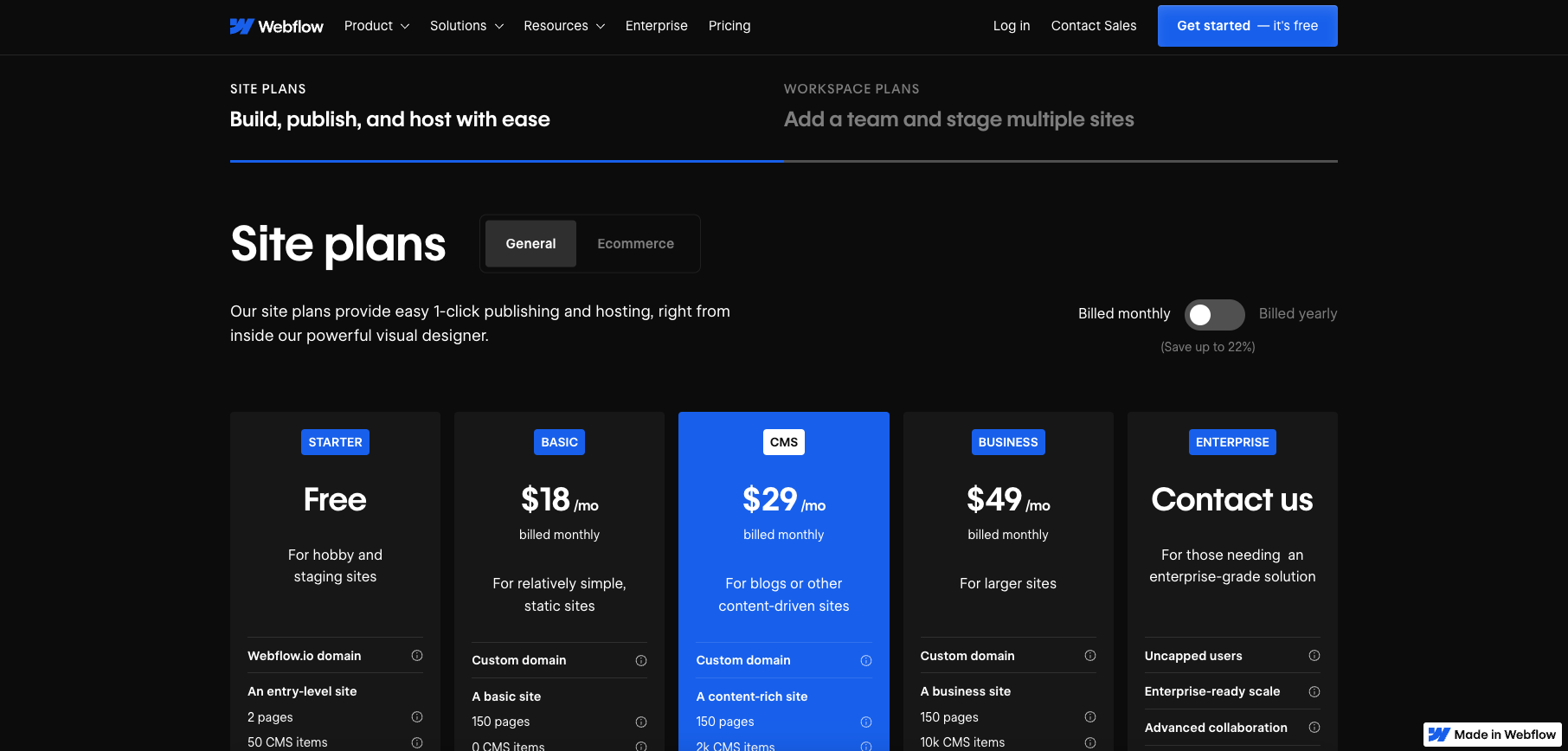

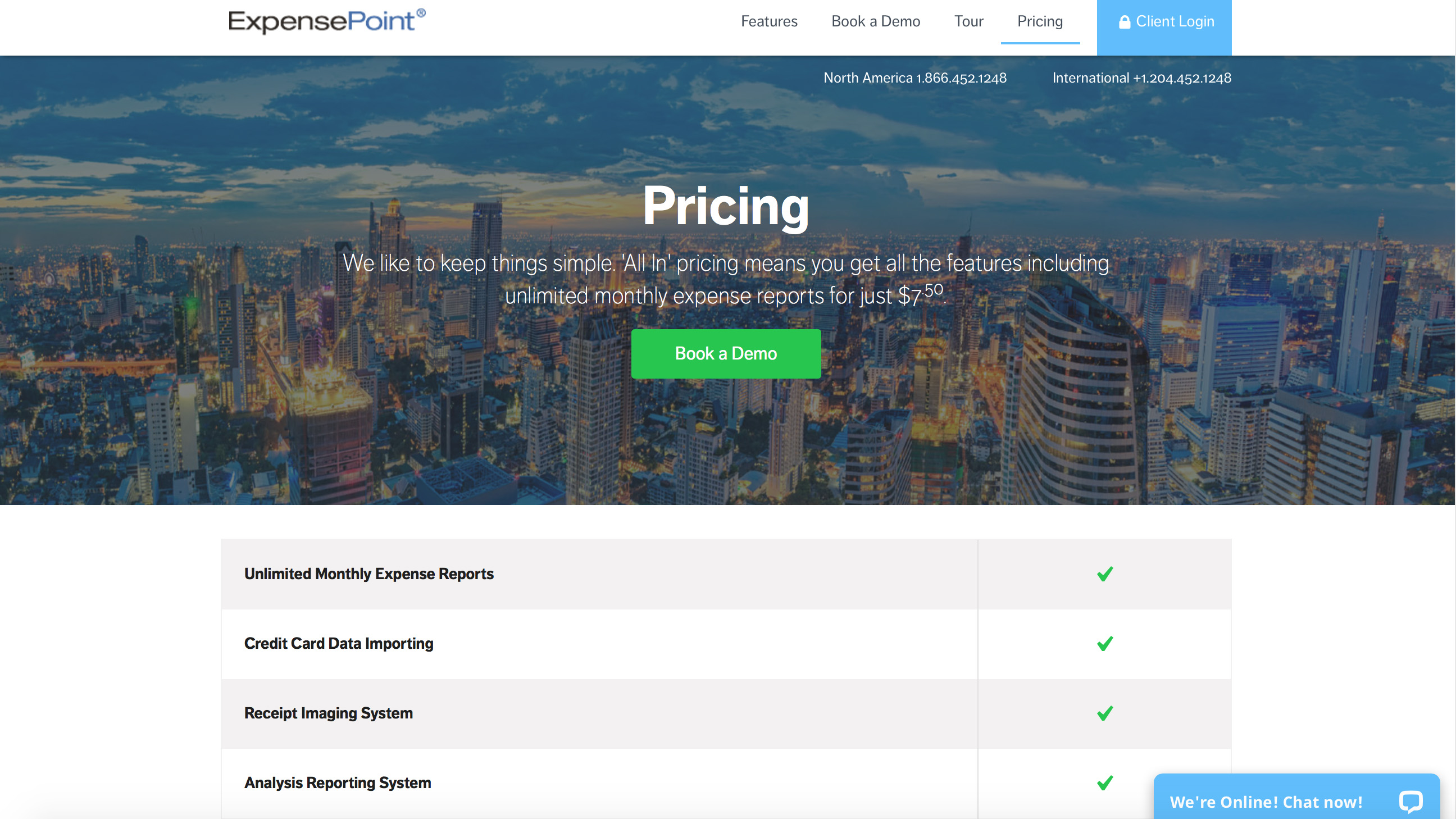

Pricing

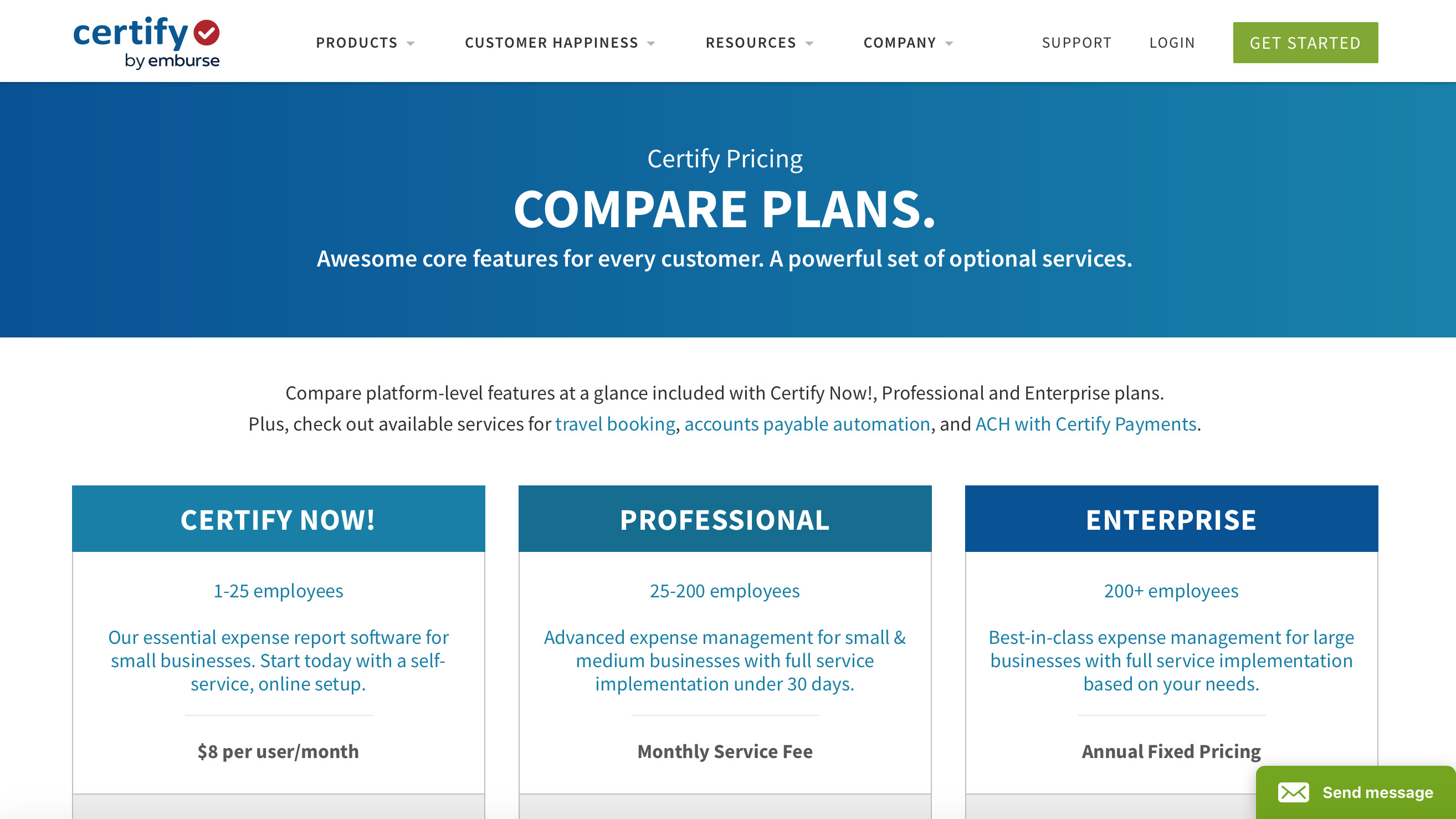

When it comes to pricing then ExpensePoint has tried to keep things straightforward and fuss free. It currently offers an ‘all in’ option that gets you all of the features in the ExpensePoint arsenal for $7.50, which includes unlimited monthly expense reports. This also gets you the use of ExpensePoints Receipt Reader team, which is a group of real individuals who pick over your paperwork when it is uploaded into the system.

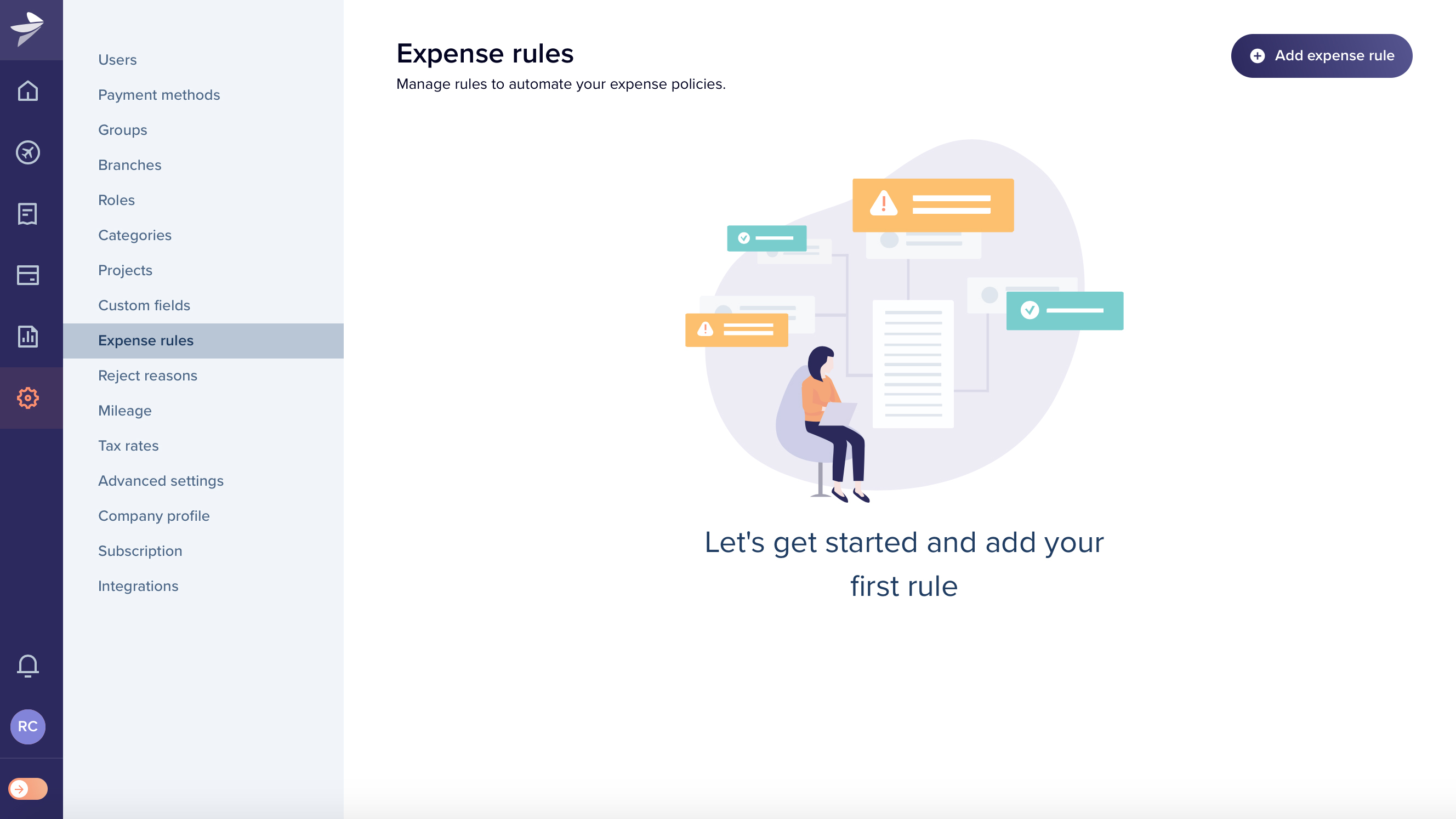

Features

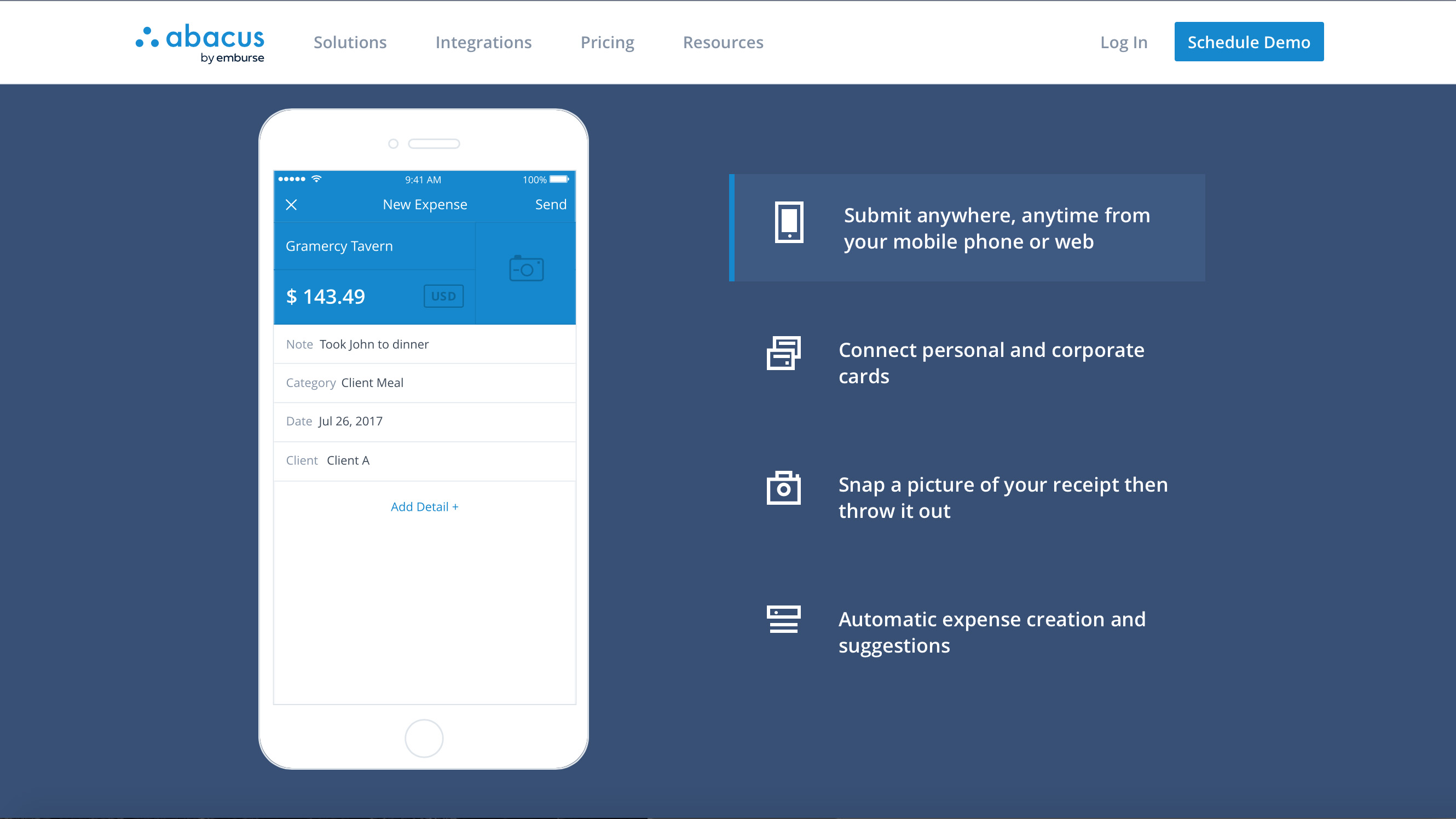

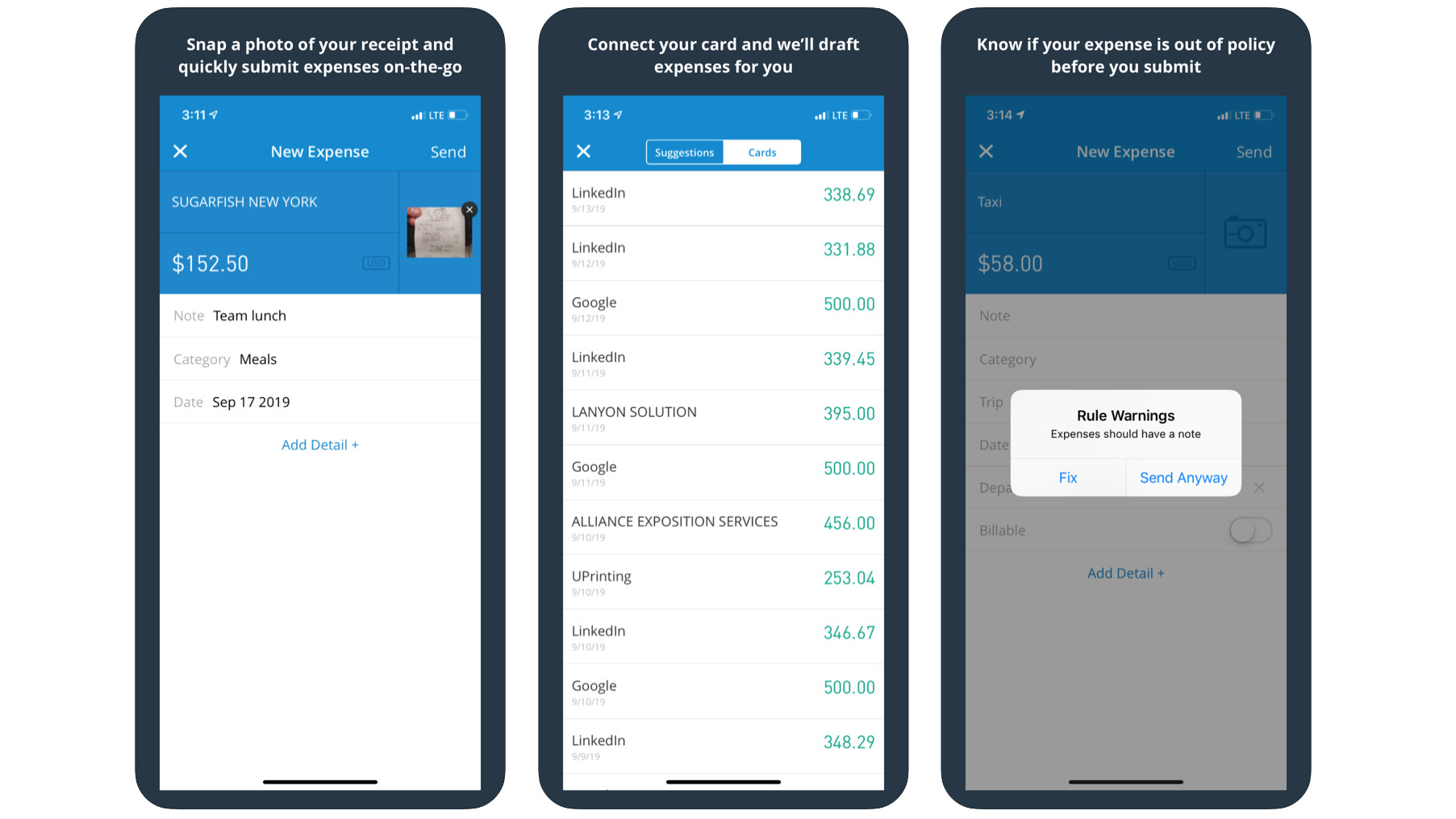

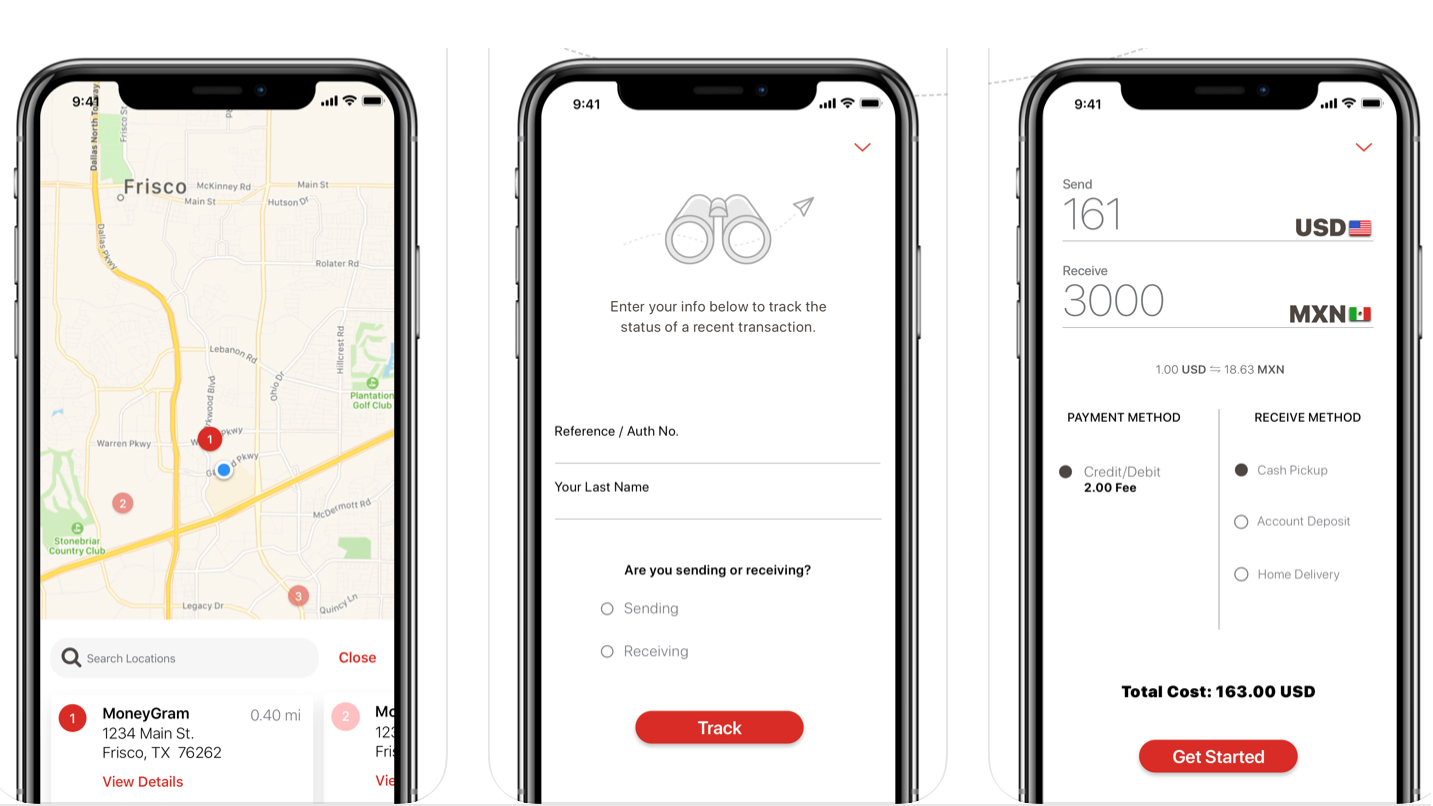

ExpensePoint comes packaged with all you’ll need to cover every aspect of processing expenses. It offers convenience with multi-device access, an innovative receipt imaging system, credit card integration, provides lots of spending data and delivers swift employee reimbursement via Automated Clearing House (ACH) batch processing when needed.

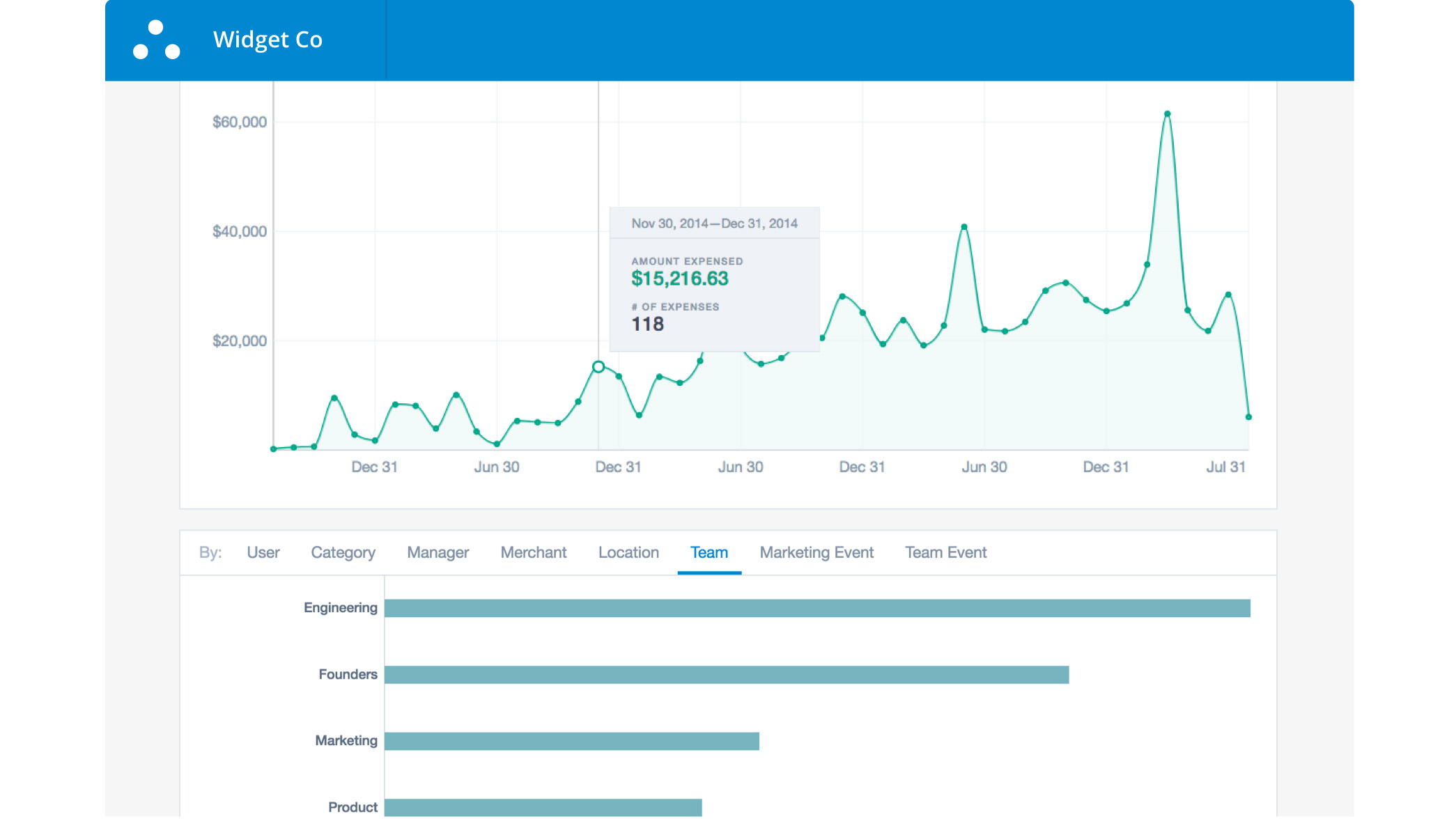

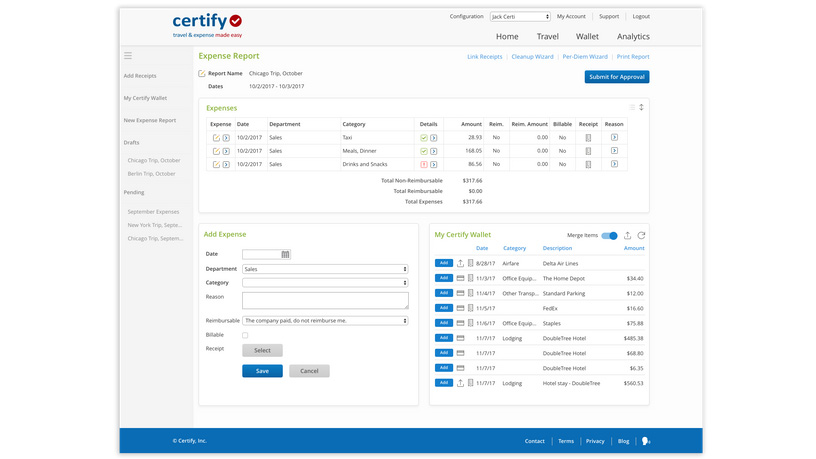

ExpensePoint can also work with multiple currencies and is safe, secure and compliant. Once you’ve got an account you’ll be able to create and submit expense claims along with getting them reviewed and approved by administrators. Expense controllers can also wrangle the data from these claims and produce detailed reports based on the securely collected information.

Interestingly, ExpensePoint even allows you to fax scanned receipt images into reports, along with slightly more modern methods such as email and digital uploads.

Performance

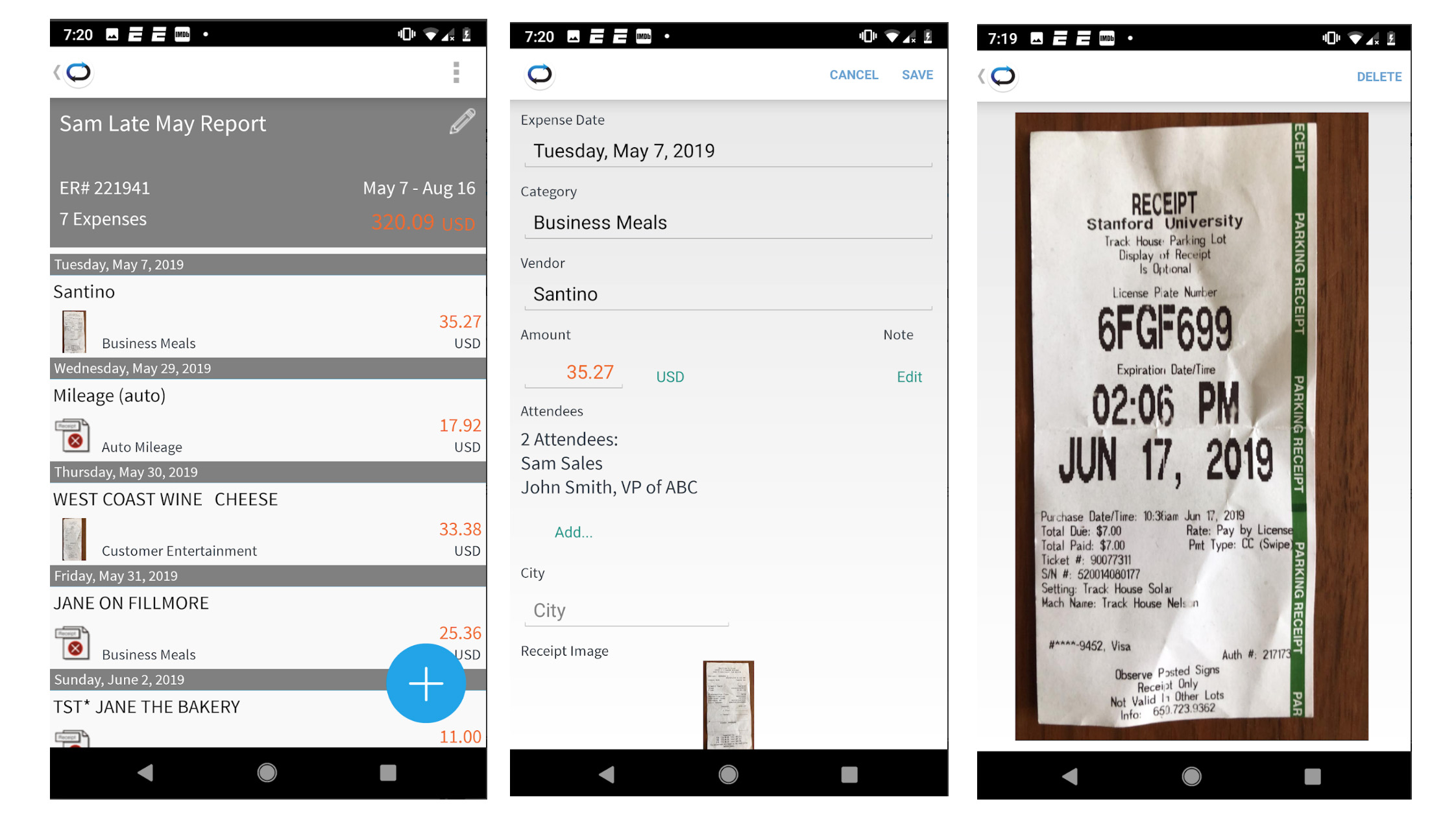

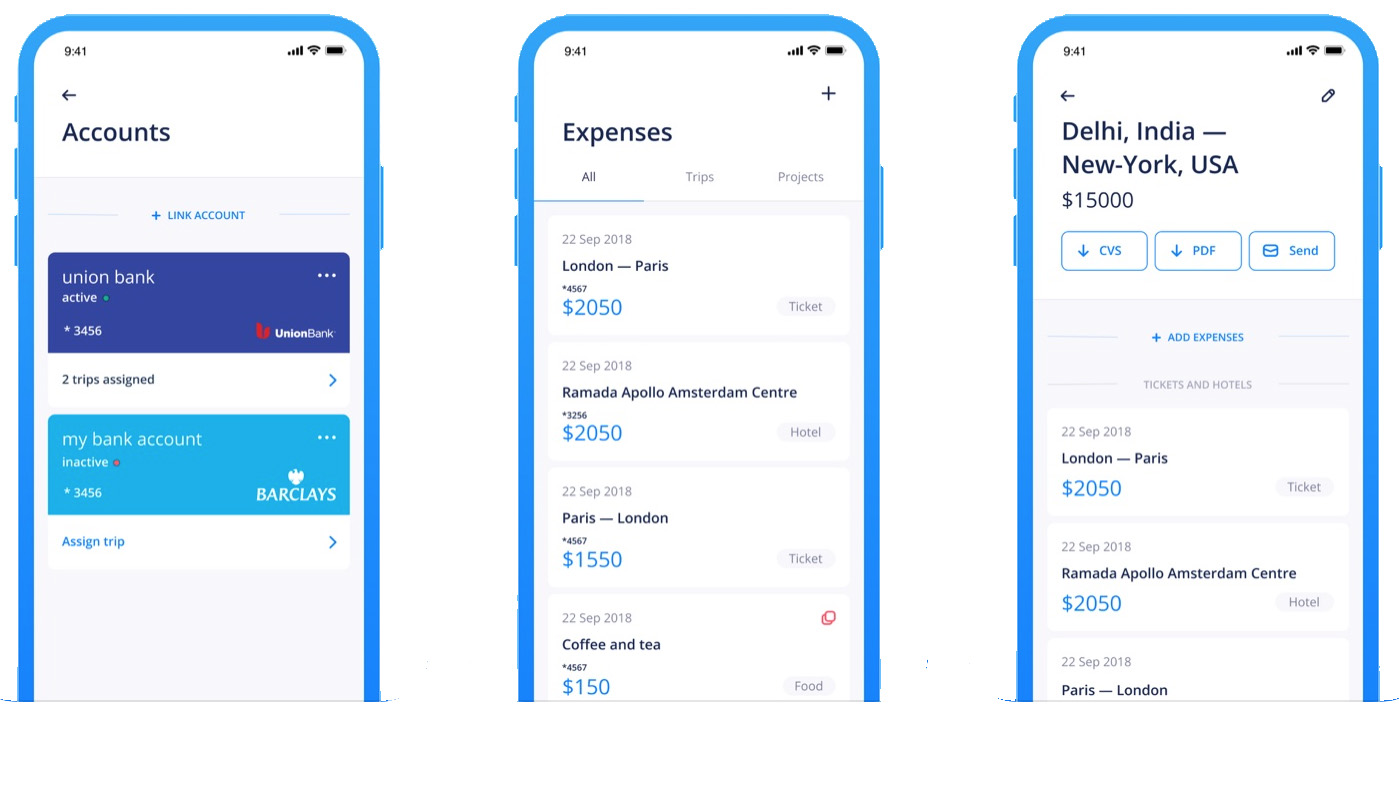

Thanks to its cloud-based setup ExpensePoint is perfect for office administrators as it allows them to receive automatic updates when reports are submitted for approval. This lets them view both the report and any receipts that have been uploaded by employees out in the field and a click to approve system means that claims can be processed quickly and efficiently.

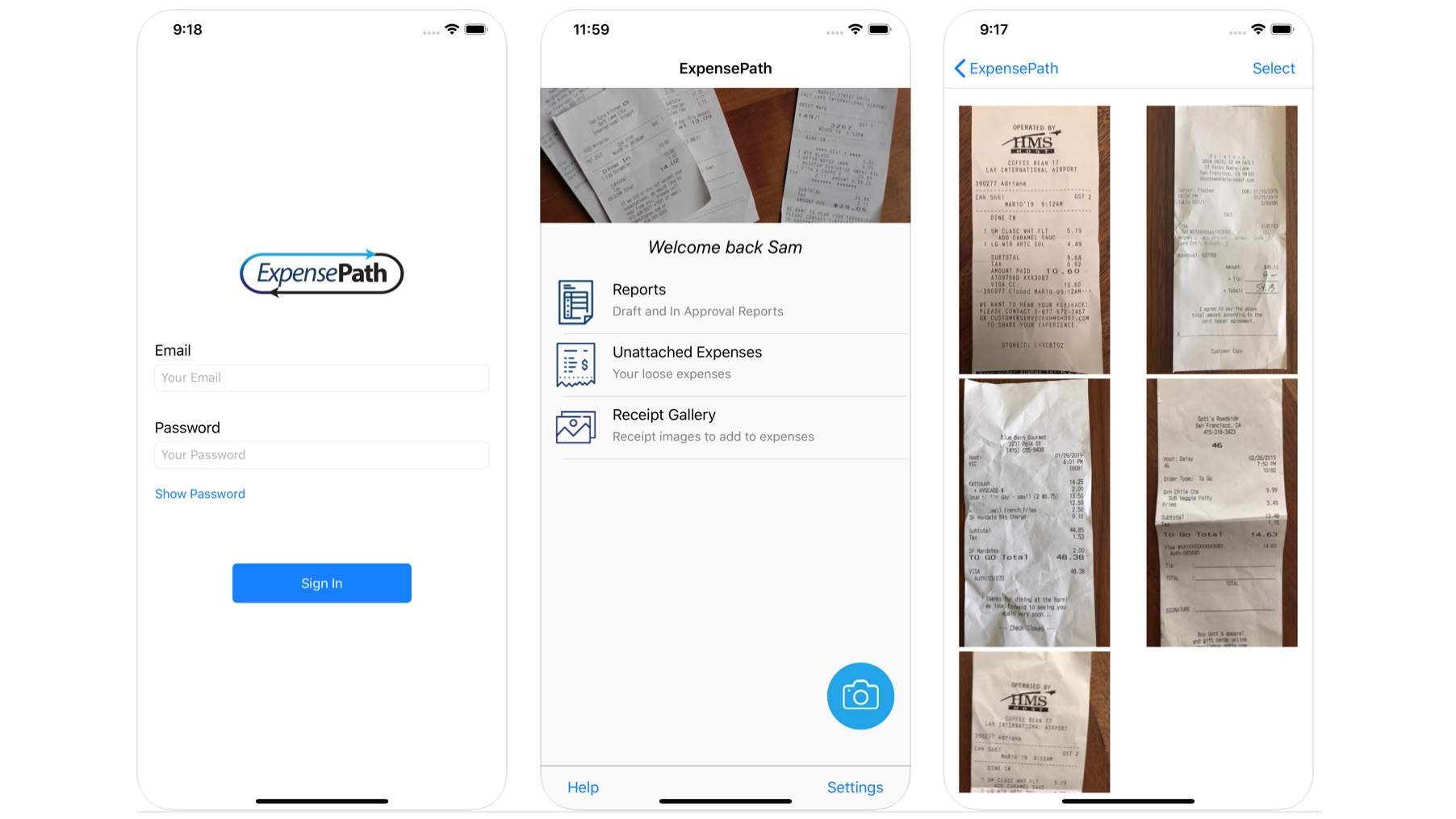

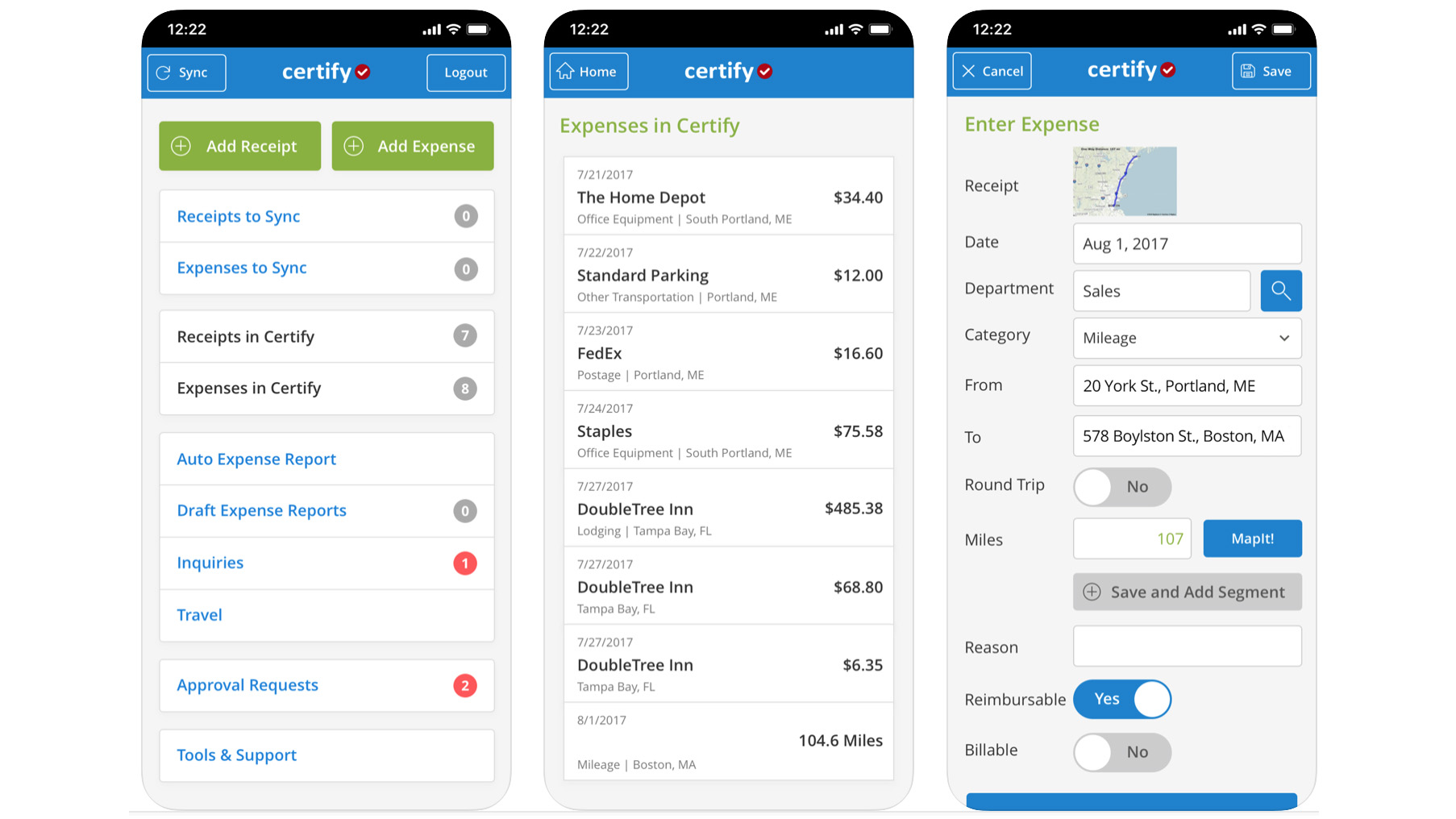

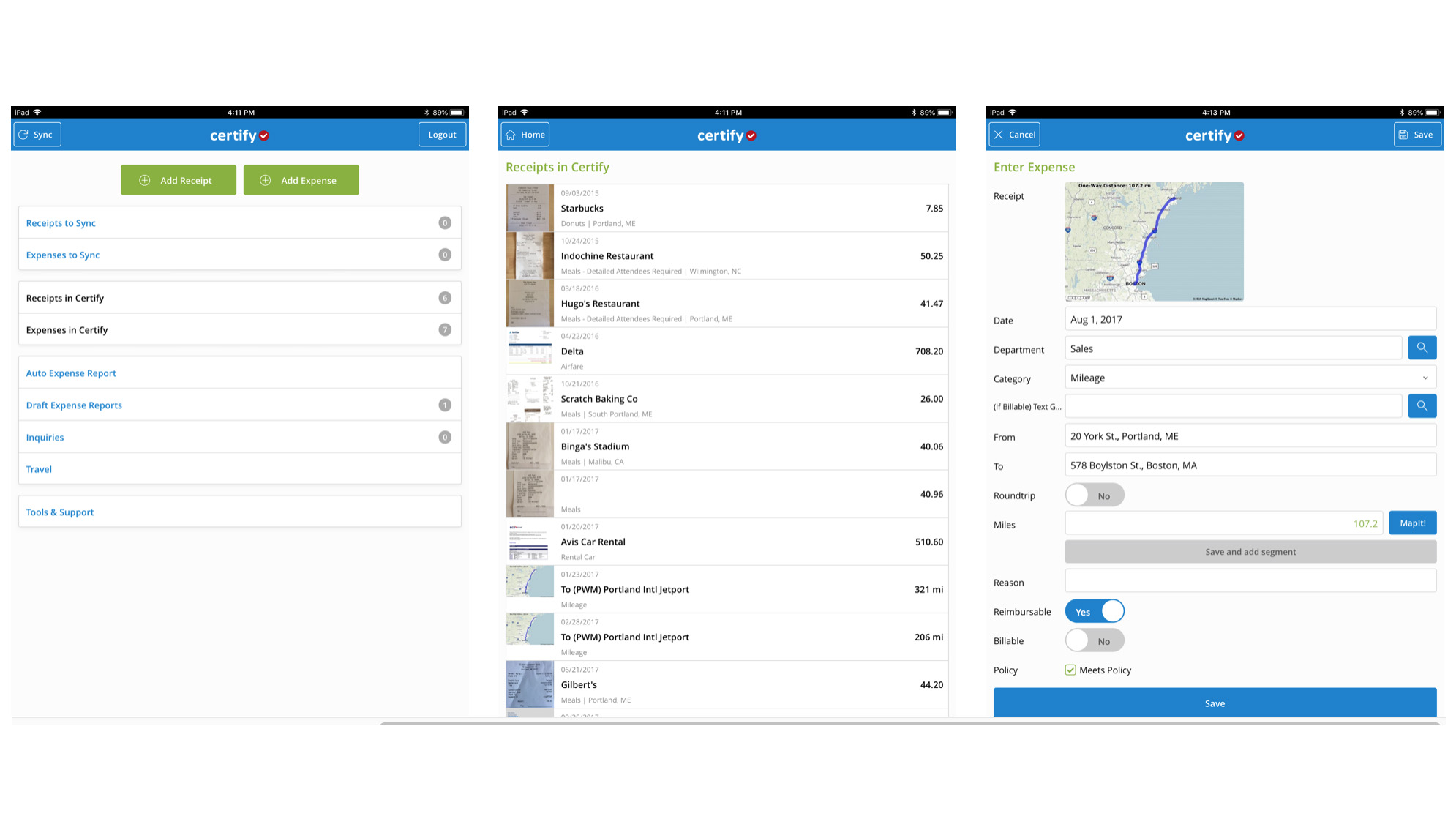

Employees should find the app helps speed up the process as the entire expense report can be produced on the go. Receipts can be placed in a Receipt Wallet feature, including those that have been captured on a mobile.

In addition, these are read by the receipt reader team, real people in other words, rather than relying on OCR, and get input into the system while credit card transactions arrive in a My Transactions folder. This means that everything can be pulled in together to produce a claim that includes the likes of dates, vendors, taxes, amounts and much more besides.

Ease of use

It’s easy to see the appeal of ExpensePoint, due in the main to its capacity for being used anywhere. The cloud-based service can be accessed using desktop or laptop machines, along with mobile devices. Adding to the appeal is the mobile app edition, which offers a full suite of supplementary features for employees on the move.

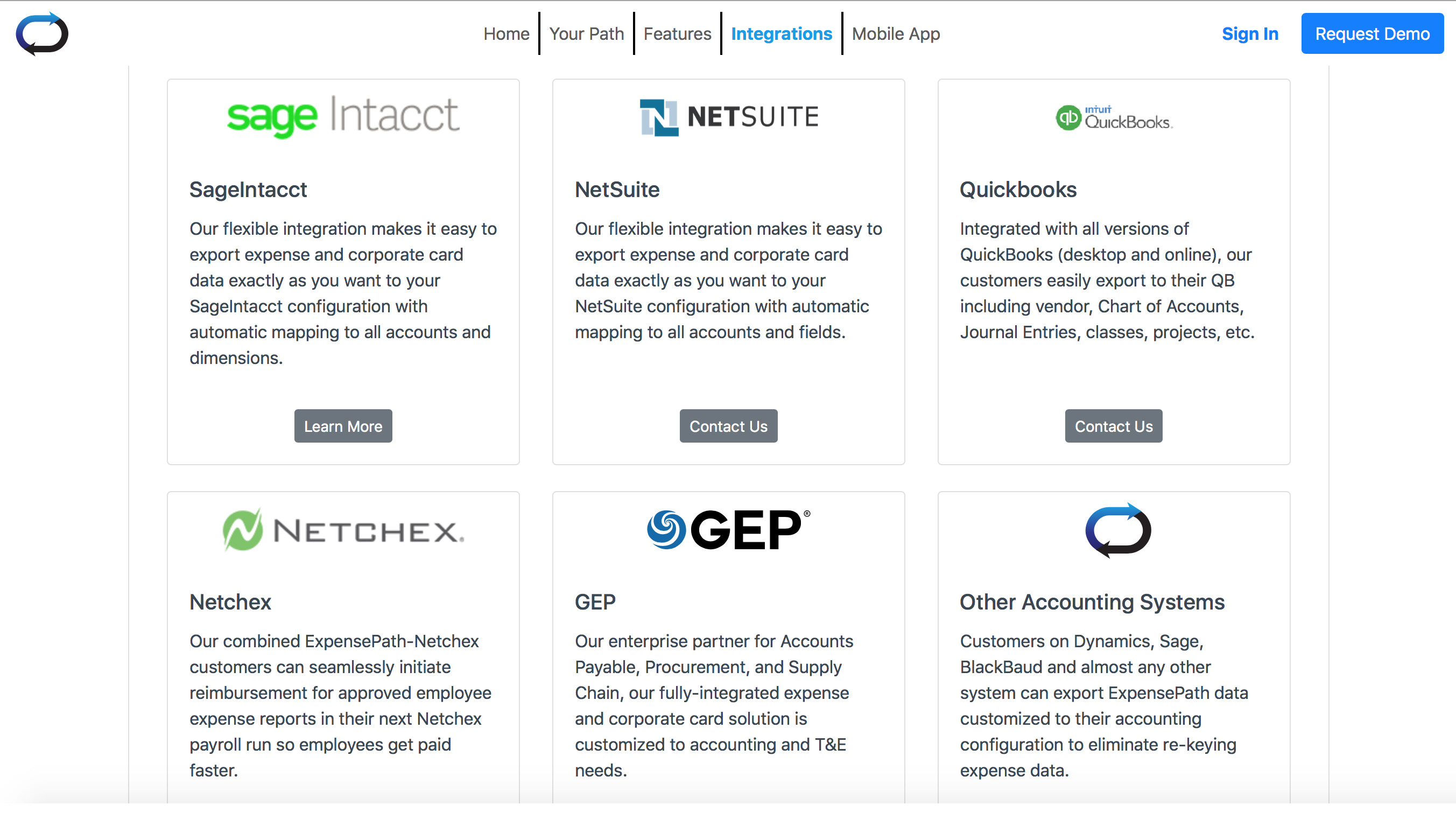

Office administrators will find that ExpensePoint comes with plenty of tools for processing claims too, while its reporting tools are simple but powerful. Better still, ExpensePoint can be used in tandem with popular accounting packages, such as QuickBooks and Sage.

Support

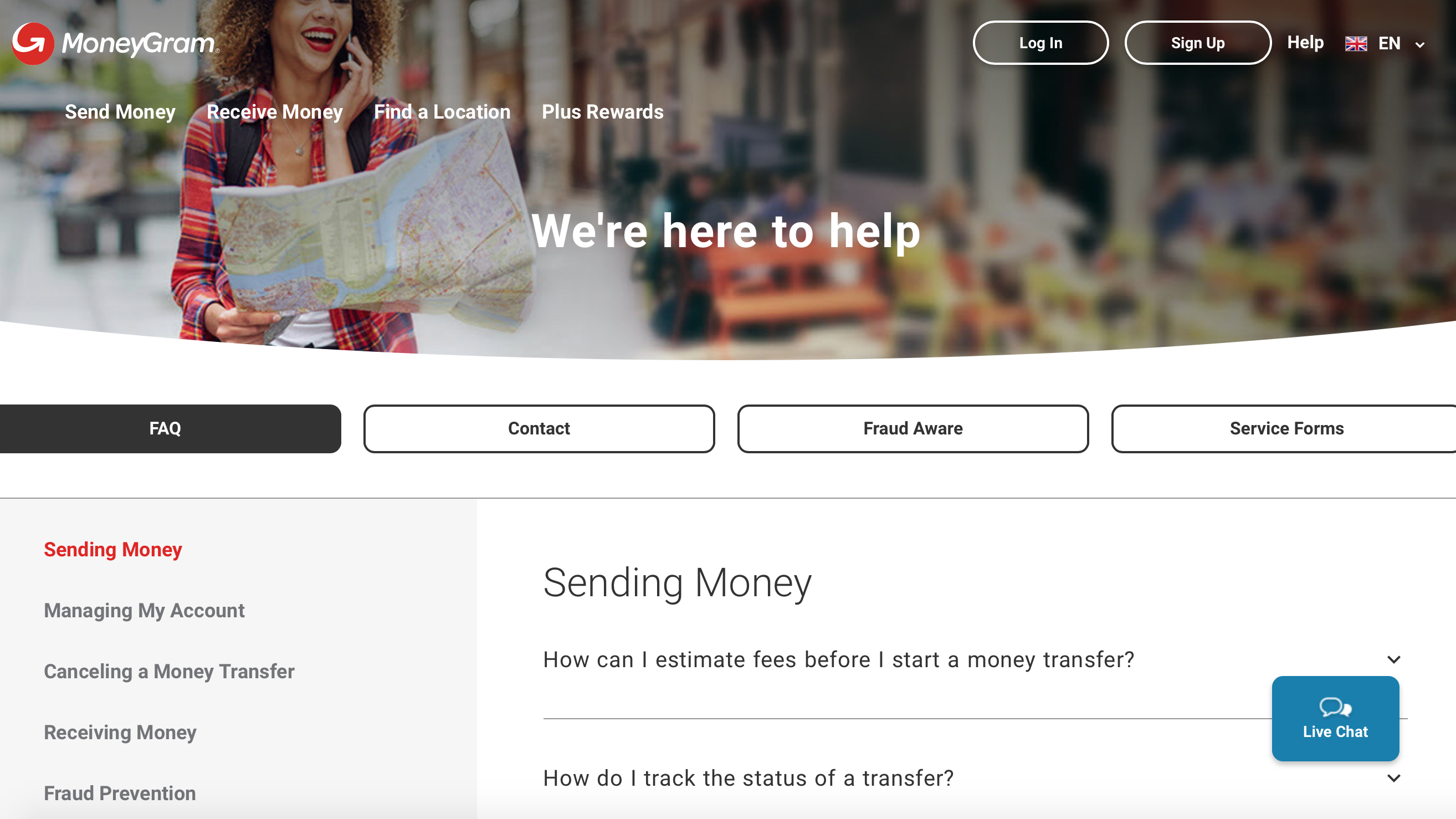

You’ll find that support for ExpensePoint comes in the usual form of help via the website that includes a rather annoying live support chat option. This is a good idea if you're in need of help, but the fact that it kept popping up while we were making our first exploration of ExpensePoint and its features soon became annoying.

However, the cloud-based service seems to offer a pretty good standard of assistance aside from that. There’s a blog too, that gives some useful insights into all manner of ExpensePoint’s feature set.

Final verdict

ExpensePoint seems like a pretty good value proposition if you're in need of an expense claim system that will handle varying volumes of claims. While there’s obvious appeal with the competitive pricing, especially considering the report producing side of things, ExpensePoint is also beefy enough for bigger businesses.

The desktop interface is more suited to those who use accountancy tools on a regular basis, but the app delivers a decent enough experience if you’re looking to stay on top of your expenses when you’re out and about.

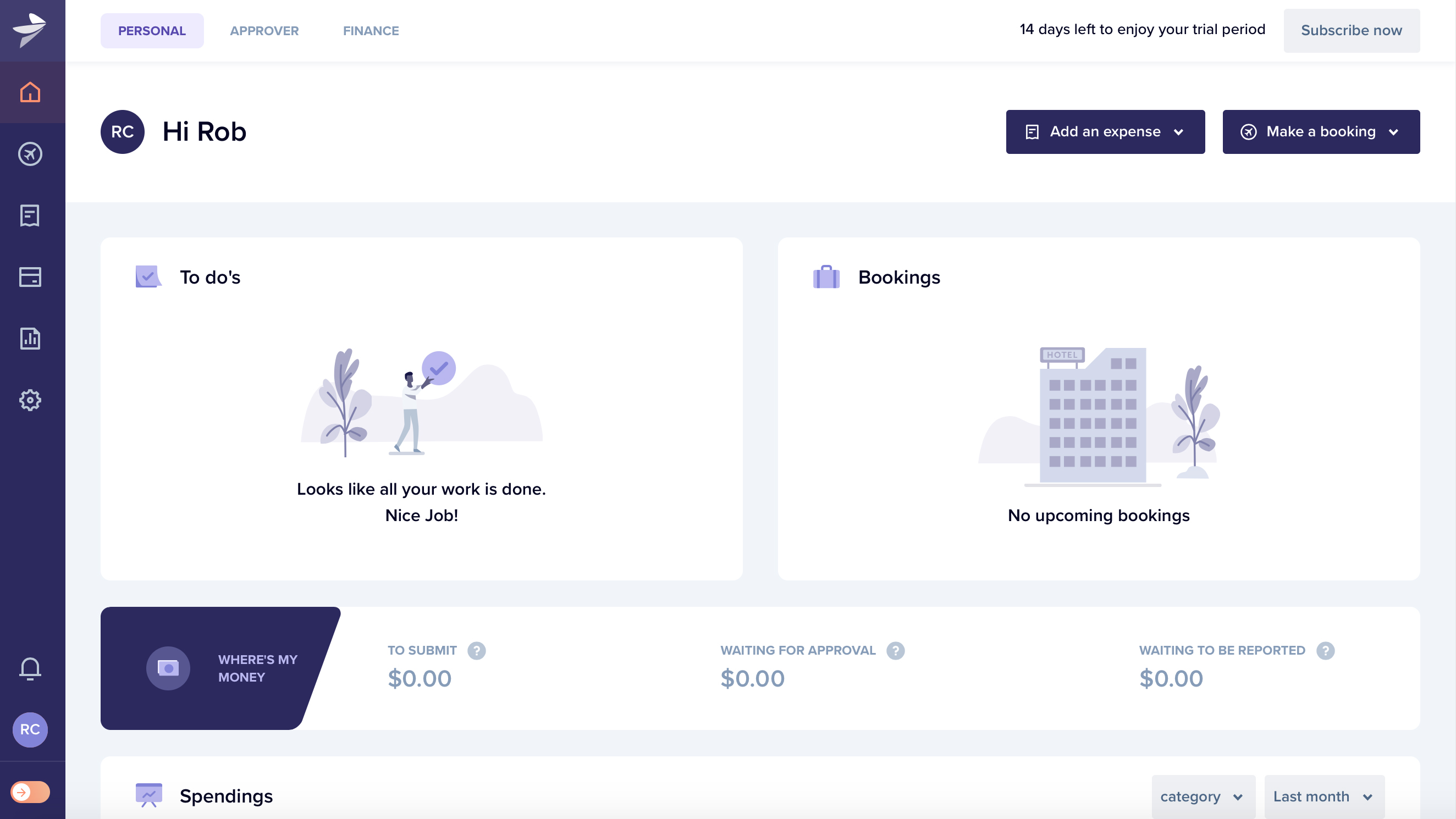

For the money ExpensePoint has plenty to recommend, particularly thanks to those key features that include the mobile convenience, the ability to import credit card transactions alongside receipts, plus strong controls for approval by administrators. That said, however, rivals such as QuickBooks, Rydoo, Hurdlr, Zoho Expense and Pocketguard are worth looking at too.

- We've also highlighted the best expense tracker apps and software